Form 8379

What is the Form 8379

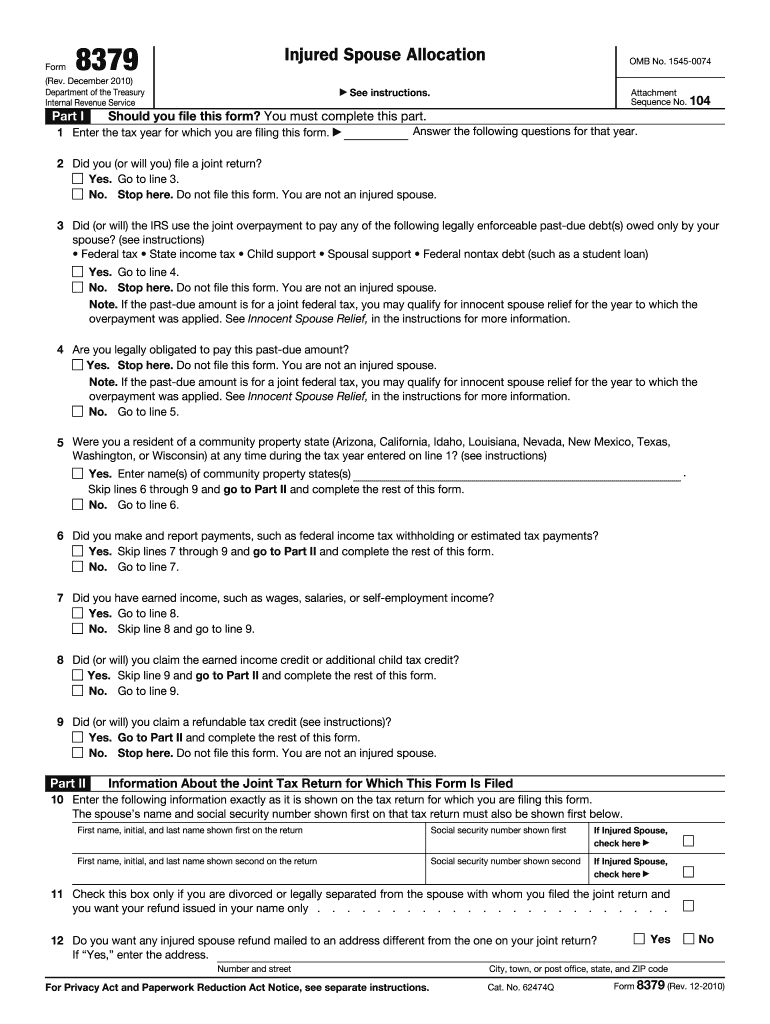

The Form 8379, also known as the injured spouse form, is a tax document used by married couples filing jointly to request their share of a tax refund when one spouse has outstanding debts. This form protects the innocent spouse from having their portion of the refund applied to the other spouse's debts, such as unpaid child support or federal student loans. By filing Form 8379, the injured spouse can ensure that their tax refund is allocated fairly, allowing them to receive their rightful share.

How to use the Form 8379

Using the Form 8379 involves a few straightforward steps. First, ensure that you meet the eligibility criteria, which includes being married and filing jointly. Next, accurately complete the form by providing necessary information about both spouses, including income and tax withheld. After filling out the form, you can submit it along with your tax return or file it separately if you have already submitted your return. It is essential to follow the instructions carefully to avoid delays in processing your request.

Steps to complete the Form 8379

Completing the Form 8379 requires attention to detail. Begin by entering your personal information, including your name, Social Security number, and address. Next, provide your spouse's information. Then, you will need to report your income and any tax withheld. The form also requires you to indicate the amount of the refund you are claiming. After reviewing the form for accuracy, sign and date it before submission. Remember to keep a copy for your records.

Legal use of the Form 8379

The legal use of Form 8379 is crucial for ensuring that your rights as a taxpayer are protected. This form is recognized by the IRS and complies with federal regulations regarding tax refunds. When filed correctly, it provides a legal basis for separating the tax refund from any debts incurred by the other spouse. It is important to understand that submitting this form does not guarantee a refund; it simply allows for the proper allocation of funds based on your circumstances.

Filing Deadlines / Important Dates

Filing deadlines for Form 8379 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If you are filing for an extension, be aware that the form must still be submitted within the extended timeframe. It is advisable to file the form as soon as possible after submitting your tax return to avoid delays in receiving your refund. Always check for any updates from the IRS regarding specific deadlines or changes in regulations.

Required Documents

To complete the Form 8379, you will need several documents on hand. These include your tax return, W-2 forms, and any other income statements for both spouses. Additionally, documentation regarding any debts that may affect the refund allocation should be gathered. Having these documents ready will streamline the process and help ensure that all information provided on the form is accurate and complete.

Quick guide on how to complete form 8379

Prepare Form 8379 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and eSign your documents without any hassle. Manage Form 8379 across any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to modify and eSign Form 8379 with minimal effort

- Obtain Form 8379 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your device of choice. Alter and eSign Form 8379 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8379

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 8379 printable and who needs it?

A form 8379 printable is a tax form used by married couples who file jointly and wish to request a refund for an injured spouse. This form helps protect the spouse's share of a refund from being applied to the other spouse's debts. It’s essential for those looking to safeguard their refunds while ensuring compliance with IRS requirements.

-

How can I obtain a form 8379 printable?

You can obtain a form 8379 printable directly from the IRS website or through tax preparation software. Many online platforms, including airSlate SignNow, provide easy access to printable forms. Simply search for the form by its number, and you'll be able to download and print it.

-

What are the benefits of using airSlate SignNow for form 8379 printable?

Using airSlate SignNow for your form 8379 printable offers a streamlined process for sending and signing documents electronically. This not only saves time but also ensures that your form is completed accurately and securely. Plus, with our user-friendly interface, you can easily track the status of your submission.

-

Is there a cost associated with accessing the form 8379 printable through airSlate SignNow?

airSlate SignNow offers various pricing plans, including a free trial that allows you to access a form 8379 printable without upfront costs. After the trial, plans are affordable and cater to businesses of all sizes. Investing in our services can enhance your document management experience while ensuring compliance.

-

Can I integrate airSlate SignNow with my existing software for form 8379 printable?

Yes, airSlate SignNow offers seamless integrations with a variety of popular applications, including CRM and document management systems. This allows you to manage your form 8379 printable efficiently within your current workflows. The integration simplifies the process, making it easier to send and eSign your documents.

-

How does eSigning a form 8379 printable work with airSlate SignNow?

eSigning a form 8379 printable with airSlate SignNow is a straightforward process. You simply upload your form, add the necessary signers, and they can sign the document electronically from any device. The platform ensures that all signatures are legally binding and securely stored.

-

What security features does airSlate SignNow offer for sensitive documents like form 8379 printable?

airSlate SignNow prioritizes document security with features like encrypted data transmission, two-factor authentication, and secure cloud storage. These measures ensure that your form 8379 printable and other sensitive documents are protected against unauthorized access. You can trust that your information remains safe throughout the signing process.

Get more for Form 8379

- Hodges university transcript request form

- Intention to employa1 in gov form

- City of cocoa beach permit application form

- Data capture format

- Printable personal physical activity log usd 501 personal physical actvity log documents topekapublicschools form

- Jenelle evans book pdf form

- Reading a utility bill worksheet form

- Buyers retail sales tax exemption certificate form 27 0032

Find out other Form 8379

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney