Domestic Partnership Declaration Form Miami Dade College Mdc

What is the Domestic Partnership Declaration Form?

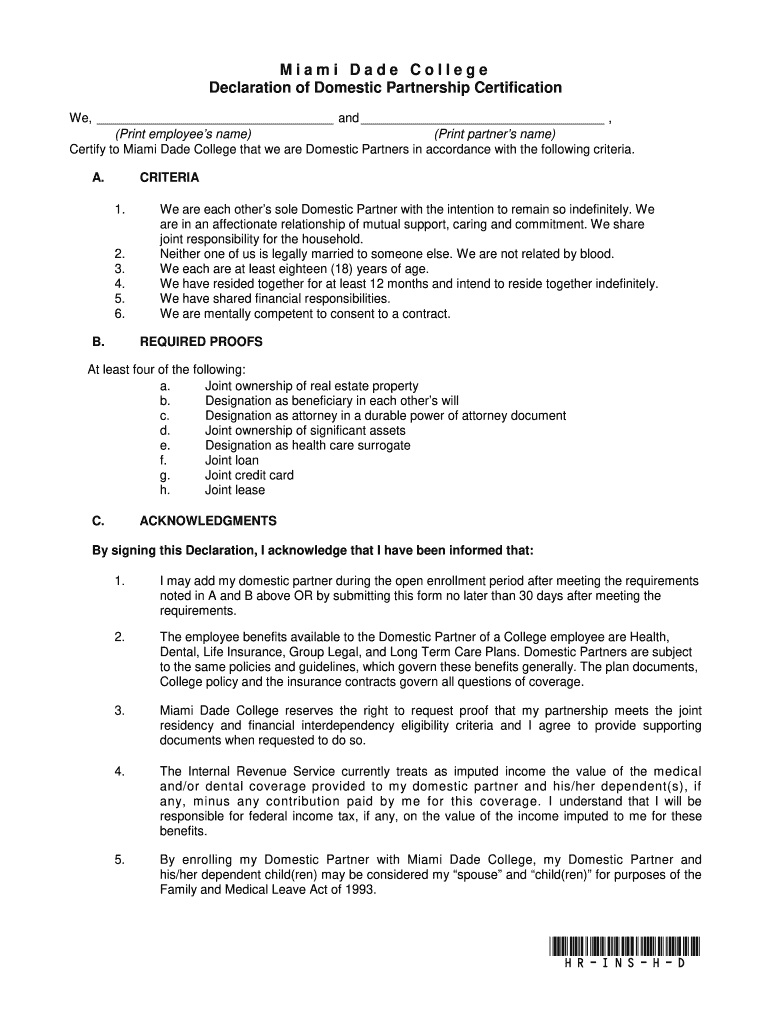

The Domestic Partnership Declaration Form is a legal document used to establish a domestic partnership in Miami Dade County. This form is essential for couples who wish to formalize their relationship without entering into marriage. By completing this form, partners can gain access to various legal rights and responsibilities, similar to those enjoyed by married couples. It is particularly relevant for same-sex couples and opposite-sex couples who choose not to marry but wish to secure their legal standing.

Steps to Complete the Domestic Partnership Declaration Form

Completing the Domestic Partnership Declaration Form involves several straightforward steps:

- Obtain the form from a reliable source, such as the Miami Dade College website.

- Fill out the required fields, including personal information for both partners.

- Review the form for accuracy and completeness to avoid delays.

- Sign the form in the presence of a notary public to ensure its validity.

- Submit the completed form to the appropriate local government office.

Key Elements of the Domestic Partnership Declaration Form

This form includes several critical components that must be accurately filled out:

- Personal Information: Names, addresses, and contact details of both partners.

- Relationship Details: Date of the partnership and any previous marriages or partnerships.

- Signatures: Both partners must sign the document, affirming their commitment.

- Notary Section: A space for the notary public to verify the signatures and date.

Legal Use of the Domestic Partnership Declaration Form

The Domestic Partnership Declaration Form serves as a legally binding document that grants partners certain rights and responsibilities under state law. These rights can include health care decision-making, inheritance rights, and access to family benefits. It is important to understand that while this form provides many legal protections, it may not confer all the benefits of marriage. Couples should consult legal resources to fully understand their rights and obligations.

How to Obtain the Domestic Partnership Declaration Form

To obtain the Domestic Partnership Declaration Form, individuals can visit the Miami Dade College website or contact the local government office responsible for vital records. The form is typically available for download in a printable format, allowing couples to fill it out at their convenience. In some cases, physical copies may also be available at designated government offices.

State-Specific Rules for the Domestic Partnership Declaration Form

Each state may have different regulations regarding domestic partnerships. In Florida, couples must meet specific criteria to qualify for a domestic partnership, including being at least eighteen years old and not being related by blood. It is essential to familiarize oneself with these state-specific rules to ensure compliance and to understand the legal implications of the partnership.

Quick guide on how to complete domestic partnership declaration form miami dade college mdc

Learn how to easily navigate the Domestic Partnership Declaration Form Miami Dade College Mdc execution with this simple guide

Online eFiling and form completion are becoming increasingly favored and the preferred choice for many users. It provides numerous benefits over traditional paper documentation, including convenience, time savings, enhanced precision, and safety.

With tools like airSlate SignNow, you can locate, edit, validate, optimize, and dispatch your Domestic Partnership Declaration Form Miami Dade College Mdc without getting bogged down in endless printing and scanning. Follow this concise guide to begin and complete your document.

Follow these steps to obtain and complete Domestic Partnership Declaration Form Miami Dade College Mdc

- Begin by clicking the Get Form button to launch your form in our editor.

- Pay attention to the green label on the left that indicates mandatory fields to ensure you don’t miss them.

- Utilize our advanced features to comment, alter, sign, secure, and enhance your form.

- Safeguard your document or convert it into a fillable form using options on the right panel.

- Review the form and verify it for any mistakes or inconsistencies.

- Click DONE to conclude editing.

- Rename your document or keep it as is.

- Select the storage option you wish to use for your form, mail it via USPS, or click the Download Now button to save your document.

If Domestic Partnership Declaration Form Miami Dade College Mdc isn’t what you intended to find, you can explore our extensive library of pre-uploaded forms that you can fill out with minimal effort. Take a look at our platform today!

Create this form in 5 minutes or less

FAQs

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Which are the colleges to do research in mathematics and how do I fill out the forms?

The answer depends on the following.The area of research you are interested in. Not all colleges support research in both Pure an Applied Mathematics. Most Universities usually encourage research in both areas. Your choice is influenced by the city you are in and your preference to travel and stay away from home.The availability of a Research Supervisor willing to oversee your research work. Visiting the department’s website will give you on who’s taking in students under his/her research group.The financial support you hope to receive from your family. If you need to support yourself, you’d wish to enter get recruited as a Junior research fellow. Such Research Assistants get a monthly stipend which may be good enough to support you through your research period. This demands that you qualify as a JRF in the bi-annual Eligibility test conducted by CSIR.Good Luck!!!

-

How do I take admission in a B.Tech without taking the JEE Mains?

Admissions into B.Tech courses offered by engineering colleges in India is based on JEE Mains score and 12th percentile. Different private and government universities have already started B Tech admission 2019 procedure. However many reputed Private Colleges in India and colleges not affiliated with the Government colleges conduct state/region wise exams for admission or have their eligibility criterion set for admission.1. State Sponsored Colleges: These colleges have their state entrance exams for entry in such colleges. These colleges follow a particular eligibility criterion2. Private Colleges: These colleges either take admission on the basis of 10+2 score of the candidate or their respective entrance exam score. These colleges generally require students with Physics and Mathematics as compulsory subjects with minimum score requirement in each subject, as prescribed by them.3. Direct Admission: This lateral entry is introduced for students who want direct admission in 2nd year of their Bachelor’s course. However, there is an eligibility criterion for the same.Students should give as many entrance exams, to widen their possibility. College preference should always be based on certain factors like placement, faculty etc.

Create this form in 5 minutes!

How to create an eSignature for the domestic partnership declaration form miami dade college mdc

How to create an eSignature for the Domestic Partnership Declaration Form Miami Dade College Mdc in the online mode

How to generate an electronic signature for the Domestic Partnership Declaration Form Miami Dade College Mdc in Chrome

How to create an eSignature for signing the Domestic Partnership Declaration Form Miami Dade College Mdc in Gmail

How to generate an electronic signature for the Domestic Partnership Declaration Form Miami Dade College Mdc straight from your smart phone

How to generate an eSignature for the Domestic Partnership Declaration Form Miami Dade College Mdc on iOS

How to generate an eSignature for the Domestic Partnership Declaration Form Miami Dade College Mdc on Android

People also ask

-

What is a domestic partnership in Miami Dade?

A domestic partnership in Miami Dade provides legal recognition for couples who choose to live together and share a domestic life without marriage. This status grants partners certain rights, responsibilities, and protections, making it essential for those in committed relationships. Understanding how domestic partnership in Miami Dade works is crucial for ensuring your rights and benefits are secured.

-

How can airSlate SignNow assist with domestic partnership documents?

airSlate SignNow simplifies the process of drafting, signing, and managing domestic partnership documents in Miami Dade. With its user-friendly interface, you can easily create legally binding agreements and get them signed digitally. This ensures your domestic partnership documents are handled efficiently and securely.

-

What are the benefits of using airSlate SignNow for domestic partnership paperwork?

Using airSlate SignNow for your domestic partnership paperwork in Miami Dade offers several benefits. It streamlines the eSigning process, reduces paperwork, and allows for easy access from any device. Additionally, you can save time and money while ensuring your documents are legally compliant.

-

Is there a cost associated with filing for a domestic partnership in Miami Dade?

Yes, there may be costs associated with filing for a domestic partnership in Miami Dade, such as application fees. However, by using airSlate SignNow, you can efficiently manage your domestic partnership documents at a lower cost compared to traditional methods. This makes the whole process more budget-friendly.

-

What features does airSlate SignNow offer for managing domestic partnership agreements?

airSlate SignNow offers features like customizable document templates, secure cloud storage, and an intuitive eSigning process that is perfect for managing domestic partnership agreements in Miami Dade. Additionally, users benefit from tracking tools that help monitor the status of their documents, ensuring everything is completed in a timely manner.

-

Are there integrations available for airSlate SignNow with other platforms?

Yes, airSlate SignNow provides integrations with various platforms, enhancing the experience for users handling domestic partnership agreements in Miami Dade. These integrations allow for seamless connections with tools like Google Drive, Salesforce, and more, making it easy to organize and manage all related documents in one place.

-

How secure is airSlate SignNow for handling sensitive domestic partnership documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive domestic partnership documents in Miami Dade. The platform employs state-of-the-art encryption and compliance with legal standards to protect your information. You can trust that your documents are safe and only accessible to authorized parties.

Get more for Domestic Partnership Declaration Form Miami Dade College Mdc

- Consultant form

- Rooftop agreement form

- Football game day stadium halo policy for sale of merchandise and distribution of informational or promotional materials

- Nfl licensing form

- United states ski and snowboard association consent and joinder form

- Net triple form

- Membership agreement template 497330399 form

- Commercial lease short form

Find out other Domestic Partnership Declaration Form Miami Dade College Mdc

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast