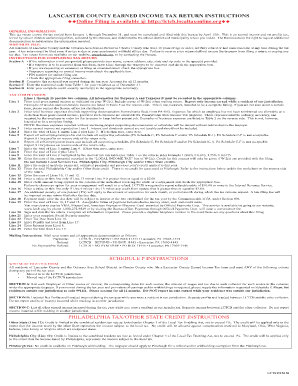

Lancaster Local Tax 2012

What is the Lancaster Local Tax

The Lancaster Local Tax refers to a municipal tax imposed on earned income within Lancaster County. This tax is collected to fund local services and infrastructure. Residents and businesses in Lancaster County are subject to this tax, which is typically calculated as a percentage of the income earned within the jurisdiction. Understanding this tax is crucial for compliance and ensuring that funds are allocated appropriately to support community needs.

Steps to complete the Lancaster Local Tax

Completing the Lancaster County earned income tax return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2 forms and any additional income statements. Next, fill out the required forms, which detail your income and any deductions you may qualify for. After completing the forms, review them thoroughly for any errors or omissions. Finally, submit your return either online through the designated portal or by mailing it to the appropriate tax office. Ensuring that these steps are followed can help avoid penalties and facilitate a smoother filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Lancaster County earned income tax return are critical to avoid late fees and penalties. Typically, the tax return must be filed by April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes in deadlines announced by local tax authorities, as they can vary from year to year. Marking these important dates on your calendar can help ensure timely compliance.

Required Documents

To successfully complete the Lancaster County earned income tax return, certain documents are essential. These typically include your W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation for deductions, such as receipts for business expenses or charitable contributions, may be required. Having these documents organized and readily available can streamline the filing process and reduce the likelihood of errors.

Legal use of the Lancaster Local Tax

The legal framework surrounding the Lancaster Local Tax ensures that it is applied fairly and consistently. Compliance with local tax laws is essential for both individuals and businesses to avoid penalties. The tax is governed by regulations that outline how it is assessed, collected, and enforced. Understanding these legal stipulations can help taxpayers navigate their obligations and rights regarding local taxation, ensuring that they fulfill their responsibilities while also being aware of any available exemptions or credits.

Who Issues the Form

The Lancaster County earned income tax return form is issued by the Lancaster County Tax Collection Bureau (LCTCB). This bureau is responsible for the administration and collection of local taxes within the county. They provide the necessary forms and guidance for taxpayers to ensure compliance with local tax laws. It is important to refer to the LCTCB for any updates or changes to the forms and filing procedures, as they are the authoritative source for local tax information.

Quick guide on how to complete lancaster local tax

Complete Lancaster Local Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It presents an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Lancaster Local Tax on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Lancaster Local Tax with ease

- Obtain Lancaster Local Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Lancaster Local Tax and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lancaster local tax

Create this form in 5 minutes!

How to create an eSignature for the lancaster local tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Lancaster County earned income tax return and how does it work?

The Lancaster County earned income tax return is a tax form required for residents who earn income within Lancaster County. It allows taxpayers to report their earned income and determine their tax liability. Understanding this form is crucial for accurate tax filing and compliance with local tax laws.

-

How can airSlate SignNow help with the Lancaster County earned income tax return process?

AirSlate SignNow simplifies the process of completing and signing the Lancaster County earned income tax return. With our user-friendly platform, you can easily fill out the necessary forms, eSign them securely, and send them directly to the relevant tax authorities. This streamlines your tax filing process, saving you time and effort.

-

Are there any fees associated with filing the Lancaster County earned income tax return through airSlate SignNow?

While filing the Lancaster County earned income tax return itself may not involve a fee, using airSlate SignNow does come with a subscription cost. Our pricing is transparent and designed to be cost-effective, providing you with the tools you need to efficiently eSign and manage documents, making tax season much easier.

-

What features does airSlate SignNow offer for handling the Lancaster County earned income tax return?

AirSlate SignNow offers features like document templates, secure eSigning, and cloud storage that are beneficial for managing the Lancaster County earned income tax return. You can utilize customizable templates to ensure all necessary information is accurately captured, making your tax filing smoother and more efficient.

-

Is it safe to use airSlate SignNow for my Lancaster County earned income tax return?

Yes, airSlate SignNow prioritizes security and ensures that your information related to the Lancaster County earned income tax return is protected. We use industry-leading encryption and comply with data protection regulations, so your sensitive tax information remains confidential and secure.

-

Can I access airSlate SignNow on different devices when filing my Lancaster County earned income tax return?

Yes, airSlate SignNow is designed to be accessible across multiple devices, including smartphones, tablets, and desktops. This flexibility allows you to work on your Lancaster County earned income tax return anywhere, ensuring you can complete your tax filing conveniently and on your schedule.

-

Does airSlate SignNow integrate with other accounting software for Lancaster County earned income tax return?

Absolutely! AirSlate SignNow integrates with various accounting and financial software, making it easier to manage your Lancaster County earned income tax return alongside your other financial tasks. These integrations help streamline your workflow and reduce the risk of errors when filing your tax returns.

Get more for Lancaster Local Tax

- Units amp conversions fact sheet form

- Pt 701pu georgia form

- Soccer scouting report pdf form

- Building a eukaryotic cell worksheet answer key form

- Cross contract for boces services erie 1 boces e1b form

- Pendaftaran model majalah aneka yess form

- Individual income tax instructions and formsdepartment of

- Radiation safety officer form

Find out other Lancaster Local Tax

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter