Life Insurance Needs Analysis Worksheet Form

What is the Life Insurance Needs Analysis Worksheet

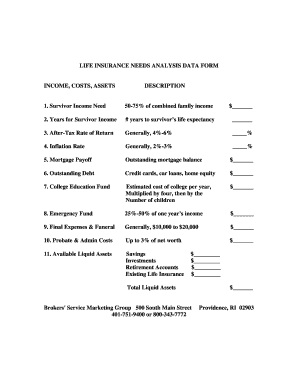

The Life Insurance Needs Analysis Worksheet is a structured tool designed to help individuals assess their life insurance requirements based on their unique financial situations and family needs. This worksheet guides users through various factors, including current debts, future financial obligations, and the desired financial security for dependents. By systematically evaluating these elements, individuals can gain clarity on the amount of life insurance coverage necessary to ensure their loved ones are financially protected in the event of an unforeseen circumstance.

How to use the Life Insurance Needs Analysis Worksheet

Using the Life Insurance Needs Analysis Worksheet involves several straightforward steps. Begin by gathering relevant financial information, such as income, expenses, debts, and assets. Next, input this data into the worksheet, which typically includes sections for calculating immediate expenses, long-term financial goals, and any existing insurance coverage. This structured approach allows users to visualize their financial landscape and identify gaps in their life insurance coverage. Regularly updating the worksheet, especially after significant life events, ensures that the analysis remains relevant and accurate.

Steps to complete the Life Insurance Needs Analysis Worksheet

Completing the Life Insurance Needs Analysis Worksheet involves a series of organized steps:

- Gather Financial Information: Collect details about your income, expenses, debts, and assets.

- Assess Immediate Needs: Calculate any immediate financial obligations, such as funeral costs and outstanding debts.

- Evaluate Long-Term Goals: Consider future financial needs, including education costs for children and retirement plans.

- Review Existing Coverage: Take stock of any current life insurance policies and their coverage amounts.

- Calculate Coverage Needs: Use the worksheet to determine the total life insurance coverage required to meet identified needs.

Key elements of the Life Insurance Needs Analysis Worksheet

The Life Insurance Needs Analysis Worksheet includes several key elements that contribute to a comprehensive assessment. These elements typically encompass:

- Income Details: Information about current income sources and amounts.

- Debt Obligations: A list of all outstanding debts, including mortgages, loans, and credit card balances.

- Future Financial Goals: Considerations for future expenses, such as education and retirement.

- Existing Insurance Policies: Documentation of any current life insurance coverage and its respective benefits.

- Beneficiary Information: Details regarding individuals or entities designated to receive benefits from the policy.

Legal use of the Life Insurance Needs Analysis Worksheet

The legal use of the Life Insurance Needs Analysis Worksheet is essential for ensuring that the information provided is accurate and reliable. While the worksheet itself is not a legally binding document, the data collected can influence decisions regarding life insurance coverage. It is important to ensure that all information is truthful and complete, as discrepancies may lead to complications during the claims process. Additionally, using a trusted platform for completing and storing this worksheet can enhance its validity and security.

Quick guide on how to complete life insurance needs analysis worksheet

Effortlessly Prepare Life Insurance Needs Analysis Worksheet on Any Device

The management of online documents has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Life Insurance Needs Analysis Worksheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Steps to Modify and Electronically Sign Life Insurance Needs Analysis Worksheet with Ease

- Find Life Insurance Needs Analysis Worksheet and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Life Insurance Needs Analysis Worksheet to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life insurance needs analysis worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a needs analysis form?

A needs analysis form is a tool used to assess a client's requirements, objectives, and potential obstacles before implementing solutions. It helps identify specific needs to ensure that the right features and functionalities are included in services like airSlate SignNow. By using a needs analysis form, businesses can avoid unnecessary costs and streamline their document signing processes.

-

How does airSlate SignNow utilize a needs analysis form?

AirSlate SignNow leverages the needs analysis form to better understand client requirements for document management and eSigning. This enables us to customize our solutions, ensuring that your specific needs are met efficiently. The information gathered through the form helps in providing features that enhance user experience and workflow.

-

What features should I look for in a needs analysis form?

When creating a needs analysis form, look for features that allow for detailed responses regarding user needs, current challenges, and desired outcomes. It's important to include sections that cover both qualitative and quantitative data. This will ensure that the information collected can effectively guide decision-making processes and product customization.

-

Are there any costs associated with using the needs analysis form in airSlate SignNow?

Using a needs analysis form within airSlate SignNow is part of our overall service offerings and does not incur additional costs. Our goal is to ensure that you fully benefit from our features, including the needs analysis form, to optimize your document workflow at no extra charge. Contact our sales team for detailed pricing plans.

-

What are the benefits of using a needs analysis form?

Using a needs analysis form provides several benefits, including improved clarity around project goals and user requirements. It helps align expectations between stakeholders and service providers, ultimately leading to faster implementation and better results. In the context of airSlate SignNow, this means a more tailored eSigning experience.

-

Can I integrate my needs analysis form with other tools?

Yes, airSlate SignNow allows for integrations with various tools and platforms, which can help streamline your needs analysis process. By integrating your needs analysis form with CRM systems or project management tools, you can easily gather and analyze data, enhancing your overall efficiency. Check our integration page for supported platforms.

-

How can a needs analysis form improve my document signing process?

A needs analysis form can signNowly enhance your document signing process by identifying specific requirements for implementation. By knowing what features and functionalities your business truly needs, you can leverage airSlate SignNow more effectively. This leads to increased productivity and a smoother signing experience for all parties involved.

Get more for Life Insurance Needs Analysis Worksheet

Find out other Life Insurance Needs Analysis Worksheet

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document