Net Pay Worksheet Answers Form

What is the Net Pay Worksheet Answers

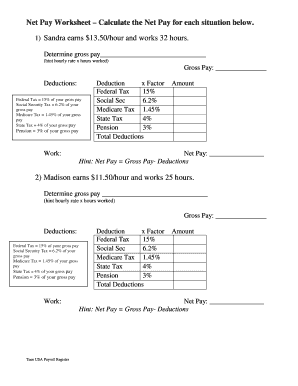

The net pay worksheet answers provide a detailed breakdown of how to calculate an employee's net pay after deductions. This worksheet typically includes various components such as gross pay, federal income tax, Social Security tax, Medicare tax, and other deductions. Understanding these elements is crucial for both employees and employers, as it ensures accurate payroll processing and compliance with tax regulations.

How to use the Net Pay Worksheet Answers

Using the net pay worksheet answers involves several steps. First, gather the necessary financial information, including gross pay and applicable tax rates. Next, input this data into the worksheet, following the provided formulas to calculate each deduction. Finally, subtract the total deductions from the gross pay to determine the net pay. This process helps ensure that employees receive the correct amount in their paychecks.

Steps to complete the Net Pay Worksheet Answers

To complete the net pay worksheet answers, follow these steps:

- Identify the gross pay amount for the pay period.

- Calculate the federal income tax based on the applicable rate.

- Determine Social Security tax, which is typically a percentage of gross pay.

- Calculate Medicare tax, applying the appropriate rate.

- Include any other deductions, such as health insurance or retirement contributions.

- Sum all deductions and subtract this total from the gross pay to find the net pay.

Key elements of the Net Pay Worksheet Answers

Key elements of the net pay worksheet answers include:

- Gross Pay: The total earnings before any deductions.

- Federal Income Tax: The tax withheld based on income level and filing status.

- Social Security Tax: A mandatory deduction for Social Security benefits.

- Medicare Tax: A tax that funds the Medicare program for health care.

- Other Deductions: Additional amounts withheld for benefits or retirement plans.

Examples of using the Net Pay Worksheet Answers

Examples of using the net pay worksheet answers can clarify how to apply the calculations. For instance, if an employee has a gross pay of $1,500, the federal income tax might be calculated at ten percent, resulting in $150. If Social Security tax is six point two percent, that would be $93. The final net pay would be determined by subtracting these amounts from the gross pay, along with any other deductions. These examples help illustrate the practical application of the worksheet.

Legal use of the Net Pay Worksheet Answers

The legal use of net pay worksheet answers is essential for compliance with federal and state tax laws. Employers must ensure that the calculations are accurate to avoid penalties. Additionally, maintaining proper records of these calculations can provide protection in case of audits or disputes. Understanding the legal implications helps both employers and employees navigate payroll responsibilities effectively.

Quick guide on how to complete net pay worksheet answers

Easily Prepare Net Pay Worksheet Answers on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Net Pay Worksheet Answers on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Edit and eSign Net Pay Worksheet Answers Effortlessly

- Find Net Pay Worksheet Answers and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Verify the details, then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Net Pay Worksheet Answers while ensuring clear communication at each step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the net pay worksheet answers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to activity 2 1 calculate net pay answers?

airSlate SignNow is a digital document signing solution that simplifies the process of sending and signing documents securely. For those tackling tasks like 'activity 2 1 calculate net pay answers,' our platform allows users to create and manage documents necessary for payroll calculations and other financial tasks efficiently.

-

How much does airSlate SignNow cost for businesses needing activity 2 1 calculate net pay answers?

Pricing for airSlate SignNow is flexible, accommodating various business needs, starting with a free trial that allows you to explore features relevant to 'activity 2 1 calculate net pay answers.' Plans vary based on features and the number of users, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer that assist with activity 2 1 calculate net pay answers?

airSlate SignNow provides a range of features such as document templates, real-time tracking, and automated workflows that can help streamline processes related to 'activity 2 1 calculate net pay answers.' These tools make it easier for businesses to manage essential financial documents effectively.

-

How can I integrate airSlate SignNow with other applications for activity 2 1 calculate net pay answers?

airSlate SignNow offers seamless integrations with various platforms like Google Workspace, Salesforce, and more, making it easier to handle 'activity 2 1 calculate net pay answers' within your existing workflow. This enhances productivity and ensures that all your tools work together efficiently.

-

What are the benefits of using airSlate SignNow for my document signing needs related to activity 2 1 calculate net pay answers?

Using airSlate SignNow for document signing offers enhanced security, speed, and a user-friendly interface, which is particularly beneficial for activities like 'activity 2 1 calculate net pay answers.' This allows businesses to complete essential agreements without delays while maintaining compliance.

-

Is airSlate SignNow user-friendly for calculating net pay documents in activity 2 1 calculate net pay answers?

Yes, airSlate SignNow is designed to be intuitive, allowing users of all skill levels to navigate and use features easily. This user-friendliness is crucial when handling documents for 'activity 2 1 calculate net pay answers,' ensuring a smooth experience.

-

Can I use airSlate SignNow for team collaboration on activities like activity 2 1 calculate net pay answers?

Absolutely! airSlate SignNow supports team collaboration, enabling multiple users to work on documents related to 'activity 2 1 calculate net pay answers' simultaneously. This fosters teamwork and ensures everyone is on the same page.

Get more for Net Pay Worksheet Answers

- Jefferson transit fixed route mits program healthcare professional authorization form

- Johns creek fence permit form

- Form 6781

- Rental listing agreement form

- Exam form chiropractic chiroassistantscom

- Fillable online san joaquin county fbn 042015 docx fax form

- Agent signature permit form city of plantation plantation

- Javelin pdf reader review form

Find out other Net Pay Worksheet Answers

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast