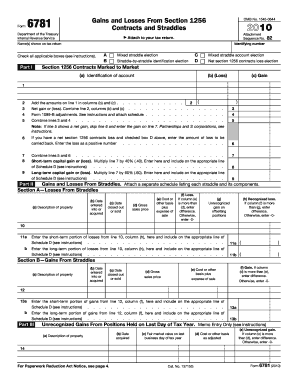

Form 6781

What is the Form 6781

The Form 6781 is a tax form used by individuals and businesses to report gains and losses from the sale or exchange of certain types of property, specifically those related to section 1256 contracts. This form is essential for accurately reporting these transactions to the Internal Revenue Service (IRS), ensuring compliance with federal tax regulations. It includes details about the types of contracts involved and the resulting financial outcomes, which can significantly impact a taxpayer's overall tax liability.

How to use the Form 6781

Using the Form 6781 involves several steps. First, gather all necessary information regarding your section 1256 contracts, including purchase and sale dates, amounts, and any associated gains or losses. Next, fill out the form by entering the required details in the appropriate sections, such as reporting the total gains and losses from these contracts. Finally, ensure that you review the completed form for accuracy before submitting it along with your tax return.

Steps to complete the Form 6781

Completing the Form 6781 can be straightforward if you follow these steps:

- Collect all relevant transaction records related to your section 1256 contracts.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Detail each transaction by entering the date, type of contract, and amounts in the designated sections.

- Calculate your total gains and losses, ensuring that you adhere to IRS guidelines for reporting.

- Review the form for any errors or omissions before finalizing it.

Legal use of the Form 6781

The legal use of the Form 6781 is governed by IRS regulations, which stipulate that taxpayers must accurately report gains and losses from section 1256 contracts. Failure to do so can result in penalties or audits. To ensure compliance, it is crucial to understand the specific requirements of the form, including the types of contracts that qualify and the reporting methods mandated by the IRS.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 6781. These guidelines include detailed instructions on how to report gains and losses, the importance of accurate record-keeping, and the deadlines for filing. Taxpayers are encouraged to consult these guidelines to avoid mistakes that could lead to financial repercussions, such as fines or additional taxes owed.

Filing Deadlines / Important Dates

Filing deadlines for the Form 6781 typically align with the annual tax return due date, which is usually April 15 for individuals. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines and to file the form on time to avoid penalties. Taxpayers should also consider any extensions that may apply to their specific situation.

Quick guide on how to complete form 6781

Complete Form 6781 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage Form 6781 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form 6781 with ease

- Obtain Form 6781 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your choice. Modify and electronically sign Form 6781 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6781

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of form 6781?

Form 6781 is used to report gains and losses from sales or exchanges of section 1256 contracts and straddles. It is essential for taxpayers who engage in trading these types of securities to accurately report their capital gains or losses. airSlate SignNow simplifies the process of signing and managing these forms digitally.

-

How does airSlate SignNow assist with filling out form 6781?

airSlate SignNow provides an intuitive platform that allows users to fill out form 6781 effortlessly. You can create templates for your frequently used documents, making future submissions faster and more efficient. Our eSigning feature ensures your forms are legally binding and securely stored.

-

Is there a cost to use airSlate SignNow for form 6781?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that support the electronic signing and management of documents, including form 6781. You can choose a subscription that best fits your usage, all at a competitive rate.

-

Can form 6781 be integrated with other software via airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with numerous applications to streamline your workflow. You can connect tools such as Google Drive and Dropbox, making it easier to store and retrieve your form 6781 files alongside other important documents.

-

What are the benefits of using airSlate SignNow for managing form 6781?

Using airSlate SignNow to manage form 6781 provides several benefits, including ease of use, time-saving functionalities, and enhanced security. You can quickly send, sign, and receive notifications about your forms, ensuring a smoother tax filing process. Additionally, our platform complies with industry standards for data protection.

-

How can I ensure the security of my form 6781 when using airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and authentication measures for all document transactions, including form 6781. Our platform ensures that your sensitive information remains protected and accessible only to authorized users. You can also track who has viewed or signed your form for added peace of mind.

-

Is it easy to share form 6781 with others through airSlate SignNow?

Yes, sharing form 6781 with collaborators using airSlate SignNow is straightforward and efficient. You can easily send the document via email directly from the platform, ensuring all parties can review and sign it promptly. Our user-friendly interface allows for seamless collaboration on important documents.

Get more for Form 6781

- Self certification form liberty university liberty

- Tmhp form 6700

- Ssa further action notice english ssa tentative nonconfirmation uscis form

- Printable complaint form washington state office of the insurance insurance wa

- Dmv 65 mcp rev 9 form

- City of grand rapids income taxresident form

- 4582 michigan business tax penalty and interest computation for underpaid estimated tax form

- City treasurer amp form

Find out other Form 6781

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter