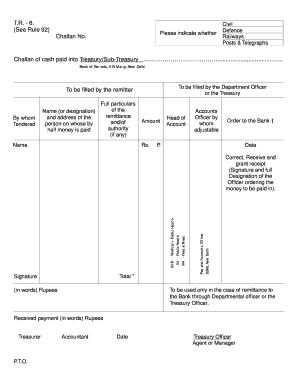

Treasury Rule 92 Challan Form

What is the Treasury Rule 92 Challan Form

The Treasury Rule 92 Challan Form is a specific document used for various financial transactions governed by treasury regulations. It serves as a payment receipt for government fees, taxes, or other financial obligations. This form is essential for maintaining accurate records of payments made to the government, ensuring compliance with financial regulations. Understanding its purpose helps individuals and businesses manage their financial responsibilities effectively.

How to use the Treasury Rule 92 Challan Form

Using the Treasury Rule 92 Challan Form involves several straightforward steps. First, identify the specific payment you need to make and ensure you have the correct form version. Next, fill out the form with accurate details, including your name, address, and payment amount. Once completed, submit the form along with your payment to the designated treasury office or online portal. Keeping a copy of the submitted form is crucial for your records and for any future reference.

Steps to complete the Treasury Rule 92 Challan Form

Completing the Treasury Rule 92 Challan Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form, either online or from a government office.

- Fill in your personal information, including your name, address, and contact details.

- Specify the purpose of the payment and the amount due.

- Review the form for accuracy before submission.

- Submit the completed form along with your payment, either electronically or in person.

Legal use of the Treasury Rule 92 Challan Form

The legal use of the Treasury Rule 92 Challan Form is critical for ensuring that payments are recognized by the government. When filled out correctly, this form acts as a legally binding document, confirming that the payment has been made. It is essential to comply with all relevant regulations to ensure that the form is accepted by the authorities. This includes adhering to deadlines and maintaining accurate records of all transactions.

Key elements of the Treasury Rule 92 Challan Form

Several key elements are crucial for the Treasury Rule 92 Challan Form to be valid. These include:

- Personal Information: Accurate details about the payer, including name and address.

- Payment Details: Clear indication of the payment amount and purpose.

- Date of Payment: The date when the payment is made must be recorded.

- Signature: The form should be signed by the payer to validate the transaction.

Form Submission Methods (Online / Mail / In-Person)

The Treasury Rule 92 Challan Form can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many jurisdictions allow for electronic submission via official government websites.

- Mail: The form can be printed and mailed to the appropriate treasury office.

- In-Person: Individuals may also submit the form directly at designated government offices.

Quick guide on how to complete treasury rule 92 challan form

Complete Treasury Rule 92 Challan Form effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documentation, allowing you to access the right form and securely save it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly without delays. Manage Treasury Rule 92 Challan Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Treasury Rule 92 Challan Form effortlessly

- Locate Treasury Rule 92 Challan Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Treasury Rule 92 Challan Form while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the treasury rule 92 challan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TR 6 challan format?

The TR 6 challan format is a standardized document utilized for making tax payments in India. It allows users to pay various taxes and fees electronically or manually. Familiarizing yourself with the TR 6 challan format can ensure that your payments are processed correctly and efficiently.

-

How can airSlate SignNow help with the TR 6 challan format?

airSlate SignNow streamlines the process of completing and signing the TR 6 challan format digitally. By providing easy-to-use templates and electronic signature capabilities, businesses can ensure compliance while enhancing efficiency in tax payment procedures. This signNowly reduces the paperwork and time traditionally associated with tax processes.

-

Is there a cost associated with using the TR 6 challan format on airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans that include access to various document templates, including the TR 6 challan format. Pricing varies based on the number of users and features required, making it a cost-effective solution for businesses looking to manage documents efficiently. It’s advisable to check the website for the latest pricing details.

-

What features does airSlate SignNow offer for the TR 6 challan format?

airSlate SignNow provides numerous features for handling the TR 6 challan format, including document editing, secure electronic signatures, and tracking capabilities. Users can easily customize the challan as needed and maintain records of submissions. These features help simplify compliance and enhance accountability in tax submissions.

-

Can I integrate airSlate SignNow with other software for managing the TR 6 challan format?

Indeed, airSlate SignNow supports integration with a variety of software solutions, allowing for seamless management of the TR 6 challan format. Integrations with accounting and CRM systems streamline the workflow, enabling users to access necessary documents without switching platforms. This interoperability enhances efficiency in tax management.

-

What are the benefits of using airSlate SignNow for the TR 6 challan format?

Using airSlate SignNow for the TR 6 challan format brings several benefits, including improved accuracy and reduced processing time. The platform’s user-friendly interface makes it easy to manage documents and ensures that you can eSign the challan securely. Additionally, it provides a centralized location for tracking expenses and payments.

-

Is there customer support available for issues related to the TR 6 challan format?

Yes, airSlate SignNow offers robust customer support to assist users with any issues related to the TR 6 challan format. Their support team is available via various channels, including chat and email, ensuring users have access to help when they need it. This level of support is crucial for businesses handling important tax documents.

Get more for Treasury Rule 92 Challan Form

- Az registrar of contractors complaint form

- Cross company guarantee template form

- Life lab requisition form

- Proof of payroll document form

- Verification of school based employment induction and mentoring form

- Adult entertainment establishment license form

- Residential permitting 101 houstontx gov city of houston form

- Patient communication consent form university medical umc ua

Find out other Treasury Rule 92 Challan Form

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online