Ovfa Form

What is the OVFA Form

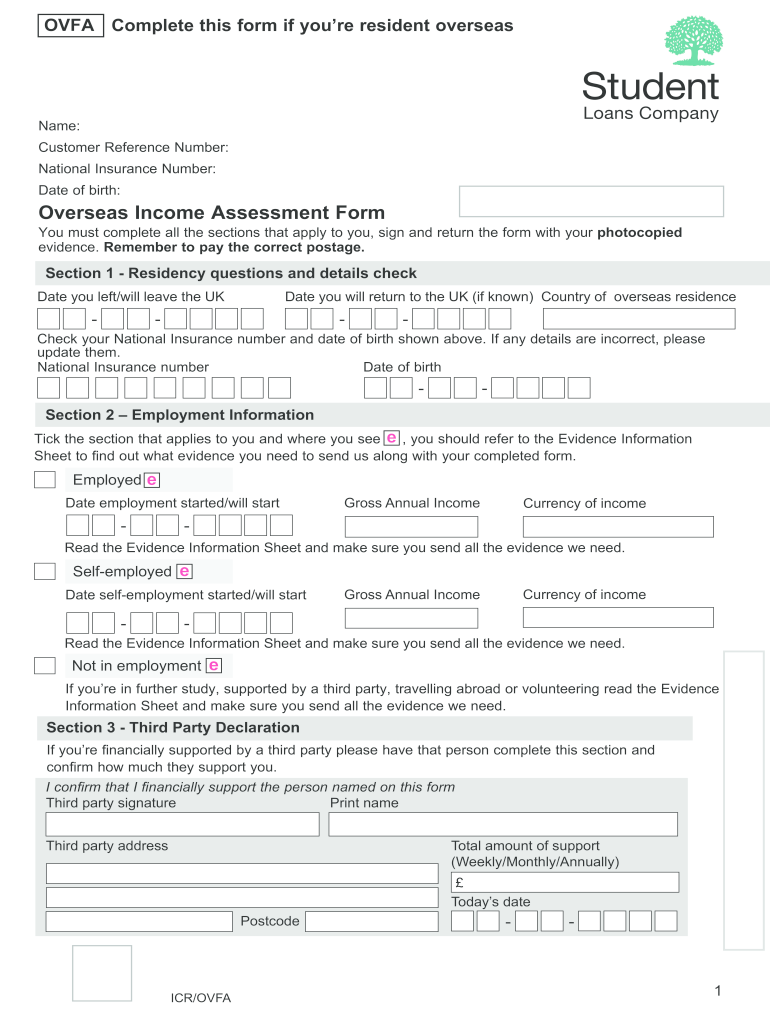

The overseas income assessment form, commonly referred to as the OVFA form, is a crucial document used by U.S. taxpayers to report income earned outside the United States. This form is particularly relevant for individuals who have foreign income that may be subject to U.S. taxation. It helps ensure compliance with tax obligations and provides a clear record of overseas earnings.

How to Use the OVFA Form

Using the OVFA form involves several steps to accurately report your foreign income. First, gather all necessary financial documents that detail your overseas earnings. Next, fill out the form with the required information, ensuring that all figures are accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate tax authority. This careful process helps maintain compliance and avoids potential penalties.

Steps to Complete the OVFA Form

Completing the OVFA form requires careful attention to detail. Follow these steps:

- Gather documentation of your foreign income, including pay stubs, tax returns from the foreign country, and any other relevant financial records.

- Access the OVFA form through the appropriate channels, ensuring you have the latest version.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your foreign income accurately, converting amounts to U.S. dollars if necessary.

- Review your entries for accuracy, checking for any discrepancies or missing information.

- Submit the completed form according to the guidelines provided, whether online, by mail, or in person.

Legal Use of the OVFA Form

The OVFA form is legally binding when completed correctly and submitted in accordance with U.S. tax laws. It is essential to adhere to all regulations regarding foreign income reporting to avoid legal issues. This form must be signed and dated, and it should be submitted within the designated filing deadlines to ensure compliance with the Internal Revenue Service (IRS) requirements.

Key Elements of the OVFA Form

Understanding the key elements of the OVFA form is vital for accurate completion. Important components include:

- Personal identification details, such as your name and Social Security number.

- Details of foreign income sources, including employer information and income amounts.

- Currency conversion rates used to translate foreign income into U.S. dollars.

- Signature and date fields, which validate the authenticity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the OVFA form are crucial to avoid penalties. Typically, the form must be submitted by April 15 of each year, aligning with the standard tax filing deadline. If you are unable to meet this deadline, you may request an extension, but it is essential to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete ovfa form

Complete Ovfa Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow provides you with all the resources you need to create, alter, and electronically sign your documents swiftly and without hassle. Manage Ovfa Form across any platform with the airSlate SignNow Android or iOS applications and simplify your document-driven processes today.

How to modify and electronically sign Ovfa Form with ease

- Locate Ovfa Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document prints. airSlate SignNow caters to your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Ovfa Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ovfa form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ovfa form, and how can I use it with airSlate SignNow?

The OVFA form is a specific document often required for various administrative processes. With airSlate SignNow, you can easily create, send, and eSign your OVFA form securely, streamlining the document management process for your business.

-

Is the OVFA form compatible with other document formats?

Yes, the OVFA form can be converted and integrated with various document formats within airSlate SignNow. This ensures that you can work seamlessly with PDFs, Word files, and other formats while maintaining the integrity of your OVFA form.

-

What are the pricing options for using airSlate SignNow to handle the OVFA form?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, including packages tailored for efficiently managing documents like the OVFA form. Check our pricing page to find a plan that suits your volume and usage requirements.

-

Can I automate the signing process of the OVFA form with airSlate SignNow?

Absolutely! airSlate SignNow includes automation features that allow you to set up workflows for the OVFA form. This means you can automate reminders and notifications, ensuring that signers receive their documents promptly and enhancing overall efficiency.

-

What benefits does airSlate SignNow provide for managing the OVFA form?

Using airSlate SignNow to manage the OVFA form enhances security, convenience, and efficiency. The platform allows you to securely eSign and store your documents while offering an intuitive interface that simplifies the process for all users.

-

How does airSlate SignNow integrate with other software for handling the OVFA form?

airSlate SignNow integrates seamlessly with various business applications such as CRM and project management tools. This ensures that you can manage your OVFA form alongside other processes, making it easier to maintain your workflow across platforms.

-

What security measures are in place for the OVFA form signed through airSlate SignNow?

The security of your OVFA form is paramount at airSlate SignNow. The platform employs advanced encryption, multi-factor authentication, and compliance with legal standards to protect your documents and ensure that your data remains safe.

Get more for Ovfa Form

Find out other Ovfa Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation