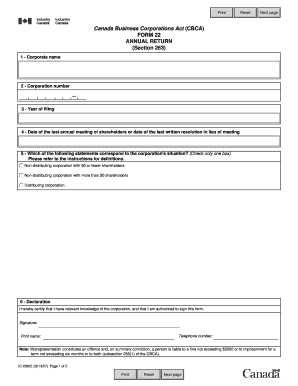

Form 22 Annual Return PDF

What is the Form 22 Annual Return Pdf

The Form 22 Annual Return PDF is a crucial document used by businesses in the United States to report their financial activities and compliance with state regulations. This form typically includes essential information about the business, such as its name, address, and financial statements. It serves as an official record that helps maintain transparency and accountability within the corporate structure. Understanding this form is vital for ensuring compliance with legal obligations and avoiding potential penalties.

How to use the Form 22 Annual Return Pdf

Using the Form 22 Annual Return PDF involves several steps to ensure accurate completion and submission. First, download the form from a reliable source. Next, gather all necessary financial documents and information required to fill out the form accurately. Once you have all the information, complete the form by entering the required details in the designated fields. After filling out the form, review it thoroughly for any errors or omissions before submitting it to the appropriate state authority.

Steps to complete the Form 22 Annual Return Pdf

Completing the Form 22 Annual Return PDF involves a systematic approach:

- Download the form from an official source.

- Gather necessary financial documents, including profit and loss statements and balance sheets.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for accuracy and completeness.

- Submit the completed form to the relevant state authority, either electronically or by mail.

Legal use of the Form 22 Annual Return Pdf

The legal use of the Form 22 Annual Return PDF is governed by state laws and regulations. This form must be filed annually to maintain good standing with state authorities. Failure to file the form or providing inaccurate information can lead to legal consequences, including fines or penalties. It is essential to ensure that the form is completed in accordance with the legal requirements to avoid any complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 22 Annual Return PDF can vary by state. Generally, businesses are required to submit their annual return within a specific timeframe after the end of their fiscal year. It is crucial to be aware of these deadlines to avoid late fees or penalties. Keeping track of important dates, such as the end of the fiscal year and the submission deadline, can help ensure timely compliance.

Required Documents

To complete the Form 22 Annual Return PDF, several documents are typically required. These may include:

- Financial statements, such as balance sheets and income statements.

- Tax identification numbers.

- Details of business ownership and management.

- Any relevant state-specific compliance documents.

Having these documents ready will facilitate a smoother process when filling out the form.

Quick guide on how to complete form 22 annual return pdf

Prepare Form 22 Annual Return Pdf effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the right form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 22 Annual Return Pdf on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and eSign Form 22 Annual Return Pdf with ease

- Find Form 22 Annual Return Pdf and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and eSign Form 22 Annual Return Pdf and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 22 annual return pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 22 annual return pdf?

The form 22 annual return pdf is a statutory document that organizations must submit to confirm their compliance and financial status for the year. This PDF format makes it easy to download, fill out, and submit your return efficiently. Utilizing airSlate SignNow simplifies the signing and submission process, ensuring your form 22 is securely completed.

-

How can airSlate SignNow help with my form 22 annual return pdf?

airSlate SignNow streamlines the process of filling out and eSigning your form 22 annual return pdf. With intuitive tools for document management and eSignature capabilities, you can efficiently complete submissions without unnecessary delays or errors. This ensures your organization stays compliant with minimal hassle.

-

Is there a cost to use airSlate SignNow for form 22 annual return pdf submissions?

Yes, airSlate SignNow offers various pricing plans tailored to fit businesses of different sizes. Plans include features that ensure proper handling of your form 22 annual return pdf, such as secure storage and easy access. Check our website for current pricing details and choose the plan that best meets your needs.

-

What features does airSlate SignNow provide for managing form 22 annual return pdfs?

airSlate SignNow offers advanced features such as document templates, team collaboration, and comprehensive tracking for your form 22 annual return pdf. This allows users to streamline workflows and ensure that documents are correctly filled out and submitted. The platform prioritizes security and compliance, safeguarding sensitive information.

-

Can I integrate airSlate SignNow with other applications for my form 22 annual return pdf?

Absolutely! airSlate SignNow provides integrations with popular applications to facilitate seamless workflow management for your form 22 annual return pdf. Whether you're using CRM systems or cloud storage solutions, our flexible API allows you to enhance your document management process effortlessly.

-

What are the benefits of using airSlate SignNow for my form 22 annual return pdf?

Using airSlate SignNow for your form 22 annual return pdf ensures faster processing times, improved accuracy, and enhanced security of your document submissions. The platform’s user-friendly interface promotes efficiency, reducing the burden of paperwork on your team. Experience peace of mind knowing your documents are securely handled and compliant.

-

How does document security work for form 22 annual return pdf in airSlate SignNow?

airSlate SignNow prioritizes document security with features such as encryption, secure access, and audit trails for your form 22 annual return pdf. These measures help protect sensitive information and ensure that only authorized users can access or modify documents. Your compliance and data security are our top priority.

Get more for Form 22 Annual Return Pdf

Find out other Form 22 Annual Return Pdf

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation