Form Os 114

What is the Form OS 114?

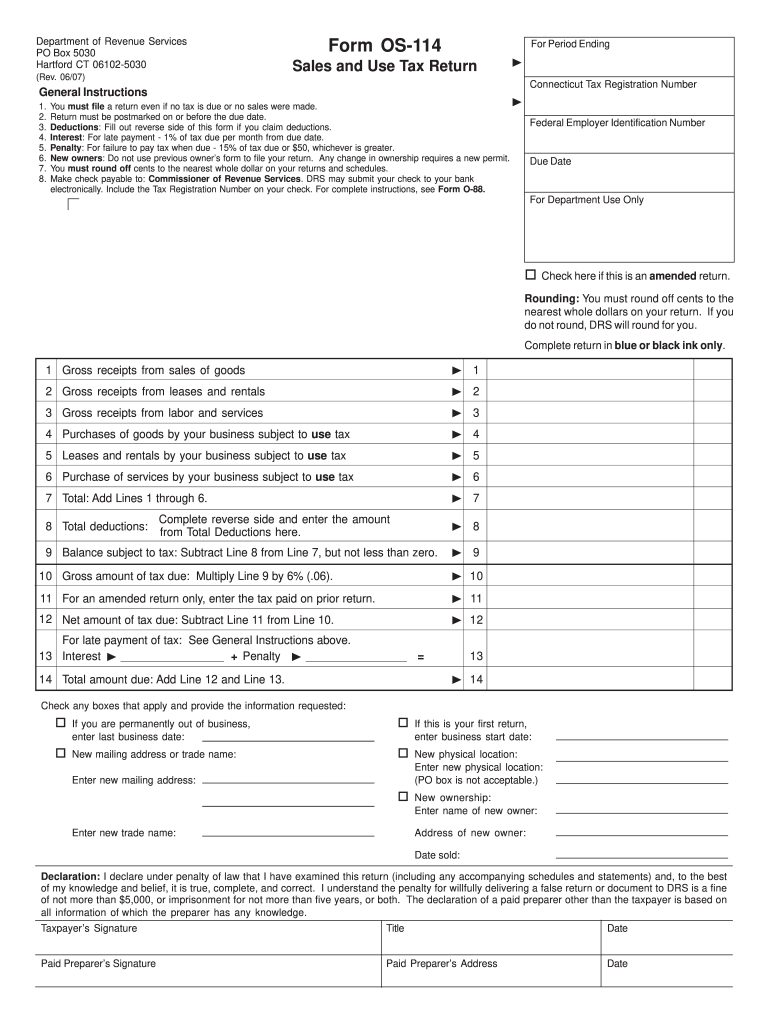

The Form OS 114 is a Connecticut-specific document used primarily for sales and use tax purposes. This form is essential for businesses and individuals who need to report and remit sales tax collected on taxable sales. It is a fillable form that allows users to enter relevant information electronically, making the process more efficient and accessible. The OS 114 form is crucial for maintaining compliance with state tax regulations and ensuring accurate reporting of sales tax obligations.

How to Use the Form OS 114

Using the Form OS 114 involves several straightforward steps. First, download the fillable version of the form from a reliable source. Next, enter your business information, including your name, address, and tax identification number. Be sure to accurately report the total sales and any applicable exemptions. After completing the form, review all entries for accuracy before submitting it. The electronic format allows for easy corrections and updates, ensuring that your submission is precise and compliant.

Steps to Complete the Form OS 114

Completing the Form OS 114 requires attention to detail. Follow these steps:

- Download the fillable OS 114 form in PDF format.

- Fill in your business name and address in the designated fields.

- Report the total sales amount and any deductions or exemptions applicable.

- Calculate the total tax due based on the reported sales.

- Review all information for accuracy and completeness.

- Save the completed form for your records.

Legal Use of the Form OS 114

The Form OS 114 is legally binding when filled out correctly and submitted in accordance with Connecticut tax laws. To ensure its validity, it is important to comply with all state regulations regarding sales tax reporting. This includes maintaining accurate records of sales and ensuring that the information provided on the form is truthful and complete. Failure to comply with these regulations can result in penalties or fines.

Form Submission Methods

The completed Form OS 114 can be submitted through various methods. Users have the option to file the form electronically via the Connecticut Department of Revenue Services website. Alternatively, the form can be printed and mailed to the appropriate address listed on the form. In-person submissions are also accepted at designated state offices. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Key Elements of the Form OS 114

Understanding the key elements of the Form OS 114 is vital for accurate completion. Important components include:

- Business identification information, including name and address.

- Total sales amount for the reporting period.

- Applicable exemptions and deductions.

- Total tax calculated based on reported sales.

- Signature and date to certify the accuracy of the information provided.

Quick guide on how to complete form os 114 100068938

Effortlessly prepare Form Os 114 on any gadget

Digital document management has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form Os 114 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form Os 114 with ease

- Find Form Os 114 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically available through airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form - via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Form Os 114 and maintain excellent communication throughout any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form os 114 100068938

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form os 114 fillable?

A form os 114 fillable is a digital document that allows users to easily complete and submit necessary information online. This form streamlines the process for various legal and administrative tasks, making it a convenient option for businesses and individuals alike.

-

How can airSlate SignNow help me with form os 114 fillable?

airSlate SignNow simplifies the process of creating and managing the form os 114 fillable by providing intuitive tools to design, edit, and send these documents. Users can easily add fields, signatures, and collect responses, all within a secure platform.

-

Is there a cost associated with using the form os 114 fillable on airSlate SignNow?

Yes, while airSlate SignNow offers a free trial, there are subscription plans that provide access to advanced features for the form os 114 fillable. Pricing is competitive and tailored to cater to the needs of both individuals and businesses.

-

Can I customize the form os 114 fillable when using airSlate SignNow?

Absolutely! airSlate SignNow allows full customization of the form os 114 fillable, enabling you to tailor it to your specific requirements. You can add custom branding, fields, and even workflows to enhance your document’s effectiveness.

-

Are there any integrations available for the form os 114 fillable?

Yes, airSlate SignNow integrates seamlessly with numerous applications, enhancing the functionality of the form os 114 fillable. You can connect it with popular apps like Google Drive, Dropbox, and CRM systems, streamlining your document management processes.

-

What are the benefits of using airSlate SignNow for form os 114 fillable?

Using airSlate SignNow for your form os 114 fillable offers several benefits, including increased efficiency, enhanced security, and ease of use. You'll eliminate paper processes, reduce errors, and accelerate your workflows, making document management a breeze.

-

Is eSignature legally binding on form os 114 fillable with airSlate SignNow?

Yes, the eSignatures obtained through airSlate SignNow on your form os 114 fillable are legally binding and compliant with electronic signature laws. This ensures that your documents are valid and enforceable both locally and globally.

Get more for Form Os 114

- Indian embassy in dc form

- Microsoft office word windows 7 64 bit full version download office preview form

- Telangana high court vakalatnama pdf form

- Diet waiver form

- Undertaking of the employer form dubai

- Eq i questionnaire download form

- Attachment dcomprehensive title iv e agency plan attachment d title iv e pre print form

- Hague child support convention formsexpire march 31

Find out other Form Os 114

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word