Indusind Bank Tan Number Form

What is the Indusind Bank Tan Number

The Indusind Bank TAN number, or Tax Deduction and Collection Account Number, is a unique identifier assigned to entities responsible for deducting or collecting tax on behalf of the government. This number is essential for businesses and individuals who need to comply with tax regulations in India. It enables the proper reporting and payment of taxes deducted at source, ensuring transparency and accountability in tax collection.

How to obtain the Indusind Bank Tan Number

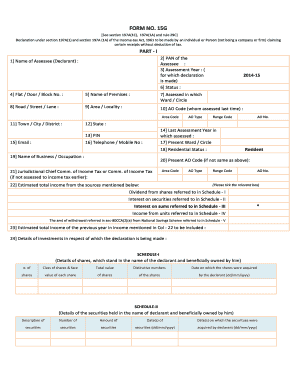

To obtain the Indusind Bank TAN number, applicants must follow a structured process. The first step involves filling out Form 49B, which is the application form for TAN. This form can be submitted online through the official website of the Income Tax Department or in person at designated offices. After submitting the form, applicants must provide necessary documentation, including identity proof and address proof. Once the application is processed, the TAN number will be issued, typically within a few weeks.

Steps to complete the Indusind Bank Tan Number

Completing the Indusind Bank TAN number involves several key steps:

- Fill out Form 49B accurately, ensuring all required fields are completed.

- Gather supporting documents such as proof of identity and address.

- Submit the form and documents either online or at a designated office.

- Receive the TAN number via email or postal service once processed.

Legal use of the Indusind Bank Tan Number

The legal use of the Indusind Bank TAN number is crucial for compliance with tax laws. It must be used when deducting tax at source and for filing tax returns. Failure to use the TAN number correctly can lead to penalties and legal repercussions. It is essential for businesses and individuals to ensure that their TAN is active and correctly linked to their tax filings to avoid any issues with the tax authorities.

Required Documents

When applying for the Indusind Bank TAN number, certain documents are required to validate the application. These typically include:

- Proof of identity (such as a passport, voter ID, or driver's license).

- Proof of address (like utility bills or bank statements).

- Business registration documents, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Indusind Bank TAN number application can be submitted through various methods. The online submission is the most efficient, allowing applicants to fill out Form 49B and upload necessary documents directly on the Income Tax Department's website. Alternatively, applicants can send the completed form and documents via mail or visit a designated office to submit them in person. Each method has its own processing times and requirements, so applicants should choose the one that best suits their needs.

Examples of using the Indusind Bank Tan Number

The Indusind Bank TAN number is used in various scenarios, such as:

- Employers deducting tax from employee salaries.

- Businesses collecting tax on payments made to vendors.

- Individuals making payments that require tax deduction at source.

Quick guide on how to complete indusind bank tan number

Effortlessly Prepare Indusind Bank Tan Number on Any Device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without hesitation. Manage Indusind Bank Tan Number across any platform using the airSlate SignNow mobile applications for Android or iOS and streamline any document-related procedure today.

The Simplest Way to Modify and Electronically Sign Indusind Bank Tan Number with Ease

- Find Indusind Bank Tan Number and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details using tools specifically designed for that by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Indusind Bank Tan Number to guarantee exceptional communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indusind bank tan number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAN number of IndusInd Bank and why is it important?

The TAN number of IndusInd Bank, or Tax Deduction and Collection Account Number, is a unique identifier required for tax purposes. It is essential for businesses that deduct tax at source on payments made to vendors. Having a TAN number ensures compliance with tax laws and facilitates seamless tax filings.

-

How can I obtain the TAN number of IndusInd Bank?

To obtain the TAN number of IndusInd Bank, you need to apply online through the Income Tax Department's website or visit the nearest tax office. The process typically requires documents such as your PAN information and details of your business activities. Once your application is processed, you will receive your TAN number via email.

-

Can the airSlate SignNow platform help in managing the TAN number of IndusInd Bank?

Yes, the airSlate SignNow platform can assist in managing documents related to the TAN number of IndusInd Bank efficiently. You can store, eSign, and share your tax documents securely using our easy-to-use platform. This enhances document management and helps ensure timely submissions.

-

What are the features of airSlate SignNow related to financial compliance?

airSlate SignNow offers features that promote financial compliance, such as legally binding eSignatures and document storage. You can easily manage documents related to the TAN number of IndusInd Bank, track changes, and automate workflows. This streamlines processes and keeps you compliant with tax regulations.

-

Is airSlate SignNow a cost-effective solution for managing my TAN number of IndusInd Bank?

Absolutely! airSlate SignNow provides a cost-effective solution for managing your TAN number of IndusInd Bank and other tax-related documents. With various pricing plans to fit different business needs, you can enhance productivity without compromising on compliance or security.

-

How does airSlate SignNow ensure the security of documents related to the TAN number of IndusInd Bank?

airSlate SignNow employs state-of-the-art security measures, including encryption and access controls, to protect documents associated with your TAN number of IndusInd Bank. Our platform ensures that sensitive financial data is kept secure and only accessible to authorized users. This commitment to security helps safeguard your business's information.

-

Can airSlate SignNow integrate with accounting software to manage my TAN number of IndusInd Bank?

Yes, airSlate SignNow seamlessly integrates with various accounting software, allowing you to manage your TAN number of IndusInd Bank alongside your financial records. This integration simplifies your document workflow and eliminates duplication, enabling better tracking and reporting of tax-related activities.

Get more for Indusind Bank Tan Number

Find out other Indusind Bank Tan Number

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF