Oklahoma Tax Exempt Form 2013-2026

What is the Oklahoma Tax Exempt Form

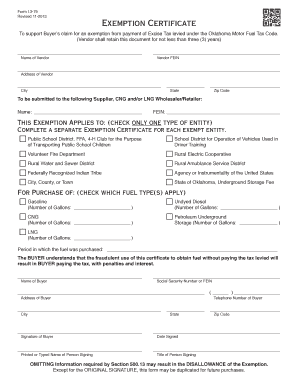

The Oklahoma Tax Exempt Form is a crucial document used by individuals and organizations to claim exemption from state sales tax. This form, often referred to as the Oklahoma Sales Tax Exemption Certificate, allows eligible entities, such as non-profits or Native American tribes, to make purchases without incurring sales tax. The form serves as proof of eligibility and must be presented to vendors at the time of purchase to validate the exemption.

How to use the Oklahoma Tax Exempt Form

Using the Oklahoma Tax Exempt Form involves several steps to ensure compliance and proper execution. First, the individual or organization must complete the form accurately, providing all necessary information, including the tax-exempt number and details about the purchases. Once filled out, the form should be presented to the seller during a transaction. It is essential for the seller to retain a copy of the form for their records to validate the tax-exempt status during audits.

Steps to complete the Oklahoma Tax Exempt Form

Completing the Oklahoma Tax Exempt Form requires careful attention to detail. Follow these steps:

- Obtain the form, which is available in PDF format.

- Fill in the name and address of the purchaser, along with the tax-exempt number.

- Indicate the type of exemption being claimed, such as for a non-profit organization or a Native American tribe.

- Detail the nature of the purchases that will be exempt from sales tax.

- Sign and date the form to certify the information provided is accurate.

Legal use of the Oklahoma Tax Exempt Form

The legal use of the Oklahoma Tax Exempt Form is governed by state laws and regulations. To ensure that the form is valid, it must be used by eligible entities only. Misuse of the form, such as using it for ineligible purchases or providing false information, can lead to penalties and legal repercussions. It is important to understand the specific criteria for exemption to avoid any compliance issues.

Eligibility Criteria

Eligibility for using the Oklahoma Tax Exempt Form varies based on the type of entity making the claim. Generally, non-profit organizations, government entities, and Native American tribes are eligible for tax exemption. Each category has specific requirements that must be met, including documentation that proves the entity's status. Understanding these criteria is essential for a successful application and use of the form.

Who Issues the Form

The Oklahoma Tax Exempt Form is issued by the Oklahoma Tax Commission. This governmental body oversees the administration of state tax laws and provides necessary forms for tax-related processes. Individuals and organizations seeking to obtain the form can do so directly from the Oklahoma Tax Commission's official resources, ensuring they have the most current version available for use.

Quick guide on how to complete oklahoma tax exempt form

Effortlessly Complete Oklahoma Tax Exempt Form on Any Device

Digital document management has gained signNow traction among organizations and individuals alike. It presents an ideal environmentally-friendly substitute to traditional printed and signed paperwork, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Oklahoma Tax Exempt Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Oklahoma Tax Exempt Form with Ease

- Locate Oklahoma Tax Exempt Form and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Oklahoma Tax Exempt Form and maintain effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form Oklahoma?

A tax exempt form Oklahoma is a legal document used by organizations and individuals to claim exemption from certain sales taxes in Oklahoma. This form is essential for qualifying non-profits, government agencies, and certain other entities to ensure they do not pay taxes on exempt purchases.

-

How can airSlate SignNow assist with tax exempt form Oklahoma?

airSlate SignNow simplifies the process of completing and signing the tax exempt form Oklahoma through its user-friendly eSignature platform. Users can quickly fill out, sign, and send their forms online, ensuring efficiency and compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for tax exempt forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Whether you're a small business or a large organization, you can find a plan that fits your budget while allowing you to manage your tax exempt form Oklahoma effectively.

-

What features does airSlate SignNow offer for tax exempt forms?

airSlate SignNow comes equipped with features like customizable templates, secure eSigning, and storage options that streamline the process of managing your tax exempt form Oklahoma. Additionally, it offers real-time tracking and reminders to ensure timely submission.

-

Can I integrate airSlate SignNow with other software for tax exempt form management?

Absolutely! airSlate SignNow can integrate seamlessly with various applications and platforms, allowing users to manage their tax exempt form Oklahoma alongside other business processes. Popular integrations include CRM systems, document management software, and cloud storage.

-

How secure is airSlate SignNow for handling tax exempt forms?

airSlate SignNow prioritizes security, utilizing advanced encryption and compliance measures to protect your tax exempt form Oklahoma and other sensitive documents. With ISO 27001 certification and HIPAA compliance, you can trust that your data is safe.

-

Can I track who has signed my tax exempt form Oklahoma?

Yes, airSlate SignNow provides tracking capabilities that allow you to see who has viewed and signed your tax exempt form Oklahoma. This feature helps ensure accountability and keeps your document workflow organized.

Get more for Oklahoma Tax Exempt Form

Find out other Oklahoma Tax Exempt Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors