Td4 Forms Trinidad Printable 2013

What is the Td4 Form 2013 Trinidad?

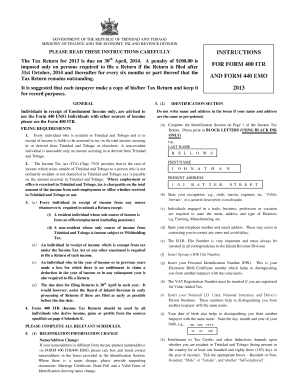

The Td4 form is a crucial document used in Trinidad for tax purposes, specifically related to the declaration of income from employment. This form is essential for both employers and employees, as it outlines the income earned and the taxes withheld during the fiscal year. The Td4 form 2013 Trinidad is particularly relevant for those who need to report their earnings accurately to the Trinidad and Tobago Inland Revenue Division. Understanding this form is vital for compliance with local tax regulations.

Steps to Complete the Td4 Form 2013 Trinidad

Filling out the Td4 form requires careful attention to detail to ensure accuracy. Here are the steps to complete the form:

- Gather all necessary documents, including your employment records and any previous tax returns.

- Begin by entering your personal information, such as your name, address, and taxpayer identification number.

- Report your total income for the year, including any bonuses or additional earnings.

- Indicate the total amount of taxes withheld by your employer.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Td4 Form 2013 Trinidad

The Td4 form is legally recognized as a valid document for reporting income and taxes in Trinidad. It must be filled out accurately to avoid any legal repercussions. Compliance with the tax laws ensures that individuals and businesses fulfill their obligations to the Trinidad and Tobago government. Failure to submit this form correctly can lead to penalties, making it essential to understand its legal implications.

How to Obtain the Td4 Form 2013 Trinidad

Obtaining the Td4 form is straightforward. It can be accessed through the official website of the Trinidad and Tobago Inland Revenue Division. Additionally, physical copies may be available at local tax offices. For those who prefer digital options, the form can be filled out online, allowing for a more efficient submission process.

Key Elements of the Td4 Form 2013 Trinidad

The Td4 form includes several key elements that must be accurately reported. These include:

- Your personal identification details.

- Total income earned during the fiscal year.

- Details of any deductions or allowances applicable.

- The total amount of taxes withheld by your employer.

Each element plays a significant role in ensuring that your tax obligations are met and that you receive any potential refunds.

Form Submission Methods for the Td4 Form 2013 Trinidad

The Td4 form can be submitted through various methods, making it accessible for all taxpayers. Options include:

- Online submission via the Trinidad and Tobago Inland Revenue Division's website.

- Mailing a physical copy to the appropriate tax office.

- In-person submission at local tax offices, where assistance may be available.

Choosing the right submission method can help streamline the process and ensure timely filing.

Quick guide on how to complete td4 forms trinidad printable

Complete Td4 Forms Trinidad Printable effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly without delays. Manage Td4 Forms Trinidad Printable on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Td4 Forms Trinidad Printable without any hassle

- Obtain Td4 Forms Trinidad Printable and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or hide sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form navigation, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Revise and eSign Td4 Forms Trinidad Printable and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct td4 forms trinidad printable

Create this form in 5 minutes!

How to create an eSignature for the td4 forms trinidad printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the td4 form 2013 trinidad No Download Needed?

The td4 form 2013 trinidad No Download Needed is a tax document used for employee earnings and is required for Trinidad and Tobago tax filings. This online form simplifies the reporting process by allowing users to fill it out without needing any downloads or cumbersome software installations.

-

How can I access the td4 form 2013 trinidad No Download Needed?

You can easily access the td4 form 2013 trinidad No Download Needed directly on the airSlate SignNow platform. Simply visit our website, navigate to the forms section, and fill out the td4 form online without downloading any additional software.

-

Are there any costs associated with using the td4 form 2013 trinidad No Download Needed?

Using the td4 form 2013 trinidad No Download Needed on airSlate SignNow is part of our cost-effective eSignature solutions. We offer various pricing plans to suit your business needs, but you can start with a free trial to see the benefits without any financial commitment.

-

What features does airSlate SignNow offer for the td4 form 2013 trinidad No Download Needed?

airSlate SignNow offers several features for the td4 form 2013 trinidad No Download Needed, including eSignatures, customizable templates, and real-time collaboration tools. These features ensure that filling out and signing the form is efficient and straightforward for both employers and employees.

-

Can I integrate airSlate SignNow with other software while using the td4 form 2013 trinidad No Download Needed?

Yes, airSlate SignNow supports various integrations with popular software solutions, enabling you to streamline your workflow while using the td4 form 2013 trinidad No Download Needed. These integrations can help you connect with CRM systems, document management tools, and more to enhance productivity.

-

How does using the td4 form 2013 trinidad No Download Needed benefit my business?

Utilizing the td4 form 2013 trinidad No Download Needed helps your business save time and reduces the likelihood of errors associated with paper forms. The digital format also offers increased security and easy access for quick modifications and audits, ultimately making your tax reporting process more efficient.

-

Is there customer support available when using the td4 form 2013 trinidad No Download Needed?

airSlate SignNow provides robust customer support for users of the td4 form 2013 trinidad No Download Needed. Whether you have questions about form completion or need help with the platform, our dedicated team is available through chat, email, or phone to assist you.

Get more for Td4 Forms Trinidad Printable

- Indian golf union membership form pdf

- Ptax 342 r st clair county 101266543 form

- Earth by cynthia sherwood form

- City of treasure island permit application form

- Phonology in nigerian english form

- Download transcript request form pdf southeastern bible college

- Hud 9887 forms printable 100081426

- Library card application form enoch pratt library prattlibrary

Find out other Td4 Forms Trinidad Printable

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later