Financial Soundness Certificate Form

What is the Financial Soundness Certificate

The financial soundness certificate is a formal document issued by a bank or financial institution, confirming the financial health and stability of an individual or business. This certificate is often required for various financial transactions, including loan applications, leasing agreements, or when establishing business relationships. It serves as proof that the entity in question meets certain financial criteria, such as liquidity and solvency, which are essential for maintaining trust in financial dealings.

How to Obtain the Financial Soundness Certificate

To obtain a financial soundness certificate from a bank, follow these steps:

- Identify the bank or financial institution where you hold an account.

- Gather necessary documentation, including financial statements, tax returns, and identification.

- Visit the bank's branch or their official website to request the certificate.

- Complete any required application forms provided by the bank.

- Submit the application along with the required documentation.

- Wait for the bank to process your request, which may take several days.

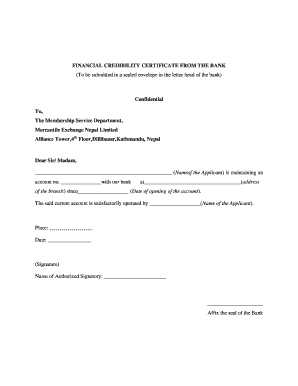

Key Elements of the Financial Soundness Certificate

A financial soundness certificate typically includes several key elements that validate its authenticity and usefulness:

- Issuer Information: The name and contact details of the bank or financial institution issuing the certificate.

- Recipient Information: The name and details of the individual or business receiving the certificate.

- Financial Overview: A summary of the financial status, including assets, liabilities, and overall solvency.

- Date of Issue: The date when the certificate is issued, which is important for validity.

- Signature: An authorized signature from a bank representative, confirming the accuracy of the information.

Steps to Complete the Financial Soundness Certificate

Completing a financial soundness certificate involves several important steps to ensure accuracy and compliance:

- Begin by filling in the personal or business information accurately.

- Provide detailed financial data, including assets, liabilities, and income statements.

- Double-check all entries for accuracy to avoid delays in processing.

- Sign the document where required, ensuring that the signature matches the one on file with the bank.

- Submit the completed certificate to the relevant parties, ensuring that you retain a copy for your records.

Legal Use of the Financial Soundness Certificate

The financial soundness certificate is a legally recognized document in the United States, provided it meets specific criteria. It is essential for various legal and financial transactions, including:

- Loan applications, where lenders require proof of financial stability.

- Business contracts, ensuring that all parties are financially capable of fulfilling their obligations.

- Government or regulatory requirements, where proof of financial soundness is mandated.

Examples of Using the Financial Soundness Certificate

There are numerous scenarios in which a financial soundness certificate may be utilized:

- When applying for a mortgage, lenders often request this certificate to assess the borrower's financial health.

- Businesses may need to provide this document when bidding for contracts or securing partnerships.

- Individuals may be asked to present this certificate when renting commercial property to demonstrate their ability to meet lease obligations.

Quick guide on how to complete financial soundness certificate

Complete Financial Soundness Certificate effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Financial Soundness Certificate on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to alter and eSign Financial Soundness Certificate effortlessly

- Locate Financial Soundness Certificate and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Financial Soundness Certificate and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the financial soundness certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank solvency certificate?

A bank solvency certificate is a document issued by a financial institution that certifies that a customer has a sufficient balance and is financially responsible. It is often required for loan applications, visa processes, or business transactions. Obtaining a bank solvency certificate can assure third parties of your financial stability.

-

How can airSlate SignNow help in obtaining a bank solvency certificate?

With airSlate SignNow, you can easily manage and eSign documents required for obtaining a bank solvency certificate. Our platform streamlines the process by allowing you to send documents securely and sign them electronically. This simplifies the workflow and reduces delays typically associated with paperwork.

-

What are the pricing plans for airSlate SignNow services?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can choose from various subscription options based on your needs, whether you need a standard or advanced plan. This ensures that you have access to all the features required to manage documents, including those related to bank solvency certificates.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure cloud storage. These functionalities make it easy to create, send, and sign documents like a bank solvency certificate efficiently. Additionally, our solution integrates seamlessly with popular tools to enhance your workflow.

-

Are there any benefits of using airSlate SignNow for managing financial documents?

Yes, using airSlate SignNow to manage your financial documents like a bank solvency certificate has several benefits. It ensures security through encryption while allowing for quick access and easy sharing. Furthermore, the platform minimizes paperwork, helping you save time and avoid errors.

-

Can airSlate SignNow integrate with other financial software?

Absolutely! airSlate SignNow can integrate with a variety of financial software, optimizing how you manage documents related to bank solvency certificates. This integration allows for data synchronization and enhances workflows, providing a more complete solution for your financial documentation needs.

-

How secure is the process of obtaining a bank solvency certificate using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform to obtain a bank solvency certificate, you'll benefit from secure encryption and compliance with industry standards. This ensures that your financial data and sensitive documents are protected throughout the workflow.

Get more for Financial Soundness Certificate

- Does submitting sir affect admissionscollege confidential form

- Practical nursing pn certificate program rcc form

- Associate degree nursingrobeson community college form

- Official independent student number in collegedocx form

- Osa disability verification form sacred heart university

- Date student interview request form thank you for considering planned parenthood for your upcoming school project

- Application for candidate corresponding form

- Commonwealth challenge application part one and part two form

Find out other Financial Soundness Certificate

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF