W 9 Form Ct

What is the W-9 Form CT

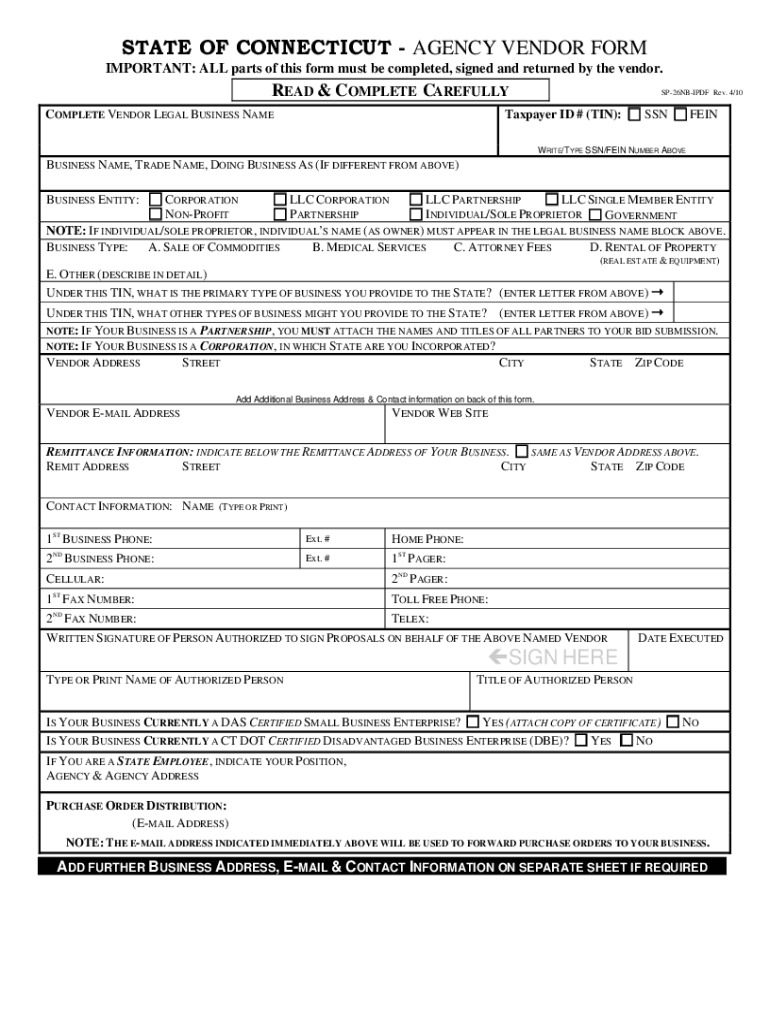

The W-9 Form CT is a tax document used in the United States for individuals and businesses to provide their taxpayer identification information to entities that will report income paid to them. This form is essential for freelancers, contractors, and other self-employed individuals who receive payments from clients. It includes details such as the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security number (SSN) or an Employer Identification Number (EIN).

How to use the W-9 Form CT

The W-9 Form CT is primarily used to ensure accurate reporting of income to the Internal Revenue Service (IRS). When a business or individual requests this form, it is typically to prepare a 1099 form for reporting payments made to independent contractors or freelancers. By submitting the W-9, the taxpayer certifies that the TIN provided is correct and that they are not subject to backup withholding. This form can be filled out and submitted electronically, ensuring a faster and more efficient process.

Steps to complete the W-9 Form CT

Completing the W-9 Form CT involves several straightforward steps:

- Begin by entering your name as it appears on your tax return.

- If applicable, include your business name in the second line.

- Provide your address, ensuring it matches the IRS records.

- Indicate your taxpayer identification number (SSN or EIN) in the appropriate field.

- Check the box that corresponds to your tax classification, such as individual, corporation, or partnership.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the W-9 Form CT

The W-9 Form CT is legally binding when filled out correctly and submitted to the requesting party. It serves as a declaration of your taxpayer status and helps prevent issues with the IRS regarding income reporting. It is important to ensure that all information is accurate and up to date, as providing incorrect information can lead to penalties or issues with tax filings. The form must be kept on file by the requesting entity for their records and compliance with tax regulations.

IRS Guidelines

The IRS provides specific guidelines for the use of the W-9 Form CT. According to these guidelines, the form should be requested whenever a business or individual needs to report payments made to a contractor or freelancer. It is important to submit the W-9 promptly to avoid delays in payment processing. The IRS also emphasizes the importance of accuracy in the information provided, as discrepancies can lead to backup withholding or other tax-related issues.

Filing Deadlines / Important Dates

While the W-9 Form CT itself does not have a specific filing deadline, it is crucial to submit it to the requesting party in a timely manner. Typically, businesses must issue 1099 forms to contractors by January thirty-first of the following year. Therefore, it is advisable to complete and submit the W-9 as soon as you begin working with a new client to ensure that all tax reporting is accurate and on time.

Quick guide on how to complete w 9 form ct

Effortlessly Prepare W 9 Form Ct on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle W 9 Form Ct on any platform with the airSlate SignNow apps for Android or iOS and enhance your document-related tasks today.

The Easiest Way to Edit and eSign W 9 Form Ct Effortlessly

- Obtain W 9 Form Ct and click Get Form to begin.

- Utilize the tools we supply to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign W 9 Form Ct and ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 9 form ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 9 Form Ct, and why is it important?

The W 9 Form Ct is a tax form required by the IRS for U.S. persons to provide their taxpayer identification information. It is essential for businesses to collect this information from independent contractors and freelancers for tax reporting purposes. Ensuring proper completion of the W 9 Form Ct helps to avoid any issues with tax compliance.

-

How can airSlate SignNow assist in completing the W 9 Form Ct?

airSlate SignNow provides an intuitive platform for easily filling out and signing the W 9 Form Ct electronically. Users can quickly upload their documents, fill in the required fields, and send them for signatures with just a few clicks. This streamline process simplifies managing tax documentation, making it efficient for users.

-

Is there a cost associated with using airSlate SignNow for the W 9 Form Ct?

Yes, airSlate SignNow offers several pricing plans tailored to businesses of all sizes. The plans include features that allow for unlimited eSigning and document management, ensuring you can handle W 9 Form Ct efficiently without unexpected costs. Explore our pricing options to find the best fit for your needs.

-

What features does airSlate SignNow offer for the W 9 Form Ct?

AirSlate SignNow provides features such as eSigning, document sharing, templates, and automated workflows specifically for the W 9 Form Ct. Users can easily save and reuse templates, track the signing process, and securely store completed forms in one place. These features make managing W 9 Form Ct documents hassle-free.

-

Can I integrate airSlate SignNow with other platforms for the W 9 Form Ct?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRM systems, cloud storage services, and accounting software, to facilitate efficient handling of the W 9 Form Ct. These integrations help streamline your workflow and ensure all your documents and financial information are connected.

-

What are the benefits of using airSlate SignNow for the W 9 Form Ct?

Using airSlate SignNow for the W 9 Form Ct simplifies the signing and submission process, reducing the time spent on paperwork. The platform ensures secure storage and easy access to completed forms, which enhances organization and compliance. Furthermore, it increases overall productivity by automating repetitive tasks.

-

How does electronic signing of the W 9 Form Ct with airSlate SignNow work?

Electronic signing of the W 9 Form Ct with airSlate SignNow is straightforward. Once the form is completed, users can click to sign it electronically using a mouse, touchscreen, or stylus. The signed document is then stored securely, ensuring compliance with electronic signature laws.

Get more for W 9 Form Ct

Find out other W 9 Form Ct

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online