Tax Credit Accountability Reporting Form

What is the Tax Credit Accountability Reporting

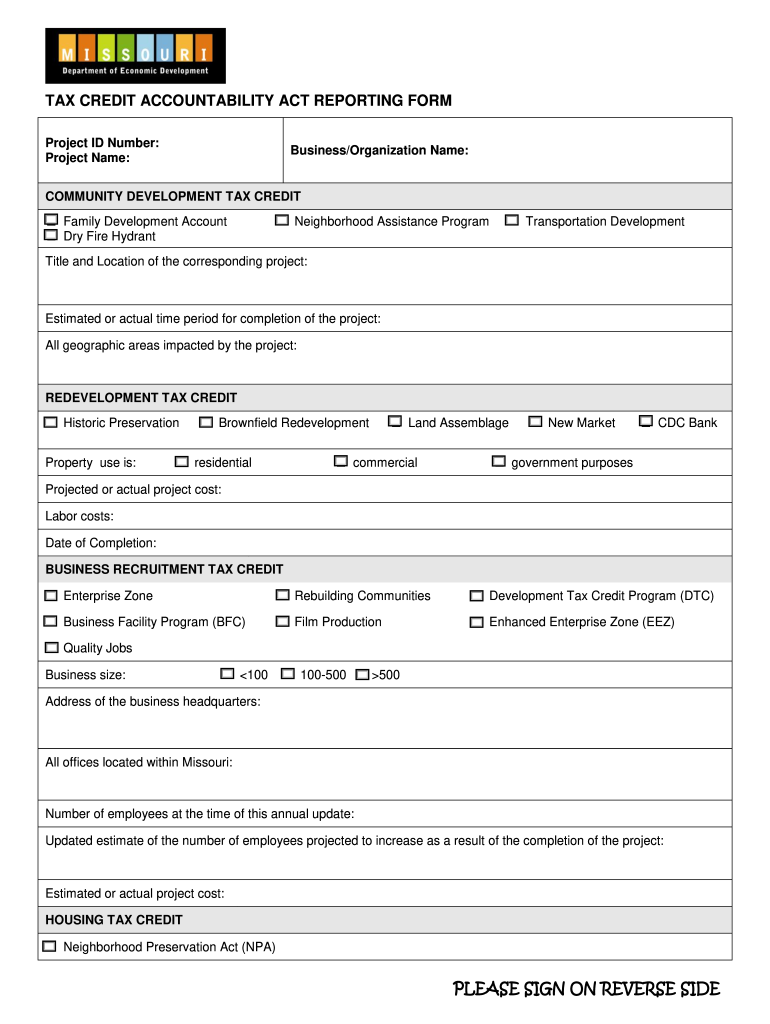

The Tax Credit Accountability Reporting form is a crucial document that ensures compliance with state regulations regarding tax credits in Missouri. This form is designed to collect information about the utilization of tax credits by businesses and individuals. It helps the state monitor the effectiveness of tax incentive programs and ensures that recipients are meeting the necessary requirements to maintain their eligibility. By accurately completing the Missouri DED reporting form, taxpayers contribute to transparency and accountability in the use of public funds.

Steps to complete the Tax Credit Accountability Reporting

Completing the Tax Credit Accountability Reporting form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial records and previous tax filings. Next, fill out the form by providing detailed information about the tax credits claimed, including the type of credit and the amount. Ensure that all fields are completed accurately, as incomplete forms may lead to delays or penalties. After filling out the form, review it thoroughly for any errors before submitting it to the appropriate state department.

Legal use of the Tax Credit Accountability Reporting

The legal use of the Tax Credit Accountability Reporting form is vital for maintaining compliance with Missouri state laws. This form must be submitted in accordance with the guidelines set forth by the Missouri Department of Economic Development (DED). Failure to use the form correctly or to submit it on time can result in penalties, including the loss of tax credits. It is essential to understand the legal implications of the information provided on the form, as it is subject to audits and reviews by state authorities.

Required Documents

To successfully complete the Tax Credit Accountability Reporting form, specific documents are required. These typically include:

- Financial statements that demonstrate the use of tax credits

- Previous tax returns relevant to the claimed credits

- Any correspondence with the Missouri DED regarding tax credits

- Proof of eligibility for the tax credits claimed

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Credit Accountability Reporting form are critical for compliance. Typically, forms must be submitted annually by a specified date, often aligned with the tax filing season. It is important to stay informed about these deadlines to avoid penalties. Additionally, any changes to state regulations regarding tax credits may affect these dates, so regular consultation with the Missouri DED is advisable.

Form Submission Methods

The Missouri DED reporting form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file the form online, which is often the quickest and most efficient method. Alternatively, forms can be submitted by mail or in person at designated state offices. Understanding the available submission methods can help ensure that the form is filed correctly and on time.

Quick guide on how to complete tax credit accountability act reporting form missouri department ded mo

Your assistance manual on how to prepare your Tax Credit Accountability Reporting

If you’re wondering how to generate and send your Tax Credit Accountability Reporting, here are some brief guidelines on how to simplify tax filing.

To begin, you simply need to set up your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, create, and finalize your income tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures while returning to amend information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Tax Credit Accountability Reporting in just a few minutes:

- Create your account and start processing PDFs quickly.

- Utilize our library to locate any IRS tax form; navigate through versions and schedules.

- Click Get form to access your Tax Credit Accountability Reporting in our editor.

- Complete the necessary fillable fields with your details (text content, numbers, check marks).

- Use the Sign Tool to append your legally-binding eSignature (if required).

- Examine your file and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can lead to increased return errors and delayed refunds. Of course, before e-filing your taxes, check the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax credit accountability act reporting form missouri department ded mo

How to generate an eSignature for the Tax Credit Accountability Act Reporting Form Missouri Department Ded Mo in the online mode

How to create an eSignature for your Tax Credit Accountability Act Reporting Form Missouri Department Ded Mo in Google Chrome

How to create an electronic signature for putting it on the Tax Credit Accountability Act Reporting Form Missouri Department Ded Mo in Gmail

How to create an electronic signature for the Tax Credit Accountability Act Reporting Form Missouri Department Ded Mo from your mobile device

How to generate an eSignature for the Tax Credit Accountability Act Reporting Form Missouri Department Ded Mo on iOS devices

How to make an electronic signature for the Tax Credit Accountability Act Reporting Form Missouri Department Ded Mo on Android OS

People also ask

-

What is Tax Credit Accountability Reporting and why is it important?

Tax Credit Accountability Reporting is a crucial process that ensures compliance with regulations surrounding tax credits. It helps organizations maintain transparency and accountability in their financial practices. By effectively managing Tax Credit Accountability Reporting, businesses can not only avoid penalties but also enhance their credibility with stakeholders.

-

How can airSlate SignNow assist with Tax Credit Accountability Reporting?

airSlate SignNow streamlines the process of Tax Credit Accountability Reporting by providing a secure platform for document management and eSigning. Our solution makes it easy to create, send, and track essential documents, ensuring that all necessary paperwork for tax credit claims is handled efficiently. This reduces administrative burden and helps maintain compliance with reporting requirements.

-

What features does airSlate SignNow offer for Tax Credit Accountability Reporting?

airSlate SignNow offers a range of features tailored to improve Tax Credit Accountability Reporting, including customizable templates, automated workflows, and real-time tracking. These tools allow businesses to efficiently gather required signatures and documentation, ensuring a smoother reporting process. Additionally, our user-friendly interface makes it simple for teams to collaborate on tax credit-related documents.

-

Is airSlate SignNow a cost-effective solution for Tax Credit Accountability Reporting?

Yes, airSlate SignNow provides a cost-effective solution for Tax Credit Accountability Reporting, making it accessible for businesses of all sizes. With our competitive pricing plans, organizations can save on administrative costs while ensuring compliance with tax credit regulations. The efficiency gained from using our platform can lead to signNow time and cost savings.

-

Can I integrate airSlate SignNow with other tools for Tax Credit Accountability Reporting?

Absolutely! airSlate SignNow offers seamless integrations with various software applications that can enhance your Tax Credit Accountability Reporting process. Whether you use CRM systems, accounting software, or project management tools, our platform can connect to streamline your workflows and improve data accuracy.

-

What are the benefits of using airSlate SignNow for Tax Credit Accountability Reporting?

Using airSlate SignNow for Tax Credit Accountability Reporting brings numerous benefits, including increased efficiency, improved compliance, and enhanced document security. Our solution helps reduce the risk of errors and delays in reporting, allowing businesses to focus on their core operations. Additionally, our robust security measures ensure that sensitive tax-related information is protected.

-

How does airSlate SignNow ensure the security of documents related to Tax Credit Accountability Reporting?

airSlate SignNow takes security seriously, especially for documents associated with Tax Credit Accountability Reporting. We employ encryption, secure access controls, and audit trails to protect your data throughout the document lifecycle. This commitment to security helps businesses comply with regulations while safeguarding their sensitive information.

Get more for Tax Credit Accountability Reporting

- Reciprocal pesticide applicators license request form

- Wwwirsgovbusinessessmall businesses selfsingle member limited liability companiesinternal revenue form

- Airline beverage carriers industrial local industrial alcohol manufacturers market research packagers and passenger train form

- Grants gateway registration form for administrators

- Remittance form charitable organization form 102 virginia

- Cos012 dual barber shop and cosmetology salon license application form

- Fillable online sos ga georgia state board of cosmetology form

- Paul d pate application for amended secretary of state 572261039 form

Find out other Tax Credit Accountability Reporting

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template