Dr0021 Form

What is the Dr0021

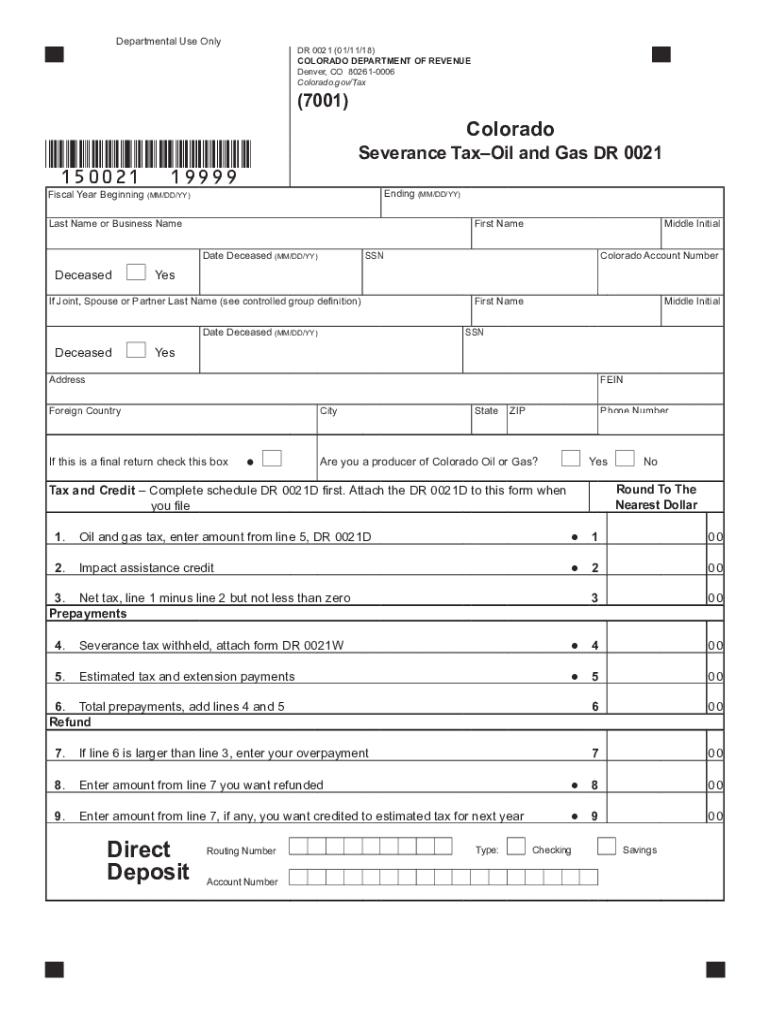

The Colorado DR0021 is a specific form used for reporting severance tax in the state of Colorado. This form is essential for businesses that engage in the extraction of natural resources, such as oil and gas. It helps ensure compliance with state tax regulations and provides a standardized method for reporting severance tax liabilities. The form captures critical information regarding the volume of resources extracted and the corresponding tax owed to the state.

How to use the Dr0021

To effectively use the Colorado DR0021, businesses must first gather all necessary data related to their severance tax obligations. This includes details about the types and quantities of resources extracted during the reporting period. Once the information is compiled, businesses can fill out the form accurately, ensuring that all required sections are completed. After filling out the form, it can be submitted electronically or via traditional mail, depending on the preferences of the business and the requirements of the Colorado Department of Revenue.

Steps to complete the Dr0021

Completing the Colorado DR0021 involves several key steps:

- Gather all relevant data regarding the amounts of resources extracted.

- Access the DR0021 form from the Colorado Department of Revenue website.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, following the submission guidelines provided.

Legal use of the Dr0021

The Colorado DR0021 is legally binding when completed and submitted in accordance with state regulations. To ensure its legality, businesses must adhere to the guidelines set forth by the Colorado Department of Revenue. This includes accurate reporting of severance tax liabilities and timely submission of the form. Failure to comply with these legal requirements can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Colorado DR0021. Typically, the form is due on a quarterly basis, with specific deadlines for each quarter. Businesses should mark their calendars to ensure timely submissions, as late filings can incur penalties. Staying informed about these important dates helps maintain compliance and avoid unnecessary fees.

Required Documents

When completing the Colorado DR0021, certain documents may be required to support the information provided on the form. These documents can include:

- Records of resource extraction volumes.

- Invoices or receipts related to sales of extracted resources.

- Previous tax returns, if applicable.

Having these documents readily available can facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete dr0021

Complete Dr0021 effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Dr0021 on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Dr0021 with ease

- Obtain Dr0021 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your choice. Alter and electronically sign Dr0021 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr0021

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is colorado dr0021 in relation to airSlate SignNow?

Colorado dr0021 refers to a specific document format or legal requirement recognized by airSlate SignNow in Colorado. Using this feature, businesses can ensure compliance and streamline their document-signing process. The platform offers tailored solutions to meet related legal standards.

-

How does airSlate SignNow help with colorado dr0021 document signing?

AirSlate SignNow simplifies the process of signing colorado dr0021 documents by providing an intuitive interface and secure eSignature options. Users can easily upload, edit, and share documents while ensuring that they meet legal requirements. This user-friendly feature streamlines workflows and saves time.

-

Is there a cost associated with using airSlate SignNow for colorado dr0021?

Yes, there is a competitive pricing structure for using airSlate SignNow, including features that support colorado dr0021 documentation. Customers can choose from various plans based on their needs, ensuring that every business, large or small, can find a cost-effective solution. Enjoy affordable rates without compromising on functionality.

-

What features does airSlate SignNow offer for managing colorado dr0021?

AirSlate SignNow includes features such as templates, document collaboration, and automated workflows specifically tailored for colorado dr0021 documents. These tools help businesses efficiently manage signing processes and increase productivity. Enhanced security and compliance further add value to these features.

-

Can I integrate airSlate SignNow with other tools for colorado dr0021 handling?

Absolutely! AirSlate SignNow offers seamless integrations with various business tools, enhancing the management of colorado dr0021 documents. You can connect with CRMs, cloud storage solutions, and productivity applications to create a holistic workflow. This flexibility makes document handling easier and more efficient.

-

What benefits can I expect by using airSlate SignNow for colorado dr0021 documents?

Using airSlate SignNow for colorado dr0021 documents provides numerous benefits, including time savings and reduced administrative overhead. The eSignature process is secure and legally binding, giving users peace of mind. Enhanced collaboration features also facilitate easier communication among team members and clients.

-

How secure is the airSlate SignNow platform for colorado dr0021 documentation?

AirSlate SignNow emphasizes security for all transactions, including colorado dr0021 documentation. The platform utilizes advanced encryption methods and complies with legal regulations to protect sensitive data. Users can confidently sign and store documents, knowing their information is safe.

Get more for Dr0021

- Respersman 1571 010 form

- Application for a military skills test waiver dmv st wvr transportation wv form

- Horse lease agreement word document form

- Waste management invoice form

- Private home care provider licensure packet this dch georgia form

- Formulario 481 1 para llenar

- Suffolk county ny police department training presentation form

- Youth congress adult code of conduct form

Find out other Dr0021

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed