State of Michigan Fillable Tax Forms

What is the State of Michigan Fillable Tax Forms

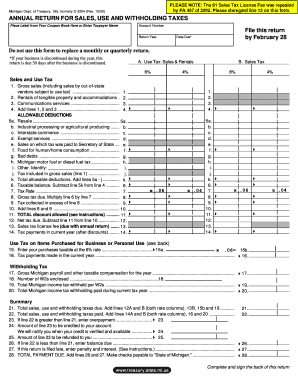

The State of Michigan fillable tax forms are official documents used by residents to report their income and calculate their tax obligations. These forms include various types, such as the Michigan 1040, which is the primary individual income tax return form. Fillable forms allow taxpayers to enter their information directly into the document, making it easier to complete and submit. The electronic format is designed to streamline the filing process, ensuring that users can fill out their tax information accurately and efficiently.

Steps to Complete the State of Michigan Fillable Tax Forms

Completing the State of Michigan fillable tax forms involves several key steps to ensure accuracy and compliance with state tax laws. First, gather all necessary documentation, including W-2s, 1099 forms, and any other income-related documents. Next, access the appropriate fillable form online, such as the Michigan 1040. Enter your personal information, including your name, address, and Social Security number. Carefully input your income details and any deductions or credits you may qualify for. Review the completed form for errors before submitting it electronically or printing it for mail submission.

Legal Use of the State of Michigan Fillable Tax Forms

Legal use of the State of Michigan fillable tax forms requires adherence to specific guidelines set forth by the Michigan Department of Treasury. These forms are legally binding documents, and it is crucial to provide accurate information to avoid penalties. When electronically signing the form, ensure compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that your electronic signature is recognized as valid and enforceable under U.S. law.

Form Submission Methods

Taxpayers in Michigan have several options for submitting their fillable tax forms. The most efficient method is electronic submission through the Michigan Department of Treasury’s online portal. This method often results in faster processing times and confirmation of receipt. Alternatively, taxpayers may choose to print their completed forms and mail them to the appropriate address. In-person submission is also an option at designated tax offices, although this method may involve longer wait times.

Filing Deadlines / Important Dates

Filing deadlines for the State of Michigan fillable tax forms are critical for compliance. Typically, individual income tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as deadlines for estimated tax payments. Keeping track of these dates helps avoid late fees and penalties associated with non-compliance.

Examples of Using the State of Michigan Fillable Tax Forms

Examples of using the State of Michigan fillable tax forms include various taxpayer scenarios. For instance, a self-employed individual may use the Michigan 1040 to report income from their business, while a retired taxpayer might utilize the same form to report pension income and Social Security benefits. Each scenario requires careful consideration of deductions and credits that may apply, such as the homestead property tax credit for homeowners. Understanding these examples can help taxpayers navigate their specific tax situations more effectively.

Quick guide on how to complete state of michigan fillable tax forms

Finish State Of Michigan Fillable Tax Forms effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage State Of Michigan Fillable Tax Forms on any device using airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

How to alter and eSign State Of Michigan Fillable Tax Forms effortlessly

- Find State Of Michigan Fillable Tax Forms and click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important portions of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Alter and eSign State Of Michigan Fillable Tax Forms and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of michigan fillable tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form tax 2000 and why is it important?

The form tax 2000 is a tax form used for reporting income and deductions for the tax year. It is crucial as it helps individuals and businesses accurately file their taxes, ensuring compliance and minimizing potential penalties.

-

How can airSlate SignNow help me with the form tax 2000?

airSlate SignNow simplifies the process of signing and sending the form tax 2000 electronically. Our platform allows you to easily gather signatures and share documents, streamlining your tax filing process signNowly.

-

Are there any costs associated with using airSlate SignNow for the form tax 2000?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. These plans provide a cost-effective solution for handling the form tax 2000, ensuring you get great value while facilitating seamless document management.

-

Can I integrate airSlate SignNow with other software for managing the form tax 2000?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software. This connectivity makes it easy to manage your form tax 2000 alongside other financial documents in one unified platform.

-

What features does airSlate SignNow offer for processing the form tax 2000?

airSlate SignNow includes features like eSigning, document templates, and real-time tracking, making it incredibly easy to manage the form tax 2000. These tools enhance your efficiency, reduce errors, and ensure that you never miss a deadline.

-

Is airSlate SignNow compliant with tax regulations for the form tax 2000?

Yes, airSlate SignNow complies with all relevant regulations, ensuring your form tax 2000 is handled securely. Our platform is designed to meet the highest standards of security and confidentiality in document management.

-

How quickly can I complete the form tax 2000 using airSlate SignNow?

Using airSlate SignNow, you can complete the form tax 2000 in a fraction of the time it would take manually. With our easy-to-use interface, you can fill out, sign, and send your forms electronically in just a few clicks.

Get more for State Of Michigan Fillable Tax Forms

- Ielts request for refund form example 195840

- Metropolitan full surrender form

- Idaho board of barbering and cosmetology form

- Generic resume template form

- Workers report occupational noise induced hearing loss od wsib drwerger form

- School volunteer form halifax county public schools halifax k12 va

- Student application form lancaster school of massage

- Liability release form wix com

Find out other State Of Michigan Fillable Tax Forms

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy