Etc 101 Form

What is the Wyoming State Sales Tax Exemption Form?

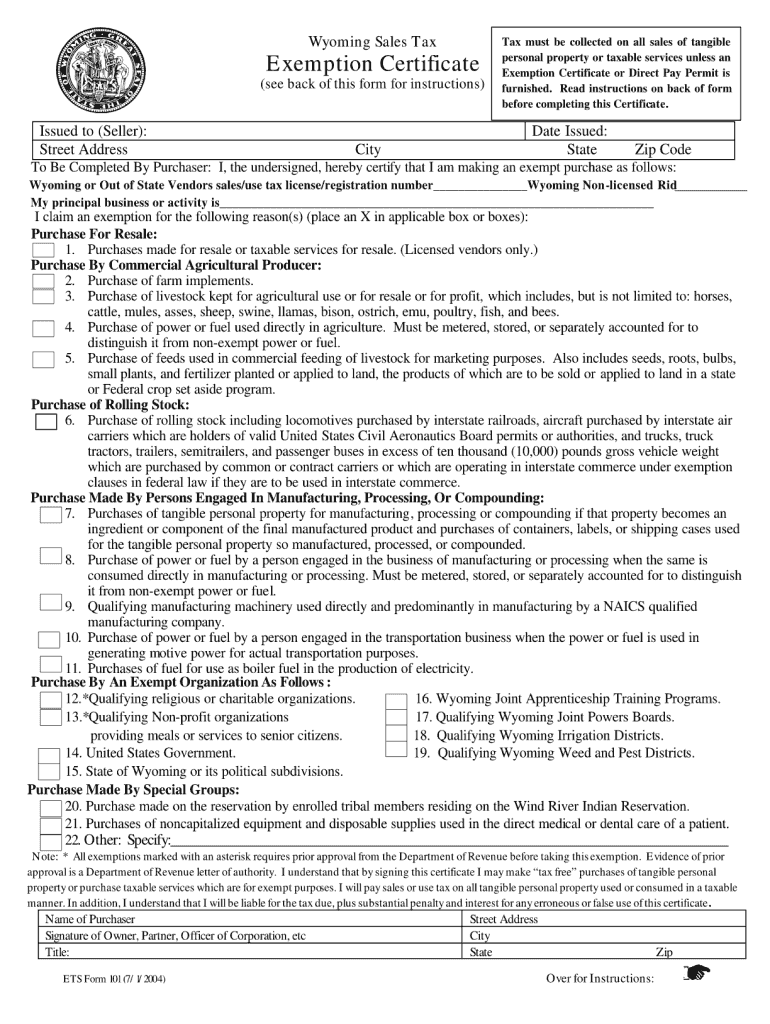

The Wyoming State Sales Tax Exemption Form, commonly referred to as the ETS Form 101, is a crucial document that allows qualifying entities to claim exemption from sales tax on certain purchases. This form is primarily used by organizations that meet specific criteria, such as non-profit organizations, government entities, and certain educational institutions. By submitting this form, eligible entities can avoid paying sales tax on items that are directly related to their exempt purposes.

How to Obtain the Wyoming State Sales Tax Exemption Form

To obtain the Wyoming State Sales Tax Exemption Form, individuals or organizations can visit the official Wyoming Department of Revenue website. The form is typically available for download in a printable format. Additionally, physical copies may be requested directly from the department or through authorized state offices. It is essential to ensure that you have the most recent version of the form to comply with current regulations.

Steps to Complete the Wyoming State Sales Tax Exemption Form

Completing the Wyoming State Sales Tax Exemption Form involves several key steps:

- Begin by entering the name and address of the entity applying for the exemption.

- Provide the entity's sales tax identification number, if applicable.

- Clearly specify the type of exemption being claimed, along with a detailed description of the items for which the exemption is requested.

- Ensure that the form is signed by an authorized representative of the organization, affirming that the information provided is accurate.

Legal Use of the Wyoming State Sales Tax Exemption Form

The legal use of the Wyoming State Sales Tax Exemption Form is governed by state tax laws. To ensure compliance, entities must use the form only for legitimate purchases that fall under the exemption criteria. Misuse of the form, such as claiming exemptions for ineligible purchases, can result in penalties, including fines or back taxes owed. It is important for organizations to maintain accurate records of exempt purchases and to be prepared for any audits by state tax authorities.

Key Elements of the Wyoming State Sales Tax Exemption Form

Several key elements are essential for the Wyoming State Sales Tax Exemption Form to be considered valid:

- Entity Information: Accurate details about the entity, including name and address.

- Exemption Type: A clear indication of the specific exemption being claimed.

- Signature: An authorized representative must sign the form to validate the claim.

- Date: The date of signing must be included to establish the timeline of the exemption request.

Eligibility Criteria for the Wyoming State Sales Tax Exemption

Eligibility for the Wyoming State Sales Tax Exemption Form is determined by specific criteria outlined by the state. Generally, organizations that qualify include:

- Non-profit organizations recognized under IRS regulations.

- Government entities, including state and local agencies.

- Educational institutions that meet certain requirements.

It is advisable for applicants to review the detailed eligibility criteria provided by the Wyoming Department of Revenue to ensure compliance.

Quick guide on how to complete etc 101 form

Manage Etc 101 Form effortlessly on any device

Digital document organization has become widely adopted by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the needed form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your files swiftly without delays. Handle Etc 101 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Etc 101 Form effortlessly

- Find Etc 101 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Etc 101 Form and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the etc 101 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wyoming state sales tax exemption form?

The Wyoming state sales tax exemption form is a document that allows eligible businesses or individuals to claim an exemption from paying sales tax on qualifying purchases in Wyoming. This form is crucial for those who wish to save money on tax liabilities while ensuring compliance with state regulations. Understanding how to properly fill out this form can signNowly benefit your business.

-

Who is eligible to use the Wyoming state sales tax exemption form?

Eligibility for the Wyoming state sales tax exemption form typically includes certain organizations like non-profits, government entities, and businesses purchasing goods for resale. It's essential to verify your eligibility based on specific criteria outlined by the Wyoming Department of Revenue. Ensure you meet these requirements before utilizing the exemption.

-

How do I fill out the Wyoming state sales tax exemption form?

Filling out the Wyoming state sales tax exemption form involves providing relevant information about your business, the items you're exempting, and any applicable identification numbers. Detailed instructions are often included on the form itself to guide you through the process. If you need assistance, resources are available to help ensure accuracy and compliance.

-

Is there a fee for using the Wyoming state sales tax exemption form?

There is no fee to obtain or use the Wyoming state sales tax exemption form itself, as it is provided by the state government. However, businesses must ensure they comply with all requirements to maintain their exemption status, which may include related administrative costs. Understanding these factors can help you manage your business expenses effectively.

-

How can airSlate SignNow help with the Wyoming state sales tax exemption form?

airSlate SignNow provides an easy-to-use platform that streamlines the process of completing and electronically signing the Wyoming state sales tax exemption form. By using our solution, you can save time and reduce errors associated with paperwork. The platform also ensures that all your documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other tools to manage my Wyoming state sales tax exemption form?

Yes, airSlate SignNow offers integrations with several popular business applications, allowing you to manage your Wyoming state sales tax exemption form alongside other essential tools. This integration simplifies your workflow and keeps your documents organized. Explore our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for the Wyoming state sales tax exemption form?

Using airSlate SignNow for your Wyoming state sales tax exemption form offers numerous benefits, including faster processing times, improved accuracy, and comprehensive security features. Our platform makes it easy to track the status of your document and collaborate with team members in real-time. This efficiency can lead to increased productivity in your business operations.

Get more for Etc 101 Form

- Aha pals course roster doc sponsorhospital form

- Atl311 water form

- Ambasciata damp39italia singapore visa application rmg travel form

- Union resignation letter form

- Documents submitted letter form

- Form 6 alberta

- For internal use onlytimesheettimesheets can be e form

- Borrowing money agreement template form

Find out other Etc 101 Form

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF