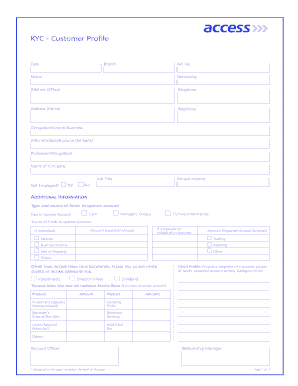

Kyc Access Bank Form

What is the KYC Access Bank?

The KYC Access Bank refers to the Know Your Customer (KYC) process implemented by Access Bank to verify the identity of its customers. This process is essential for preventing fraud and ensuring compliance with regulatory requirements. It involves collecting and verifying personal information from customers, such as identification documents, proof of address, and other relevant details. The KYC Access Bank is crucial for maintaining the integrity of the banking system and protecting both the institution and its clients.

Steps to Complete the KYC Access Bank

Completing the KYC Access Bank process involves several key steps to ensure that all necessary information is accurately provided. First, gather all required documents, including a government-issued ID, proof of address, and any additional identification as specified by the bank. Next, visit the KYC submission portal at kyc submission accessbankplc com to begin the online submission process. Follow the prompts to upload your documents and fill out the required forms. After submitting, monitor your application status through the portal to ensure that your KYC is processed in a timely manner.

Required Documents

To successfully complete the KYC Access Bank process, specific documents are required. These typically include:

- A valid government-issued identification, such as a passport or driver's license.

- Proof of address, which can be a utility bill, bank statement, or lease agreement.

- Social Security Number (SSN) or Tax Identification Number (TIN) for U.S. citizens.

- Any additional documents as requested by Access Bank based on individual circumstances.

Legal Use of the KYC Access Bank

The KYC Access Bank process is legally binding and must adhere to various regulatory frameworks in the United States. Compliance with laws such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act is essential for financial institutions. These regulations require banks to implement robust KYC procedures to mitigate risks associated with money laundering and other financial crimes. By following the KYC process, Access Bank ensures that it meets legal obligations while safeguarding customer information.

How to Use the KYC Access Bank

Using the KYC Access Bank process is straightforward. Customers can access the online portal to initiate their KYC submission. Once on the portal, users can fill out the necessary forms and upload required documents. It is important to ensure that all information is accurate and complete to avoid delays in processing. After submission, customers can track their application status through the same portal, providing transparency throughout the process.

Penalties for Non-Compliance

Failure to complete the KYC Access Bank process can result in significant penalties for both the customer and the bank. For customers, non-compliance may lead to restricted access to banking services or account suspension. For Access Bank, failing to adhere to KYC regulations can result in hefty fines and legal repercussions from regulatory authorities. It is crucial for customers to understand the importance of completing the KYC process to avoid these potential issues.

Quick guide on how to complete kyc access bank

Complete Kyc Access Bank effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage Kyc Access Bank on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to alter and eSign Kyc Access Bank without hassle

- Locate Kyc Access Bank and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Kyc Access Bank and maintain excellent communication throughout any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kyc access bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the access bank KYC process and why is it important?

The access bank KYC process is a systematic verification of your identity to comply with legal requirements. It is important because it helps prevent fraud, protects your account, and ensures the safety of financial transactions. By completing the access bank KYC process, you can enjoy uninterrupted banking services.

-

How can I complete my access bank KYC online?

You can complete your access bank KYC online by visiting the bank's official website and following the provided guidelines. Typically, you'll need to submit essential documents such as identification and proof of address. Completing your access bank KYC online is convenient and can save you time.

-

What documents are required for the access bank KYC?

For the access bank KYC, you are generally required to provide identity proof, address proof, and a recent photograph. Commonly accepted documents include a passport, driver's license, or utility bill. Having these documents ready will streamline the access bank KYC process.

-

Are there any fees associated with the access bank KYC process?

Typically, there are no fees associated with completing the access bank KYC process. It is a free service provided by the bank to ensure compliance with regulations. However, always confirm with the bank for any specific charges related to your account.

-

How long does the access bank KYC verification take?

The duration of the access bank KYC verification can vary but usually takes between 24 to 48 hours. Once your documents are submitted, you should receive confirmation via email or SMS. For any delays, it's advisable to contact customer support for updates.

-

What are the benefits of completing my access bank KYC?

Completing your access bank KYC provides several benefits, including enhanced account security and access to banking services like loans and credit cards. A completed KYC also makes your banking transactions smoother and quicker. Ultimately, it helps you maintain a good standing with the bank.

-

Can I update my access bank KYC information?

Yes, you can update your access bank KYC information by visiting your nearest branch or through the bank’s online portal. Make sure to provide updated documents to reflect any changes, such as a new address or identification. Keeping your information current is essential for seamless banking.

Get more for Kyc Access Bank

- Genre and subgenre worksheet 2 answer key 448585659 form

- Melting zing evaporation condensation sublimation worksheet form

- Veip extension form

- Employer evaluation of student form

- 100255909 package form

- Chefs association of ghana form

- Dom of information act myrtle beach

- Medical benefit request mbr published 040101 coverageforall form

Find out other Kyc Access Bank

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors