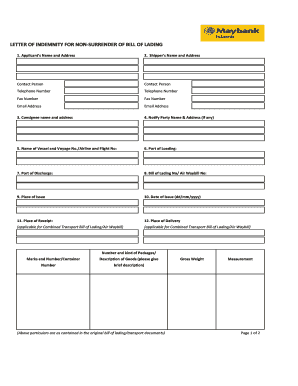

Letter of Indemnity Maybank Form

What is the Letter of Indemnity Maybank

The letter of indemnity Maybank is a formal document that provides a guarantee from one party to another, ensuring that any losses or damages incurred will be compensated. This document is commonly used in banking and financial transactions to protect against potential risks. It serves as a safeguard for the bank and the parties involved, ensuring that obligations are met and liabilities are covered. The letter typically outlines specific terms and conditions under which indemnification will occur, making it a critical component of various financial agreements.

How to Use the Letter of Indemnity Maybank

Using the letter of indemnity Maybank involves several key steps. First, identify the specific transaction or situation that requires indemnification. Next, draft the letter, ensuring it includes all necessary details such as the parties involved, the nature of the indemnity, and any relevant dates. Once the document is prepared, it should be signed by authorized representatives of the parties involved. Finally, submit the letter to the appropriate bank department or individual as required by the institution's policies.

Steps to Complete the Letter of Indemnity Maybank

Completing the letter of indemnity Maybank requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary information, including the names and addresses of all parties involved.

- Clearly define the scope of indemnity, including any limitations or exclusions.

- Include a statement of the purpose of the letter, detailing the specific transaction or circumstance.

- Ensure that all parties sign the document, confirming their agreement to the terms.

- Keep a copy of the signed letter for your records and submit the original as required.

Key Elements of the Letter of Indemnity Maybank

Several key elements must be included in the letter of indemnity Maybank to ensure its validity. These elements typically include:

- Identification of Parties: Clearly state the names and addresses of all parties involved in the agreement.

- Scope of Indemnity: Define the extent of the indemnity, specifying what losses or damages are covered.

- Conditions: Outline any conditions that must be met for the indemnity to be invoked.

- Signatures: Ensure that the document is signed by authorized representatives of all parties.

- Date: Include the date of execution to establish the timeline of the agreement.

Legal Use of the Letter of Indemnity Maybank

The legal use of the letter of indemnity Maybank is governed by specific regulations and laws. It is essential to ensure that the document complies with applicable legal standards to be enforceable in a court of law. The letter should clearly articulate the responsibilities of each party and the circumstances under which indemnification will take place. Additionally, it must be signed voluntarily by all parties without coercion. Understanding the legal implications and requirements is crucial for safeguarding interests in financial transactions.

How to Obtain the Letter of Indemnity Maybank

To obtain the letter of indemnity Maybank, individuals or businesses typically need to contact their bank representative or visit a local branch. The bank may provide a standard template or guidelines for drafting the letter. It is important to gather all necessary information and documentation beforehand to facilitate the process. Additionally, some banks may offer the option to request the letter online through their official website or banking portal, streamlining the acquisition process.

Quick guide on how to complete letter of indemnity maybank

Easily Prepare Letter Of Indemnity Maybank on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Letter Of Indemnity Maybank on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and eSign Letter Of Indemnity Maybank with Ease

- Locate Letter Of Indemnity Maybank and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select signNow sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Letter Of Indemnity Maybank to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter of indemnity maybank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a letter of indemnity Maybank?

A letter of indemnity Maybank is a document that provides security against potential financial loss or liability that may arise from a specific transaction or situation. It acts as a guarantee from one party to another, ensuring that they will be compensated for any losses incurred. Businesses often use it as a risk management tool.

-

How does airSlate SignNow help with creating a letter of indemnity Maybank?

airSlate SignNow streamlines the process of creating a letter of indemnity Maybank by offering customizable templates and an easy-to-use interface. Users can quickly draft, sign, and send the document without any hassle. This increases efficiency and reduces the time needed for legal paperwork.

-

What are the key features of airSlate SignNow for managing letters of indemnity Maybank?

Key features of airSlate SignNow include electronic signatures, document templates, automated workflows, and real-time tracking. These tools facilitate the seamless creation and management of a letter of indemnity Maybank, ensuring that all parties are on the same page. The platform also ensures that documents are legally binding and secure.

-

Is there a cost associated with using airSlate SignNow for a letter of indemnity Maybank?

Yes, there are different pricing plans available for using airSlate SignNow, which cater to various business needs. The cost-effectiveness of the platform allows businesses to manage financial documents like a letter of indemnity Maybank without breaking the bank. You can choose a plan that fits your budget while accessing all the essential features.

-

Can I integrate airSlate SignNow with other applications for managing letters of indemnity Maybank?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Salesforce, and Zapier. This allows for a streamlined process where you can manage documents, including a letter of indemnity Maybank, in conjunction with the tools you already use. Integrations help to save time and improve overall efficiency.

-

What security measures does airSlate SignNow implement for letters of indemnity Maybank?

airSlate SignNow takes document security seriously by employing industry-standard encryption and secure data storage. Each letter of indemnity Maybank created through the platform is protected against unauthorized access, ensuring that sensitive information remains confidential. Users can trust that their documents are safe and secure.

-

How does eSigning a letter of indemnity Maybank work with airSlate SignNow?

eSigning a letter of indemnity Maybank with airSlate SignNow is simple and efficient. Users can send the document to the relevant parties who can sign it electronically at their convenience. This eliminates the need for printing and scanning, providing a fast and convenient solution for obtaining necessary signatures.

Get more for Letter Of Indemnity Maybank

- Time card change sign off form ritricted access

- Renovation notice letter to tenant form

- Rental application resident center century 21 oviedo realty form

- How to write a landlord tenant lease agreement 5 form

- Vendor space rental agreement luxury house turkeylht form

- Move in move out landlord tenant checklist formdocx

- Letter of intent for lease form

- Fda prior notice form fedex

Find out other Letter Of Indemnity Maybank

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online