Nyc 210 Form 2022

What is the NYC 210 Form?

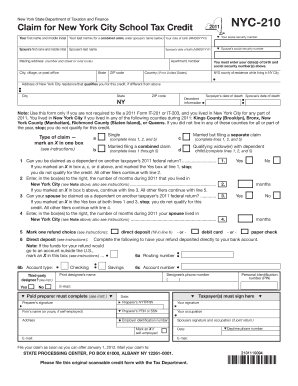

The NYC 210 form, also known as the NYC school tax form 2019, is a tax document used by eligible New York City residents to claim a tax credit for school-related expenses. This form is specifically designed to provide financial relief to taxpayers who have children enrolled in public or private schools. The NYC 210 form allows individuals to report qualified education expenses, thereby reducing their overall tax liability. Understanding the purpose of this form is essential for taxpayers looking to maximize their credits and ensure compliance with local tax regulations.

Steps to Complete the NYC 210 Form

Completing the NYC 210 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts for eligible school expenses. Next, fill out the personal information section, providing details such as your name, address, and Social Security number. Once the personal information is complete, move on to the section detailing your eligible expenses. Be sure to include all relevant amounts and ensure that they align with the guidelines set forth by the city. After reviewing the form for any errors, sign and date it before submission.

How to Obtain the NYC 210 Form

The NYC 210 form can be obtained through various channels to ensure accessibility for all taxpayers. It is available for download directly from the official New York City Department of Finance website. Additionally, physical copies can often be found at local tax offices or public libraries. For those who prefer digital formats, the form is also accessible in PDF format, allowing for easy printing and completion. Ensuring you have the correct version of the form for the tax year is crucial for accurate filing.

Legal Use of the NYC 210 Form

The legal use of the NYC 210 form is governed by specific regulations that dictate how and when it can be utilized. To be considered valid, the form must be completed accurately and submitted by the designated filing deadline. Taxpayers must ensure that all claimed expenses are legitimate and supported by appropriate documentation, as failure to comply with these regulations could result in penalties or denial of the tax credit. Understanding the legal framework surrounding the NYC 210 form is essential for ensuring that taxpayers can confidently claim their credits without facing legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 210 form are critical for taxpayers to observe to avoid penalties. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April fifteenth. However, it is essential to check for any specific announcements from the New York City Department of Finance regarding changes or extensions. Marking these important dates on your calendar can help ensure timely submission and compliance with local tax laws.

Required Documents

When completing the NYC 210 form, certain documents are required to substantiate your claims. These may include receipts for tuition payments, fees for extracurricular activities, and any other school-related expenses that qualify for the tax credit. It is advisable to keep copies of all supporting documents, as they may be requested by tax authorities for verification purposes. Having these documents organized and readily available can streamline the filing process and enhance the accuracy of your submission.

Eligibility Criteria

Eligibility for claiming the NYC school tax credit through the NYC 210 form is determined by specific criteria set forth by the city. Generally, taxpayers must be residents of New York City and have children enrolled in eligible educational institutions. Income limits may also apply, affecting the amount of credit available. Understanding these eligibility requirements is crucial for taxpayers to ensure they qualify for the credit and can successfully complete the form.

Quick guide on how to complete nyc 210 form 16851202

Accomplish Nyc 210 Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Nyc 210 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and eSign Nyc 210 Form with ease

- Find Nyc 210 Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Nyc 210 Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nyc 210 form 16851202

Create this form in 5 minutes!

How to create an eSignature for the nyc 210 form 16851202

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC school tax form 2019 and why is it important?

The NYC school tax form 2019 is a crucial document for residents who want to claim credits and deductions related to their property taxes. Completing this form correctly ensures you receive all eligible benefits and helps support local education funding. It's essential to file accurately to avoid any penalties or issues with the tax department.

-

How can airSlate SignNow assist with completing the NYC school tax form 2019?

airSlate SignNow simplifies the process of filling out the NYC school tax form 2019 by providing an intuitive platform for electronic signatures and document management. You can easily upload your tax documents, fill them out, and securely sign them from any device. This streamlines the filing process and reduces the hassle of dealing with paper forms.

-

What are the pricing options for using airSlate SignNow for the NYC school tax form 2019?

airSlate SignNow offers a variety of pricing plans to fit different needs, starting with affordable monthly subscriptions. These plans include features that are beneficial for completing the NYC school tax form 2019, such as unlimited document uploads and electronic signatures. You can choose a plan based on your usage requirements and budget.

-

Can I integrate airSlate SignNow with other software while filing the NYC school tax form 2019?

Yes, airSlate SignNow seamlessly integrates with many popular software solutions, enhancing your experience while filing the NYC school tax form 2019. Whether you use CRM systems or cloud storage services, these integrations allow for easy access and management of documents. This feature simplifies the overall process and saves you time.

-

What are the benefits of using airSlate SignNow for the NYC school tax form 2019?

Using airSlate SignNow for the NYC school tax form 2019 offers numerous benefits, including ease of use, security, and speed. The platform allows you to complete and send documents securely without the need for physical signatures, making the process efficient. You can also track your documents in real-time, ensuring that everything is processed promptly.

-

Is airSlate SignNow user-friendly for someone unfamiliar with the NYC school tax form 2019?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy even for those unfamiliar with the NYC school tax form 2019. The intuitive interface guides you through each step of the document completion and signing process, ensuring that you can file your tax form efficiently and accurately. Customer support is also available for any questions.

-

What if I encounter issues while completing the NYC school tax form 2019 using airSlate SignNow?

If you face any issues while completing the NYC school tax form 2019 using airSlate SignNow, our dedicated customer support team is ready to assist you. You can signNow out via chat, email, or phone, and our representatives will help resolve any concerns. We aim to ensure a smooth experience for all users during the filing process.

Get more for Nyc 210 Form

- Obsessive fear monitoring form

- Consolidated general application form for student visa

- Sotips scoring sheet form

- Order regarding alternate service form

- Personal bond malaysia sample form

- Brand new day otc form

- Schedule e cash bank deposits ampampampamp misc personal property rev 1508 formspublications

- Mobile home owners pdcbank state nj us form

Find out other Nyc 210 Form

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple