Tax Law Section 606ggg 2022

What is the Tax Law Section 606ggg

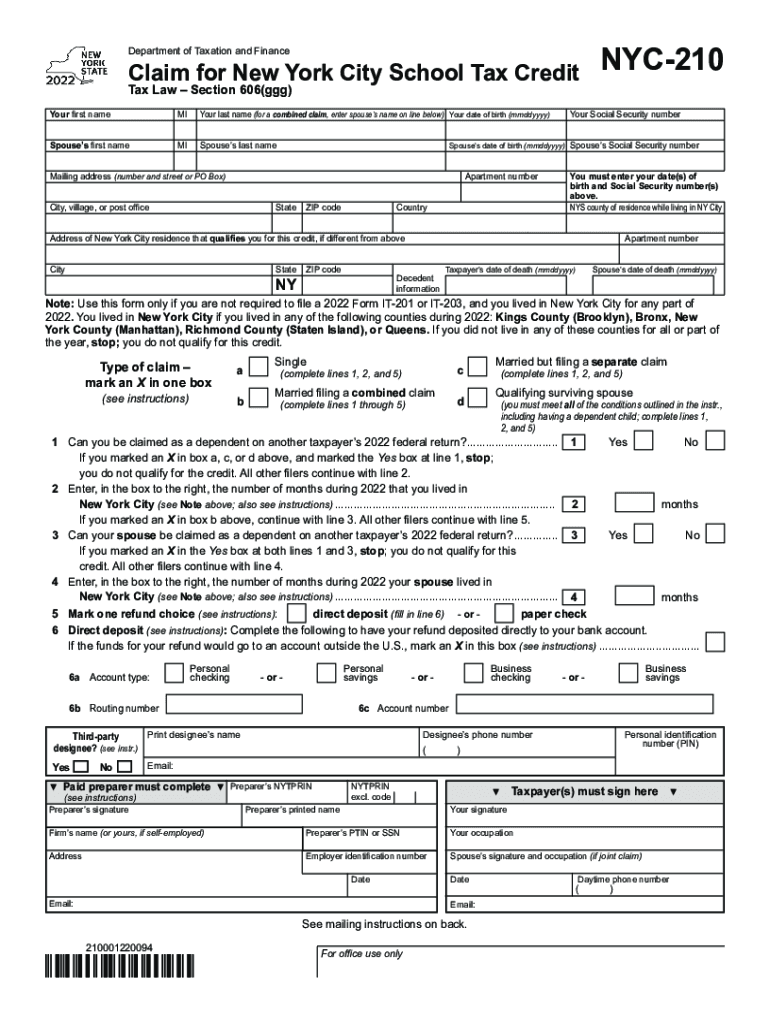

The Tax Law Section 606ggg pertains to the New York City school tax credit, specifically designed to provide financial relief to eligible homeowners. This section outlines the criteria for claiming the credit, the amount available, and the necessary documentation required for submission. It is essential for taxpayers to understand this section to maximize their benefits and ensure compliance with local tax regulations.

Eligibility Criteria

To qualify for the benefits under Tax Law Section 606ggg, applicants must meet specific eligibility requirements. These typically include:

- Ownership of a residential property within New York City.

- Meeting income limits as set forth by the New York City Department of Finance.

- Filing a complete and accurate NYC 210 form for the applicable tax year.

It is crucial for applicants to review the eligibility criteria carefully to ensure that they qualify before submitting their forms.

Steps to Complete the Tax Law Section 606ggg

Completing the NYC 210 form requires careful attention to detail. Here are the steps to ensure proper completion:

- Gather necessary documentation, including proof of income and property ownership.

- Obtain the NYC 210 form, which can be downloaded or filled out online.

- Fill in personal information accurately, including your name, address, and Social Security number.

- Provide financial information as required, ensuring all figures are correct.

- Review the form for completeness and accuracy before submission.

Following these steps will help ensure that your submission is processed without delays.

Form Submission Methods

The NYC 210 form can be submitted through various methods, allowing for flexibility based on individual preferences:

- Online Submission: Use the official New York City Department of Finance website to submit your form electronically.

- Mail: Print the completed form and send it to the designated address provided on the form.

- In-Person: Visit a local tax office to submit your form directly and receive assistance if needed.

Each method has its advantages, so choose the one that best fits your needs.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the NYC 210 form to avoid penalties. Typically, the deadline for submitting the form coincides with the annual tax filing deadline, which is usually April fifteenth. However, it is advisable to check for any specific changes or updates from the New York City Department of Finance regarding deadlines for the 2022 tax year.

Required Documents

When completing the NYC 210 form, certain documents are necessary to support your application. These may include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of property ownership, including a deed or mortgage statement.

- Any prior tax documents relevant to your claim.

Having these documents readily available will facilitate a smoother application process.

Quick guide on how to complete tax law section 606ggg

Accomplish Tax Law Section 606ggg seamlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly and without interruptions. Manage Tax Law Section 606ggg on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Tax Law Section 606ggg effortlessly

- Find Tax Law Section 606ggg and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to retain your modifications.

- Choose how you wish to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Adjust and eSign Tax Law Section 606ggg and ensure excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax law section 606ggg

Create this form in 5 minutes!

How to create an eSignature for the tax law section 606ggg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC 210 form 2022?

The NYC 210 form 2022 is a tax form used by residents of New York City to report their taxable income for the year. It serves as a critical document for tax filing and ensures compliance with local tax laws. Completing this form accurately is essential to avoid penalties and ensure correct tax payments.

-

How can airSlate SignNow help with the NYC 210 form 2022?

AirSlate SignNow provides a seamless way to create, send, and eSign your NYC 210 form 2022. With customizable templates, you can easily input the required information and collect signatures electronically. This saves time and reduces the hassle of traditional paperwork.

-

Is airSlate SignNow cost-effective for filing the NYC 210 form 2022?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. By utilizing digital signatures for the NYC 210 form 2022, businesses can save on printing and mailing costs. Additionally, the time saved in processing documents translates to increased efficiency.

-

What integrations does airSlate SignNow offer for the NYC 210 form 2022?

AirSlate SignNow integrates seamlessly with popular software such as Google Drive, Dropbox, and various CRM systems. This allows users to access their documents and fill out the NYC 210 form 2022 directly from their preferred platforms. Integrations enhance workflow and streamline the signing process.

-

Can I collaborate with others when completing the NYC 210 form 2022 in airSlate SignNow?

Yes, airSlate SignNow facilitates collaboration by allowing multiple users to work on the NYC 210 form 2022 simultaneously. You can invite team members to review or edit the document, ensuring everyone provides input before finalizing. This collaborative feature enhances accuracy and completeness.

-

What security features does airSlate SignNow provide for my NYC 210 form 2022?

AirSlate SignNow prioritizes security and offers features such as data encryption, secure cloud storage, and audit trails. These measures ensure that your NYC 210 form 2022 and other sensitive documents are protected against unauthorized access. You can rest assured that your information remains confidential.

-

Is electronic signing of the NYC 210 form 2022 legally valid?

Yes, electronic signatures on the NYC 210 form 2022 are legally valid under U.S. law, including the ESIGN Act and UETA. AirSlate SignNow complies with all regulations governing electronic signatures, making it a compliant solution for your tax documents. This simplifies the process while adhering to legal standards.

Get more for Tax Law Section 606ggg

- Application for sublease texas form

- Texas post form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out texas form

- Property manager agreement texas form

- Agreement partial rent 497327650 form

- Tenants maintenance repair request form texas

- Texas lease guarantor form

- Amendment rental agreement form

Find out other Tax Law Section 606ggg

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure