Form NYC 210 Claim for New York City School Tax Credit Tax Year 2023-2026

Understanding the NYC 210 Claim for New York City School Tax Credit

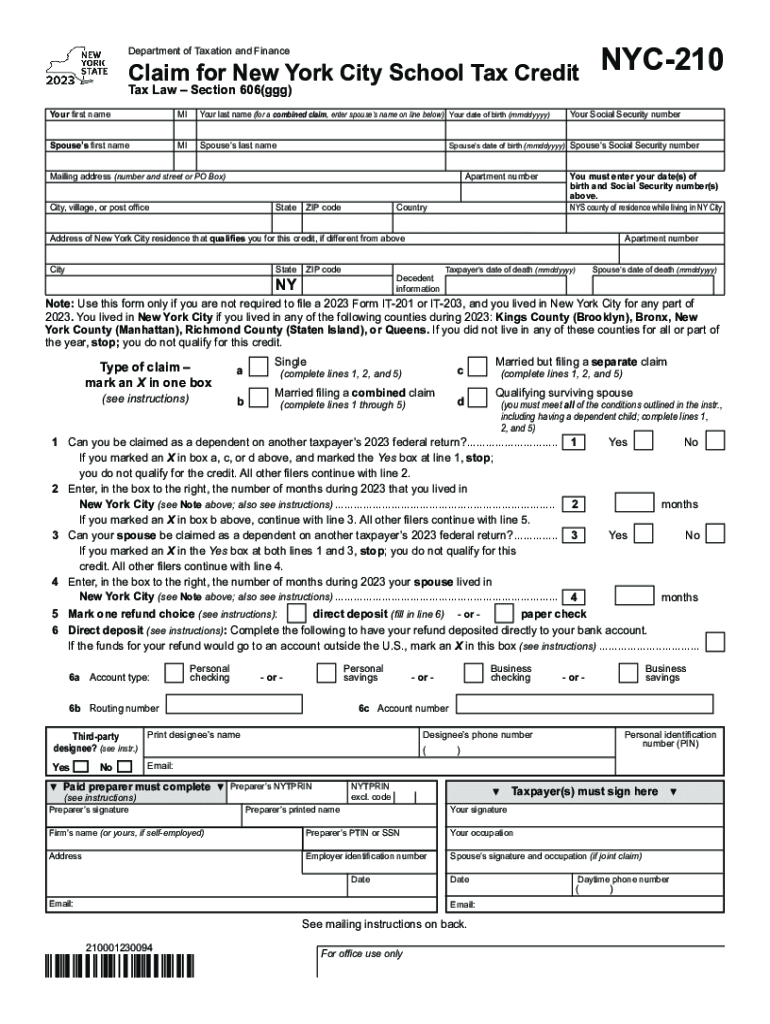

The NYC 210 Claim is a vital form for residents of New York City seeking to apply for the School Tax Credit for the tax year 2022. This credit is designed to provide financial relief to homeowners who meet specific eligibility criteria. The form allows taxpayers to claim a credit against their property taxes, which can significantly reduce their overall tax burden. It is essential to understand the requirements and benefits associated with this form to maximize potential savings.

Steps to Complete the NYC 210 Claim for New York City School Tax Credit

Completing the NYC 210 Claim involves several straightforward steps. First, gather necessary documentation, including proof of residency and property ownership. Next, accurately fill out the form, ensuring all personal and property information is correct. Pay special attention to the sections detailing income and tax amounts, as these will determine your eligibility for the credit. Once completed, review the form for accuracy before submission to avoid delays in processing.

Eligibility Criteria for the NYC 210 Claim

To qualify for the NYC 210 Claim, applicants must meet specific eligibility criteria. Generally, homeowners must occupy the property as their primary residence and have a household income below a certain threshold. Additionally, the property must be assessed for school taxes. It is important to check the latest income limits and property assessment requirements to ensure compliance and maximize the potential benefit of the credit.

How to Obtain the NYC 210 Claim Form

The NYC 210 Claim form can be obtained through several channels. It is available for download in PDF format from the official New York City Department of Finance website. Alternatively, residents can request a physical copy by contacting their local tax office. For convenience, many tax preparation services also provide access to the form, ensuring that taxpayers can easily obtain the necessary documents to claim their credit.

Filing Deadlines for the NYC 210 Claim

Filing deadlines for the NYC 210 Claim are crucial to ensure that taxpayers do not miss out on potential credits. Typically, the deadline for submitting the form is aligned with the annual tax filing deadline, which is usually April fifteenth. However, it is advisable to check for any updates or changes in deadlines, as local regulations may vary. Submitting the form on time is essential to secure the tax credit for the applicable tax year.

Form Submission Methods for the NYC 210 Claim

Taxpayers have multiple options for submitting the NYC 210 Claim form. The form can be submitted online through the New York City Department of Finance's electronic filing system. Alternatively, residents may choose to mail the completed form to the designated tax office or deliver it in person. Each submission method has its own processing times, so it is beneficial to choose the method that best fits your timeline and preferences.

Quick guide on how to complete form nyc 210 claim for new york city school tax credit tax year

Prepare Form NYC 210 Claim For New York City School Tax Credit Tax Year effortlessly on any device

The management of online documents has become widely embraced by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to easily find the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form NYC 210 Claim For New York City School Tax Credit Tax Year on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and electronically sign Form NYC 210 Claim For New York City School Tax Credit Tax Year with ease

- Find Form NYC 210 Claim For New York City School Tax Credit Tax Year and click on Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form NYC 210 Claim For New York City School Tax Credit Tax Year and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form nyc 210 claim for new york city school tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form nyc 210 claim for new york city school tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 tax credit?

The 2022 tax credit refers to various tax benefits available to individuals and businesses for the tax year 2022. These credits can signNowly reduce your tax liability, making it essential to understand how they apply to your financial situation. With airSlate SignNow, you can efficiently manage and eSign documents related to tax credits, ensuring a smooth filing process.

-

How can airSlate SignNow help with the 2022 tax credit documentation?

airSlate SignNow enables businesses to streamline the preparation and electronic signing of documents needed for claiming the 2022 tax credit. Our platform offers templates and automated workflows that simplify the process of completing necessary tax forms. By using airSlate SignNow, you can ensure all documentation is accurate and submitted on time.

-

Is airSlate SignNow cost-effective for managing 2022 tax credit forms?

Yes, airSlate SignNow is a cost-effective solution for managing your 2022 tax credit forms. Our pricing plans are designed to fit various business sizes and needs, allowing you to control costs while ensuring compliance and efficiency. By digitizing your document processes, you can save both time and money.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow provides essential features such as eSignature capabilities, template creation, and document tracking, all geared towards facilitating tax-related processes, including those for the 2022 tax credit. Our user-friendly interface allows for seamless collaboration and ensures that all your documentation is securely handled. These tools enhance productivity and compliance throughout the tax filing process.

-

Can airSlate SignNow integrate with accounting software for tax credit management?

Absolutely! airSlate SignNow integrates smoothly with various accounting software, making it easier to manage documents related to the 2022 tax credit. This integration allows for efficient data transfer and synchronization between systems, ensuring that all your tax filing information is up-to-date. By automating these processes, you can save time and reduce the chances of errors.

-

What benefits does airSlate SignNow provide for businesses claiming the 2022 tax credit?

Using airSlate SignNow offers numerous benefits for businesses claiming the 2022 tax credit, including enhanced efficiency, document security, and real-time collaboration. Our platform ensures that your documents are organized and accessible, reducing the risk of missing deadlines. This can lead to greater savings and relief during tax season.

-

Is there customer support available for questions about the 2022 tax credit?

Yes, airSlate SignNow provides robust customer support to assist you with any questions related to the 2022 tax credit and our services. Our dedicated team is ready to guide you through the document preparation and signing process. Having the right support can make a signNow difference in your overall tax filing experience.

Get more for Form NYC 210 Claim For New York City School Tax Credit Tax Year

Find out other Form NYC 210 Claim For New York City School Tax Credit Tax Year

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word