Mo Quarterly Contribution and Wage Report Form

What is the Missouri Quarterly Contribution and Wage Report?

The Missouri Quarterly Contribution and Wage Report is a crucial document for employers in the state of Missouri. It is used to report employee wages and contributions to the state's unemployment insurance program. This report helps the Missouri Division of Employment Security track employment trends and ensure compliance with unemployment insurance laws. Employers must accurately complete this report to maintain their eligibility for unemployment benefits and avoid penalties.

Steps to Complete the Missouri Quarterly Contribution and Wage Report

Completing the Missouri Quarterly Contribution and Wage Report involves several key steps:

- Gather employee wage information for the reporting period.

- Access the official form, which can be found on the Missouri Division of Employment Security website.

- Fill out the required fields, including employer information, employee wages, and contributions.

- Review the completed report for accuracy to prevent errors.

- Submit the report by the specified deadline, either online or via mail.

Legal Use of the Missouri Quarterly Contribution and Wage Report

The Missouri Quarterly Contribution and Wage Report is legally binding when completed and submitted according to state regulations. To ensure its validity, employers must adhere to the guidelines set forth by the Missouri Division of Employment Security. This includes maintaining accurate records and submitting the report on time. Failure to comply with these regulations can result in penalties, including fines and loss of unemployment insurance benefits.

Form Submission Methods

Employers have multiple options for submitting the Missouri Quarterly Contribution and Wage Report. The primary methods include:

- Online Submission: Employers can fill out and submit the report electronically through the Missouri Division of Employment Security's online portal.

- Mail Submission: Employers may also print the completed report and send it via postal mail to the appropriate state office.

- In-Person Submission: In some cases, employers can deliver the report directly to a local office of the Missouri Division of Employment Security.

Filing Deadlines / Important Dates

Timely submission of the Missouri Quarterly Contribution and Wage Report is essential for compliance. The filing deadlines are typically set for the last day of the month following the end of each quarter. For example:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31

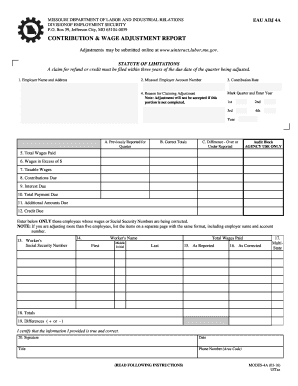

Key Elements of the Missouri Quarterly Contribution and Wage Report

Understanding the key elements of the Missouri Quarterly Contribution and Wage Report is vital for accurate completion. The report typically includes:

- Employer Identification: Name, address, and identification number of the employer.

- Employee Information: Names and Social Security numbers of employees.

- Wages Paid: Total wages paid to each employee during the reporting period.

- Contributions: Amount of unemployment insurance contributions owed based on reported wages.

Penalties for Non-Compliance

Employers who fail to submit the Missouri Quarterly Contribution and Wage Report on time or provide inaccurate information may face several penalties. These can include:

- Monetary fines imposed by the Missouri Division of Employment Security.

- Increased contribution rates for unemployment insurance.

- Loss of eligibility for unemployment benefits for affected employees.

Quick guide on how to complete mo quarterly contribution and wage report

Complete Mo Quarterly Contribution And Wage Report effortlessly on any device

Web-based document administration has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork quickly and without delays. Manage Mo Quarterly Contribution And Wage Report on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to alter and eSign Mo Quarterly Contribution And Wage Report with ease

- Locate Mo Quarterly Contribution And Wage Report and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Mo Quarterly Contribution And Wage Report and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo quarterly contribution and wage report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Missouri quarterly contribution and wage report?

The Missouri quarterly contribution and wage report is a document that employers must file to report employee wages and contributions to state funds. This report is crucial for maintaining compliance with Missouri's labor and tax laws. Utilizing tools like airSlate SignNow can streamline the process of preparing and submitting these reports.

-

How can airSlate SignNow help me with the Missouri quarterly contribution and wage report?

airSlate SignNow simplifies the process of preparing your Missouri quarterly contribution and wage report by allowing you to create, send, and eSign documents effortlessly. Our platform helps you ensure accuracy and compliance while saving you valuable time. With automated workflows, you can prepare these reports more efficiently.

-

Is airSlate SignNow cost-effective for handling the Missouri quarterly contribution and wage report?

Yes, airSlate SignNow is a cost-effective solution for businesses managing the Missouri quarterly contribution and wage report. Our pricing plans are designed to suit different business needs, providing you with great value for your investment. Plus, by reducing document processing time, you save money in the long run.

-

What features does airSlate SignNow offer for managing the Missouri quarterly contribution and wage report?

airSlate SignNow offers a variety of features tailored for managing the Missouri quarterly contribution and wage report, including customizable templates, automated workflows, and secure eSigning capabilities. These features help streamline the documentation process and reduce potential errors. You can easily track the status of your reports in real-time.

-

Can I integrate airSlate SignNow with other tools for my Missouri quarterly contribution and wage report?

Absolutely! airSlate SignNow can seamlessly integrate with a variety of tools, allowing you to import and export data necessary for your Missouri quarterly contribution and wage report. This ensures that all your documentation is cohesive and accessible. Integrations enhance efficiency by eliminating the need for duplicate data entry.

-

What are the benefits of using airSlate SignNow for my Missouri quarterly contribution and wage report?

Using airSlate SignNow for your Missouri quarterly contribution and wage report offers numerous benefits, including increased efficiency, improved accuracy, and enhanced security for your documents. Our platform allows for easier collaboration among team members and external parties involved in the reporting process. Additionally, you'll have peace of mind knowing your documents are securely stored and legally binding.

-

Is the Missouri quarterly contribution and wage report easy to eSign with airSlate SignNow?

Yes, eSigning your Missouri quarterly contribution and wage report with airSlate SignNow is straightforward and user-friendly. The platform guides you through the process step by step, ensuring all necessary fields are completed and signed. You can invite multiple signers and receive notifications when your documents are signed, all in one place.

Get more for Mo Quarterly Contribution And Wage Report

- University of iowa blue requisition form

- Verified complaint for possession of real property form 1b dccourts

- Ds 260 form pdf 359141217

- Code indiana form

- Templates to appoint healthcare representative form

- Spds form

- Dost medical certificate form

- Florida high school athletic association clearance form

Find out other Mo Quarterly Contribution And Wage Report

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT