Optum Bank Hsa Contribution Form 2015

What is the Optum Bank HSA Contribution Form?

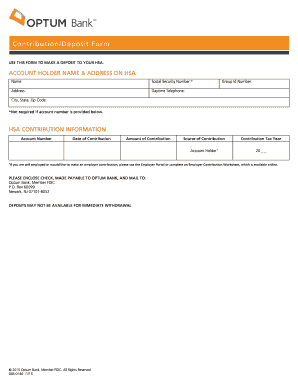

The Optum Bank HSA Contribution Form is a document used to make contributions to a Health Savings Account (HSA). This form is essential for individuals who wish to deposit funds into their HSA, which can be utilized for qualified medical expenses. The form captures necessary information such as the contributor's details, the amount being contributed, and the account information for the HSA. Understanding this form is crucial for ensuring that contributions are made correctly and in compliance with IRS regulations.

How to Use the Optum Bank HSA Contribution Form

Using the Optum Bank HSA Contribution Form involves several straightforward steps. First, download the form from a reliable source. Next, fill in your personal information, including your name, address, and HSA account number. Specify the contribution amount and the type of contribution, whether it is a personal contribution or an employer contribution. After completing the form, review it for accuracy before submitting it to Optum Bank, either online or via mail. Proper use of this form ensures that your contributions are processed efficiently.

Steps to Complete the Optum Bank HSA Contribution Form

Completing the Optum Bank HSA Contribution Form requires attention to detail. Follow these steps for accurate completion:

- Download the form from the Optum Bank website or obtain a physical copy.

- Fill in your personal information, including your full name, address, and Social Security number.

- Provide your HSA account number to ensure the contribution is credited to the correct account.

- Indicate the contribution amount and specify whether it is a personal or employer contribution.

- Review all entered information for accuracy.

- Sign and date the form to validate your submission.

- Submit the completed form either online or by mailing it to Optum Bank.

Key Elements of the Optum Bank HSA Contribution Form

The Optum Bank HSA Contribution Form includes several key elements that must be accurately filled out to ensure proper processing. These elements typically include:

- Personal Information: Your name, address, and Social Security number.

- HSA Account Information: The account number associated with your HSA.

- Contribution Amount: The specific dollar amount you wish to contribute.

- Type of Contribution: Indication of whether the contribution is personal or from an employer.

- Signature: Your signature and the date to confirm the accuracy of the information provided.

Legal Use of the Optum Bank HSA Contribution Form

The legal validity of the Optum Bank HSA Contribution Form is essential for ensuring compliance with IRS regulations. To be legally binding, the form must be completed accurately and signed by the contributor. It is important to retain a copy of the submitted form for your records, as it serves as proof of your contributions. Additionally, understanding the legal implications of HSA contributions can help you avoid potential penalties associated with improper reporting or contributions exceeding IRS limits.

Form Submission Methods

There are multiple methods for submitting the Optum Bank HSA Contribution Form. You can choose to submit the form online through Optum Bank’s secure portal, which offers a convenient and efficient way to ensure your contribution is processed quickly. Alternatively, you may print the completed form and mail it directly to Optum Bank. When mailing, ensure that you use the correct address and consider using a trackable mailing option to confirm receipt.

Quick guide on how to complete optum bank hsa contribution form

Accomplish Optum Bank Hsa Contribution Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Optum Bank Hsa Contribution Form on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-based procedure today.

How to modify and eSign Optum Bank Hsa Contribution Form with ease

- Obtain Optum Bank Hsa Contribution Form and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Optum Bank Hsa Contribution Form and ensure effective communication at any point in your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct optum bank hsa contribution form

Create this form in 5 minutes!

How to create an eSignature for the optum bank hsa contribution form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HSA contribution form template?

An HSA contribution form template is a pre-designed document that allows individuals to record their health savings account contributions accurately. Using an HSA contribution form template can simplify tracking your contributions and ensure compliance with IRS regulations. With airSlate SignNow, you can easily customize and eSign your HSA contribution forms.

-

How can I create an HSA contribution form template?

Creating an HSA contribution form template is straightforward with airSlate SignNow. You can choose from various customizable templates available on our platform. Simply outline the necessary fields for contributions and signatures, and you'll have your HSA contribution form template ready in minutes.

-

Are there any costs associated with using the HSA contribution form template on airSlate SignNow?

airSlate SignNow offers a range of pricing plans to suit various budgets. There may be an initial fee for premium features, but you can start with a free trial to explore the HSA contribution form template's functionalities. Evaluate your needs and select a plan that fits your budget while maximizing benefits.

-

What features does the HSA contribution form template include?

The HSA contribution form template from airSlate SignNow includes essential features such as editable fields, eSignature capabilities, and compliance checks. Additionally, you can integrate it with other tools to streamline your workflows. This ensures an efficient process for managing your contributions.

-

Can I customize the HSA contribution form template?

Yes, you can fully customize the HSA contribution form template using airSlate SignNow. Adjust the layout, add specific fields, and modify text to fit your unique requirements. The intuitive design tools make it easy to tailor the template to your preferences.

-

How does the HSA contribution form template enhance productivity?

Using an HSA contribution form template helps eliminate manual paperwork and speeds up the contribution process. With airSlate SignNow, you can quickly fill out, send, and collect eSignatures, ensuring that your workflow remains uninterrupted. This digital solution is designed for efficiency and ease of use.

-

Is the HSA contribution form template secure?

Absolutely! The HSA contribution form template on airSlate SignNow is secured with encrypted technology to protect sensitive information. Our commitment to security ensures that your eSignatures and personal data remain confidential and compliant with industry standards.

Get more for Optum Bank Hsa Contribution Form

Find out other Optum Bank Hsa Contribution Form

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement