32479E 042023 EMP HSA OB Contribution Deposit Form 2021-2026

What is the 32479E 042023 EMP HSA OB Contribution Deposit Form

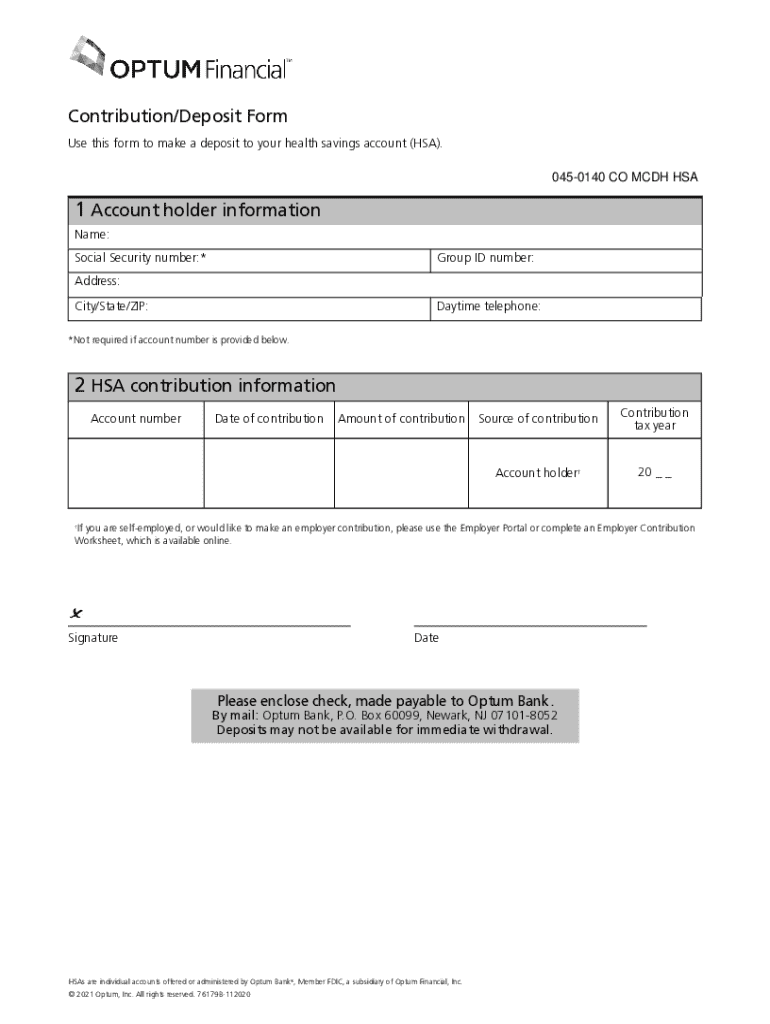

The 32479E 042023 EMP HSA OB Contribution Deposit Form is a specialized document used for making contributions to Health Savings Accounts (HSAs) within the United States. This form is essential for employers and employees who wish to manage their HSA contributions in compliance with federal regulations. It enables individuals to deposit funds into their HSAs, ensuring that contributions are properly documented and reported for tax purposes.

How to use the 32479E 042023 EMP HSA OB Contribution Deposit Form

To effectively use the 32479E 042023 EMP HSA OB Contribution Deposit Form, individuals should first gather all necessary information regarding their HSA contributions. This includes the contributor's name, account details, and the amount being deposited. Once the form is completed, it should be submitted according to the instructions provided, which may include online submission or mailing to the appropriate financial institution. Ensuring accuracy on the form is crucial to avoid any delays in processing contributions.

Steps to complete the 32479E 042023 EMP HSA OB Contribution Deposit Form

Completing the 32479E 042023 EMP HSA OB Contribution Deposit Form involves several key steps:

- Gather personal and account information, including Social Security numbers and HSA account numbers.

- Fill in the contributor's details accurately, ensuring all required fields are completed.

- Indicate the contribution amount and specify the tax year for which the contribution applies.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, whether online or via mail.

Legal use of the 32479E 042023 EMP HSA OB Contribution Deposit Form

The 32479E 042023 EMP HSA OB Contribution Deposit Form must be used in accordance with IRS regulations governing Health Savings Accounts. This includes adhering to contribution limits set by the IRS and ensuring that the funds deposited qualify under HSA guidelines. Proper use of the form helps maintain compliance and supports accurate tax reporting, which is critical for both individuals and employers.

Key elements of the 32479E 042023 EMP HSA OB Contribution Deposit Form

Key elements of the 32479E 042023 EMP HSA OB Contribution Deposit Form include:

- Contributor's name and contact information.

- HSA account number to ensure proper allocation of funds.

- Contribution amount and designation for the applicable tax year.

- Signature of the contributor to authorize the deposit.

Filing Deadlines / Important Dates

Filing deadlines for the 32479E 042023 EMP HSA OB Contribution Deposit Form are typically aligned with IRS tax deadlines. Contributions for a given tax year must be made by the tax filing deadline, which is usually April fifteenth of the following year. It is important to keep track of these dates to ensure contributions are valid and can be deducted on tax returns.

Create this form in 5 minutes or less

Find and fill out the correct 32479e 042023 emp hsa ob contribution deposit form

Create this form in 5 minutes!

How to create an eSignature for the 32479e 042023 emp hsa ob contribution deposit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 32479E 042023 EMP HSA OB Contribution Deposit Form?

The 32479E 042023 EMP HSA OB Contribution Deposit Form is a document used for submitting contributions to Health Savings Accounts (HSAs) for employees. This form ensures that contributions are processed correctly and in compliance with IRS regulations. Utilizing airSlate SignNow, you can easily fill out and eSign this form, streamlining your contribution process.

-

How can I access the 32479E 042023 EMP HSA OB Contribution Deposit Form?

You can access the 32479E 042023 EMP HSA OB Contribution Deposit Form directly through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the specific form. Our user-friendly interface makes it easy to find and manage your documents.

-

What are the benefits of using airSlate SignNow for the 32479E 042023 EMP HSA OB Contribution Deposit Form?

Using airSlate SignNow for the 32479E 042023 EMP HSA OB Contribution Deposit Form offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. Our platform allows you to eSign documents securely and track their status in real-time. This efficiency helps you manage contributions seamlessly.

-

Is there a cost associated with using the 32479E 042023 EMP HSA OB Contribution Deposit Form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing plans vary based on features and usage, ensuring you only pay for what you need. Check our pricing page for detailed information on plans that include the 32479E 042023 EMP HSA OB Contribution Deposit Form.

-

Can I integrate airSlate SignNow with other software for the 32479E 042023 EMP HSA OB Contribution Deposit Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when using the 32479E 042023 EMP HSA OB Contribution Deposit Form. Whether you use CRM systems, accounting software, or other tools, our platform can connect seamlessly to enhance your productivity.

-

How does airSlate SignNow ensure the security of the 32479E 042023 EMP HSA OB Contribution Deposit Form?

airSlate SignNow prioritizes security by employing advanced encryption protocols and secure cloud storage for all documents, including the 32479E 042023 EMP HSA OB Contribution Deposit Form. Our platform complies with industry standards to protect sensitive information, ensuring that your contributions are safe and secure.

-

What features does airSlate SignNow offer for managing the 32479E 042023 EMP HSA OB Contribution Deposit Form?

airSlate SignNow provides a variety of features for managing the 32479E 042023 EMP HSA OB Contribution Deposit Form, including customizable templates, automated workflows, and real-time tracking. These features help you efficiently manage contributions and ensure that all necessary steps are completed accurately and promptly.

Get more for 32479E 042023 EMP HSA OB Contribution Deposit Form

- Texas register v27 no51 the portal to texas history yumpu form

- Section 1 purpose 100 the purpose of this ordinance is to form

- Sanitation of public eating and drinking places form

- An ordinance amending the passenger vehicle for hire code form

- An ordinance adding section 5250 to the city of klamath form

- Local government code chapter 214 municipal regulation of form

- Chapter 12 massage parlorscode of ordinances form

- Rezoningsfuture land use map amendments city of cedar form

Find out other 32479E 042023 EMP HSA OB Contribution Deposit Form

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe