Itr Format

What is the ITR Format

The Income Tax Return (ITR) format is a standardized document used by taxpayers in the United States to report their annual income to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to declare their earnings, calculate tax liabilities, and claim deductions or credits. The ITR format varies based on the taxpayer's situation, such as their filing status, income sources, and whether they are self-employed or employed by a company. Understanding the specific ITR format applicable to your circumstances is crucial for compliance with tax laws.

How to Use the ITR Format

Using the ITR format involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any receipts for deductible expenses. Next, select the appropriate ITR form based on your filing status and income sources. Fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it electronically or via mail to the IRS. Utilizing digital tools can simplify this process, allowing for easy eSignature and secure submission.

Steps to Complete the ITR Format

Completing the ITR format involves a systematic approach to ensure compliance and accuracy. Follow these steps:

- Gather all relevant financial documents, including income statements and deduction records.

- Select the correct ITR form based on your filing status and income type.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, dividends, and any self-employment income.

- Claim eligible deductions and credits to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring to retain a copy for your records.

Legal Use of the ITR Format

The ITR format is legally binding when completed and submitted according to IRS regulations. It is essential to provide truthful and accurate information, as discrepancies can lead to penalties or audits. The IRS accepts electronically filed ITRs, which must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Using a reliable eSignature solution ensures that your submission meets legal standards and maintains the integrity of your tax documents.

Required Documents

To complete the ITR format accurately, several documents are necessary. These typically include:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills, charitable donations, and business-related costs.

- Records of any other income sources, such as rental income or interest from savings accounts.

Having these documents organized will streamline the process of filling out the ITR format and ensure that all income and deductions are accounted for.

Form Submission Methods

There are various methods for submitting the ITR format to the IRS. Taxpayers can choose to file online using approved e-filing software, which often includes features for eSigning and secure document submission. Alternatively, forms can be printed and mailed directly to the IRS. In-person filing is also an option at designated IRS offices, although this method is less common. Each submission method has its own timeline for processing, so it is important to choose one that aligns with your filing deadlines.

Quick guide on how to complete itr format

Complete Itr Format effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to easily access the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Itr Format on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Itr Format seamlessly

- Locate Itr Format and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important parts of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your revisions.

- Choose your preferred method to submit your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that demand printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Itr Format and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itr format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

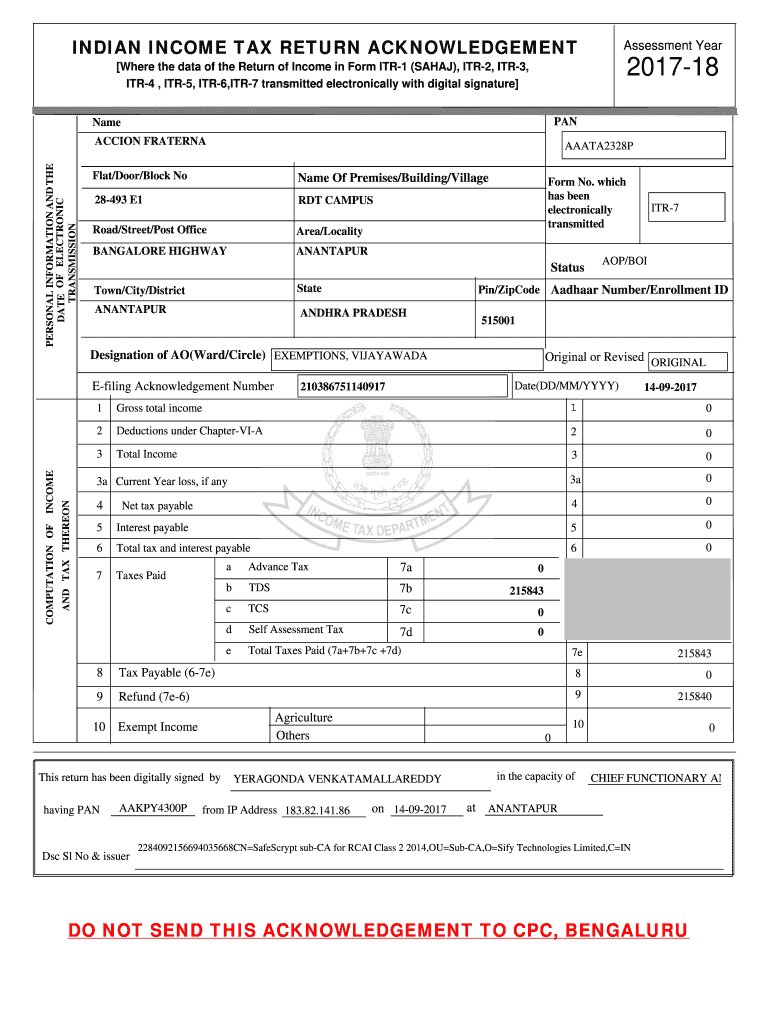

What is an income tax acknowledgement, and why is it important?

An income tax acknowledgement is a document that confirms the receipt and processing of your income tax return by tax authorities. It serves as proof that your tax documents have been filed correctly and can be referenced in case of any disputes. Ensuring you have an income tax acknowledgement is crucial for maintaining financial records and preparing for future tax filings.

-

How does airSlate SignNow help with generating an income tax acknowledgement?

With airSlate SignNow, users can easily create and send documents that require signatures, including income tax acknowledgements. The platform streamlines the process of preparing and sharing these important tax documents, making it easy to get them signed quickly and securely. This ensures you have the necessary acknowledgement for your records.

-

What features does airSlate SignNow offer for income tax acknowledgement processing?

AirSlate SignNow offers features such as eSignature, document templates, automated workflows, and secure storage to facilitate the management of income tax acknowledgements. These tools enhance efficiency and ensure that all necessary parties can sign documents effortlessly. This makes it a cost-effective solution for individuals and businesses alike.

-

Is airSlate SignNow affordable for small businesses needing income tax acknowledgement solutions?

Yes, airSlate SignNow is designed to be cost-effective, making it accessible for small businesses that need reliable solutions for managing income tax acknowledgements. Our pricing plans cater to various budgets, allowing businesses to choose a plan that fits their financial needs. This ensures that even small teams can maintain compliance and secure documentation.

-

Can I integrate airSlate SignNow with my existing tools for handling income tax acknowledgements?

Absolutely! AirSlate SignNow offers numerous integrations with popular tools such as CRM systems and accounting software, making it easier to manage income tax acknowledgements within your existing workflow. This seamless integration saves time and enhances productivity by allowing you to sync data between platforms efficiently.

-

What are the benefits of using airSlate SignNow for income tax acknowledgements?

Using airSlate SignNow for income tax acknowledgements streamlines your document management process. It offers fast, secure eSigning solutions that eliminate the need for paper documents, reducing errors and ensuring compliance. Additionally, it provides a clear audit trail for all signed documents, enhancing accountability and transparency.

-

Are there any security features for handling sensitive income tax acknowledgements in airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents, including income tax acknowledgements. The platform uses advanced encryption methods and two-factor authentication to protect sensitive information, ensuring that your data remains confidential. This provides peace of mind for individuals and businesses managing important tax documents.

Get more for Itr Format

Find out other Itr Format

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later