Tc69c Form

What is the Tc69c

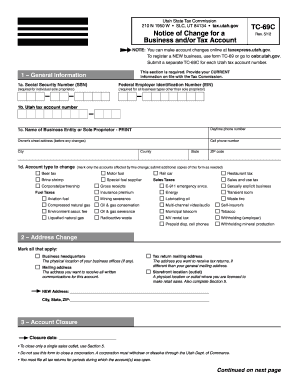

The Tc69c form is a specific document used in various administrative processes, particularly in the state of Utah. It serves as a formal request or declaration, and its completion is essential for various legal and procedural purposes. Understanding the function and requirements of the Tc69c is crucial for individuals and businesses alike, as it ensures compliance with state regulations.

How to use the Tc69c

Using the Tc69c form involves several key steps to ensure that it is filled out correctly and submitted appropriately. First, gather all necessary information, including personal details and any relevant supporting documents. Next, complete the form accurately, paying attention to any specific instructions provided. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the requirements set forth by the issuing authority.

Steps to complete the Tc69c

Completing the Tc69c form requires careful attention to detail. Follow these steps:

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary documentation that supports your request.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form according to the designated method, whether online, by mail, or in person.

Legal use of the Tc69c

The Tc69c form is legally binding when completed and submitted according to the relevant laws and regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to legal consequences. Compliance with applicable state laws is necessary to validate the use of the Tc69c in official matters.

State-specific rules for the Tc69c

Each state may have unique rules governing the use of the Tc69c form. In Utah, for instance, there are specific guidelines regarding how the form should be completed and submitted. It is important for users to familiarize themselves with these regulations to ensure compliance and avoid potential issues. Checking with local authorities or legal resources can provide clarity on any state-specific requirements.

Examples of using the Tc69c

The Tc69c form can be utilized in various scenarios, including:

- Submitting a request for a license or permit.

- Filing an official declaration with a government agency.

- Requesting modifications to existing legal documents.

Understanding these examples can help users identify when and how to effectively use the Tc69c form in their specific situations.

Quick guide on how to complete tc69c

Effortlessly Prepare Tc69c on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Tc69c on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric operation today.

The easiest method to modify and electronically sign Tc69c without stress

- Find Tc69c and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the issues of lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Tc69c and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc69c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc69c and how does it benefit my business?

tc69c represents an advanced feature set within airSlate SignNow that enhances document management and electronic signing. By utilizing tc69c, businesses can streamline their workflows and improve efficiency, ultimately leading to faster turnaround times for important documents.

-

How does pricing work for tc69c features in airSlate SignNow?

Pricing for tc69c features varies depending on the plan you choose. airSlate SignNow offers multiple tiers that include access to tc69c capabilities, allowing businesses of all sizes to select options that fit their budgets and needs effectively.

-

Can I integrate tc69c with other tools my business uses?

Yes, the tc69c features in airSlate SignNow can easily integrate with various third-party applications. This ensures that you can enhance your existing workflows without needing to overhaul your current systems.

-

What types of documents can I manage using tc69c?

With tc69c in airSlate SignNow, you can manage a wide array of document types, including contracts, agreements, and forms. The flexibility of tc69c ensures that all your signing and document management needs are met efficiently.

-

Is there a mobile app for tc69c functionalities?

Absolutely! The airSlate SignNow mobile app incorporates tc69c functionalities, allowing you to manage and sign documents on the go. This feature ensures that your business remains productive and agile, regardless of your location.

-

What security measures are in place for tc69c documents?

airSlate SignNow employs robust security measures for all documents processed through tc69c, including encryption and data storage protocols. This commitment to security helps protect sensitive information, giving you peace of mind as you conduct business.

-

How can tc69c improve collaboration within my team?

The tc69c features in airSlate SignNow enhance collaboration by allowing multiple users to interact with documents seamlessly. Team members can review, comment, and sign documents in real-time, facilitating a smoother workflow and faster decision-making process.

Get more for Tc69c

- Mitosis crossword puzzle answer key pdf form

- This application will not be accepted unless 1199 form

- Springfield college transcript request form

- Wrl tplic form

- Financing addendum fha insured mortgage form

- Heads of terms agreement template form

- Health care service agreement template form

- Healing separation agreement template form

Find out other Tc69c

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF