Loan Review Template Form

What is the Loan Review Template

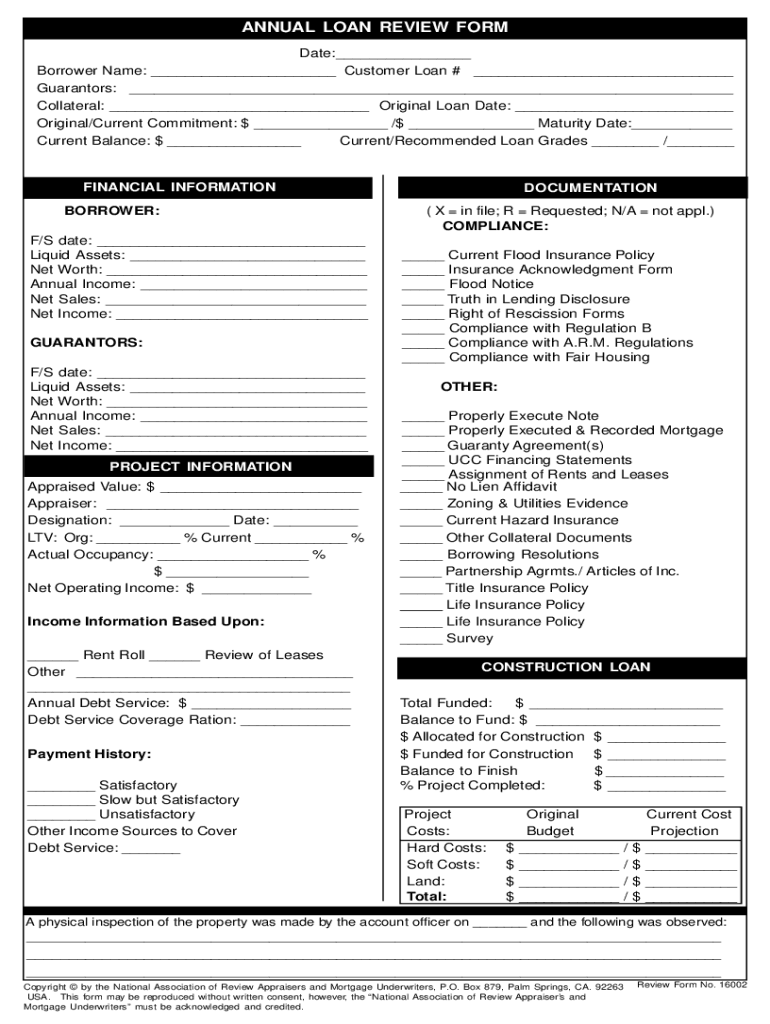

The commercial loan review template is a structured document designed to facilitate the assessment and evaluation of commercial loans. This template serves as a guide for financial institutions to systematically analyze loan performance, borrower compliance, and risk factors. It typically includes sections for borrower information, loan details, financial performance metrics, and risk assessments. By using this template, lenders can ensure a comprehensive review process that adheres to industry standards and regulatory requirements.

How to use the Loan Review Template

Using the commercial loan review template involves several key steps. First, gather all necessary documentation related to the loan, including the loan agreement, borrower financial statements, and any previous review reports. Next, fill out the template with relevant data, ensuring accuracy and completeness. Review each section carefully, paying close attention to financial metrics and compliance indicators. Finally, submit the completed template to the appropriate department for further analysis and decision-making.

Key elements of the Loan Review Template

The commercial loan review template consists of several essential elements that contribute to a thorough evaluation. Key components typically include:

- Borrower Information: Details about the borrower, including business name, address, and contact information.

- Loan Details: Information about the loan amount, interest rate, term, and purpose of the loan.

- Financial Performance Metrics: Analysis of the borrower's financial statements, including income, cash flow, and balance sheet data.

- Risk Assessment: Evaluation of potential risks associated with the loan, such as market conditions and borrower creditworthiness.

- Compliance Check: Verification of adherence to lending policies and regulatory requirements.

Steps to complete the Loan Review Template

Completing the commercial loan review template involves a systematic approach. Follow these steps for an effective review:

- Collect all relevant loan documentation and borrower financials.

- Input borrower and loan information into the designated sections of the template.

- Analyze financial performance metrics, ensuring all calculations are accurate.

- Conduct a risk assessment based on current market conditions and borrower history.

- Review compliance with internal policies and regulatory requirements.

- Finalize the document and submit it for approval or further action.

Legal use of the Loan Review Template

The commercial loan review template is legally binding when used in accordance with established regulations and standards. It is crucial for lenders to ensure that the template complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). By adhering to these legal frameworks, lenders can ensure that the completed template holds up in legal contexts, providing a reliable record of the loan review process.

Examples of using the Loan Review Template

Practical examples of utilizing the commercial loan review template can enhance understanding and application. For instance, a bank may use the template to review a loan for a small business seeking expansion. The bank would analyze the business's financial health, assess the risks associated with the expansion, and ensure compliance with lending regulations. Another example could involve a real estate investment firm using the template to evaluate a commercial property loan, focusing on market trends and property performance metrics.

Quick guide on how to complete loan review template

Complete Loan Review Template effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without any hold-ups. Manage Loan Review Template on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to edit and eSign Loan Review Template with ease

- Locate Loan Review Template and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Loan Review Template and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan review template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a commercial loan review template?

A commercial loan review template is a structured document designed to streamline the assessment of loan applications. It includes key sections that evaluate the borrower's financial health, lending risks, and compliance with underwriting standards, making the review process systematic and efficient.

-

How can a commercial loan review template benefit my business?

Using a commercial loan review template can substantially enhance your loan processing efficiency. It helps ensure that all necessary information is gathered and evaluated, reducing the likelihood of errors and speeding up decision-making while maintaining compliance with regulations.

-

Does airSlate SignNow offer the ability to customize a commercial loan review template?

Yes, airSlate SignNow allows you to customize your commercial loan review template to fit your business's specific needs. You can add or remove sections, tailor questions, and adapt the format, ensuring that it aligns perfectly with your organization's review process.

-

What features does airSlate SignNow provide to enhance the use of a commercial loan review template?

airSlate SignNow offers several powerful features to enhance your commercial loan review template, including eSigning, document tracking, and collaboration tools. These functionalities facilitate quick approvals and enable multiple team members to collaborate efficiently on the review process.

-

What are the pricing options for using the commercial loan review template with airSlate SignNow?

airSlate SignNow provides various pricing plans to cater to businesses of different sizes. Pricing is typically based on the number of users and additional features you wish to access, ensuring that you find a plan that suits your budget while benefiting from using the commercial loan review template.

-

Is it easy to integrate the commercial loan review template into existing business systems?

Absolutely! airSlate SignNow offers seamless integration options with popular business applications and systems. This means you can easily incorporate the commercial loan review template into your existing workflows, enhancing operational efficiency without disrupting your current processes.

-

How secure is the information collected in the commercial loan review template?

Security is a top priority at airSlate SignNow. The commercial loan review template utilizes advanced encryption and secure storage protocols to ensure that all data collected is protected from unauthorized access, helping you maintain confidentiality and comply with regulatory standards.

Get more for Loan Review Template

- Registro de paciente form

- Pa form sp 4 127 for york county

- Goods return form template excel

- Facility ancillary long term care application mmcp dhmh maryland form

- Dallas police department open records form

- Sickle cell care plan form

- Reset form print form notice of intention to leave

- Medical partnership agreement template form

Find out other Loan Review Template

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document