R 1085 Form

What is the R 1085

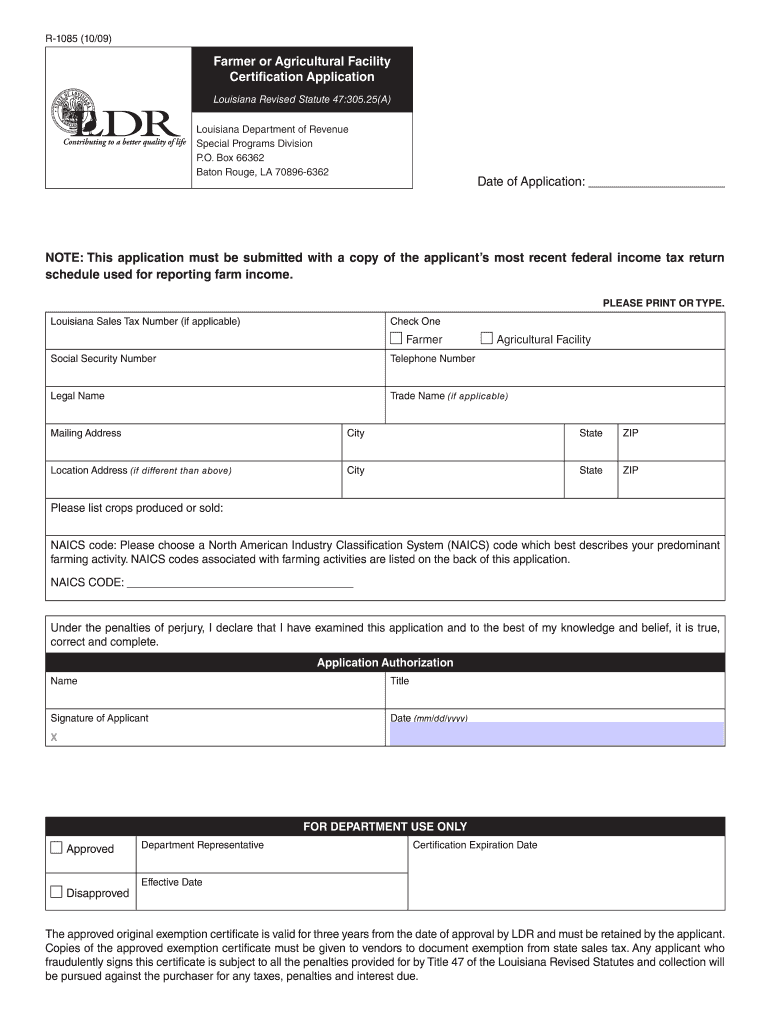

The R 1085 is a specific form used in Louisiana for reporting certain tax-related information. This form is essential for individuals and businesses that need to comply with state tax regulations. It serves as a means to report income, deductions, and other relevant financial data to the Louisiana Department of Revenue. Understanding the purpose and requirements of the R 1085 is crucial for accurate tax reporting and compliance.

How to use the R 1085

Using the R 1085 involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and deductions. Next, accurately fill out the form, providing all required information, such as your name, address, and financial details. After completing the form, review it for any errors before submission. Ensure that you follow the specific guidelines provided by the Louisiana Department of Revenue to avoid any compliance issues.

Steps to complete the R 1085

Completing the R 1085 requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Fill out your personal information at the top of the form, including your name and address.

- Report your total income in the designated section, ensuring all figures are accurate.

- List any deductions you are claiming, providing necessary details and documentation.

- Review the completed form for accuracy and completeness before signing.

- Submit the form according to the guidelines provided by the Louisiana Department of Revenue.

Legal use of the R 1085

The R 1085 must be used in accordance with Louisiana state tax laws to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. The form is legally binding once submitted, and any discrepancies or inaccuracies can lead to penalties. It is important to understand the legal implications of the information reported on the R 1085 to avoid potential legal issues with the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the R 1085 are critical for compliance with Louisiana tax regulations. Typically, the form must be submitted by a specific date, often aligned with the annual tax filing deadline. It is essential to stay informed about these dates to avoid late penalties. Check the Louisiana Department of Revenue's official website or contact their office for the most current information regarding filing deadlines and any changes that may occur.

Required Documents

To successfully complete the R 1085, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Any other documents that support the income and deductions reported.

Having these documents readily available will streamline the process of filling out the R 1085 and ensure that all necessary information is reported accurately.

Quick guide on how to complete r 1085

Complete R 1085 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage R 1085 on any device with airSlate SignNow's Android or iOS apps and simplify any document-centered task today.

The easiest way to modify and eSign R 1085 without hassle

- Locate R 1085 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click Done to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your requirements in document management in just a few clicks from any device you choose. Modify and eSign R 1085 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1085

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is r 1085 and how does it relate to airSlate SignNow?

r 1085 refers to a specific document type that can be efficiently processed using airSlate SignNow. Our platform streamlines the sending and signing process, ensuring compliance and security for all your documents, including the r 1085.

-

How much does airSlate SignNow cost for using r 1085?

Pricing for airSlate SignNow varies based on the plan you choose. We offer competitive rates that fit different business needs, and you can efficiently manage r 1085 documents without breaking your budget.

-

What features does airSlate SignNow offer for handling r 1085 documents?

With airSlate SignNow, you get a host of features for r 1085 document management, including eSignature functionality, customizable templates, and real-time tracking. This makes it easy to ensure that your documents are signed quickly and efficiently.

-

Can I integrate airSlate SignNow with other tools for r 1085?

Yes, airSlate SignNow offers seamless integrations with popular applications that can help in managing r 1085 documents. This flexibility enhances your workflow by allowing you to connect with your existing tools for consistent efficiency.

-

What are the benefits of using airSlate SignNow for r 1085 transactions?

Using airSlate SignNow for r 1085 transactions means faster turnaround times and reduced paperwork. Our platform not only saves time but also increases accuracy and security in your document management processes.

-

Is airSlate SignNow secure for sending and signing r 1085 documents?

Absolutely, airSlate SignNow prioritizes security for all transactions, including those involving r 1085 documents. We implement advanced encryption and compliance measures to protect your sensitive information.

-

How user-friendly is airSlate SignNow for managing r 1085 documents?

airSlate SignNow is designed with usability in mind, enabling even non-technical users to manage r 1085 documents easily. The intuitive interface ensures a smooth experience from document creation to execution.

Get more for R 1085

Find out other R 1085

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval