W 9 Form Printable

What is the W-9 Form Printable

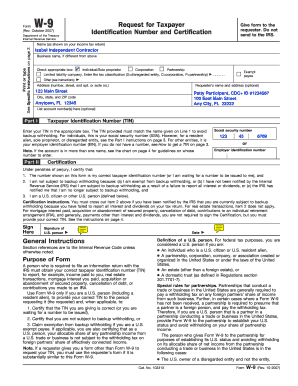

The W-9 form printable is a tax document used in the United States by individuals and businesses to provide their taxpayer identification information to the Internal Revenue Service (IRS). This form is essential for reporting income, particularly for freelancers, contractors, and other self-employed individuals. The W-9 form requires the individual to provide their name, business name (if applicable), address, and taxpayer identification number, which can be a Social Security number or Employer Identification Number. By completing this form, the requester can accurately report payments made to the individual or business to the IRS.

Steps to Complete the W-9 Form Printable

Completing the W-9 form printable involves several straightforward steps:

- Download the form: Obtain the W-9 form from a reliable source, ensuring it is the most current version.

- Fill in your information: Provide your name, business name (if applicable), and address in the designated sections.

- Enter your taxpayer identification number: Include either your Social Security number or Employer Identification Number, depending on your tax status.

- Sign and date the form: Your signature certifies that the information provided is accurate and complete. Ensure you date the form appropriately.

Once completed, the form can be submitted to the requester as instructed.

How to Obtain the W-9 Form Printable

The W-9 form printable can be easily obtained online. The IRS website provides a downloadable version of the form, ensuring that users have access to the most recent updates. Additionally, many accounting software programs and tax preparation services offer the W-9 form within their platforms, allowing for easy access and completion. It is important to ensure that the form is downloaded from a reputable source to avoid any outdated versions.

Legal Use of the W-9 Form Printable

The legal use of the W-9 form printable is crucial for compliance with IRS regulations. This form is primarily used to report income paid to independent contractors and freelancers. By accurately completing and submitting the W-9, individuals and businesses ensure that the payments made are reported correctly to the IRS, which helps in avoiding potential penalties for misreporting income. The form also serves as a means for the requester to obtain necessary information for issuing tax documents, such as the 1099 form.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 form printable. It is important for users to understand the purpose of the form, which is to provide accurate taxpayer information. The IRS requires that the form be completed in full and submitted to the requester, who will use the information for tax reporting purposes. Additionally, the IRS outlines the importance of keeping the information updated, particularly if there are changes in the taxpayer's name or identification number.

Examples of Using the W-9 Form Printable

The W-9 form printable is commonly used in various scenarios, including:

- Freelancers: Individuals providing services, such as graphic design or writing, often complete a W-9 for clients to report payments made.

- Contractors: Construction or consulting contractors use the W-9 form to provide their taxpayer information to businesses hiring them.

- Real estate transactions: Landlords may request a W-9 from tenants for reporting rental income.

These examples illustrate the versatility and necessity of the W-9 form in various financial transactions.

Quick guide on how to complete w 9 form printable

Prepare W 9 Form Printable effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage W 9 Form Printable on any gadget using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign W 9 Form Printable with ease

- Obtain W 9 Form Printable and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign W 9 Form Printable and ensure seamless communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 9 form printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W-9 form printable and why do I need it?

A W-9 form printable is an IRS document used by businesses to request your taxpayer identification number. It's essential for independent contractors, freelancers, and vendors as it helps in tax reporting and ensures compliance with IRS regulations. Using airSlate SignNow, you can quickly generate and send a W-9 form printable to streamline your document processes.

-

Is there a cost associated with using the W-9 form printable feature?

airSlate SignNow offers a variety of pricing plans, including a free trial for you to explore the W-9 form printable feature. The costs vary depending on the plan you choose, but our services are designed to be cost-effective. This means you can manage your documents without breaking the bank.

-

Can I customize a W-9 form printable in airSlate SignNow?

Yes, with airSlate SignNow, you can easily customize a W-9 form printable to meet your specific needs. You can add your logo, change the layout, and adjust the fields. This flexibility allows you to create a professional-looking form that aligns with your brand.

-

How secure is my information when using the W-9 form printable?

Security is a top priority at airSlate SignNow. When you use our W-9 form printable feature, your information is encrypted and securely stored. You can trust that your sensitive data is protected throughout the document management process.

-

Can I integrate the W-9 form printable feature with other software?

Absolutely! airSlate SignNow offers various integrations, allowing you to connect seamlessly with popular platforms like Google Drive, Dropbox, and more. This capability enhances your workflow and makes it easier to manage your W-9 form printable along with other essential documents.

-

How do I send a W-9 form printable using airSlate SignNow?

Sending a W-9 form printable is straightforward with airSlate SignNow. Simply create your printable form, enter the recipient's email address, and send it for eSignature. The process is quick, and you’ll be notified when the form is signed and completed.

-

Can I track the status of my W-9 form printable once sent?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your W-9 form printable. You will receive notifications when the document is viewed and signed. This transparency helps you stay informed about your business transactions.

Get more for W 9 Form Printable

- Sample business agreement contract all american hot dog form

- Satisfaction of judgment blumberg legal forms online

- Invoice 100603273 form

- Customer maintenance form

- M15c fill out and sign printable pdf template form

- Ryan pdf form

- 74a118 1 25 commonwealth of kentucky department form

- Installment plan agreement template form

Find out other W 9 Form Printable

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template