What is a Standby Letter of Credit SLOC and How Does it 2018-2026

Understanding a Standby Letter of Credit (SLOC)

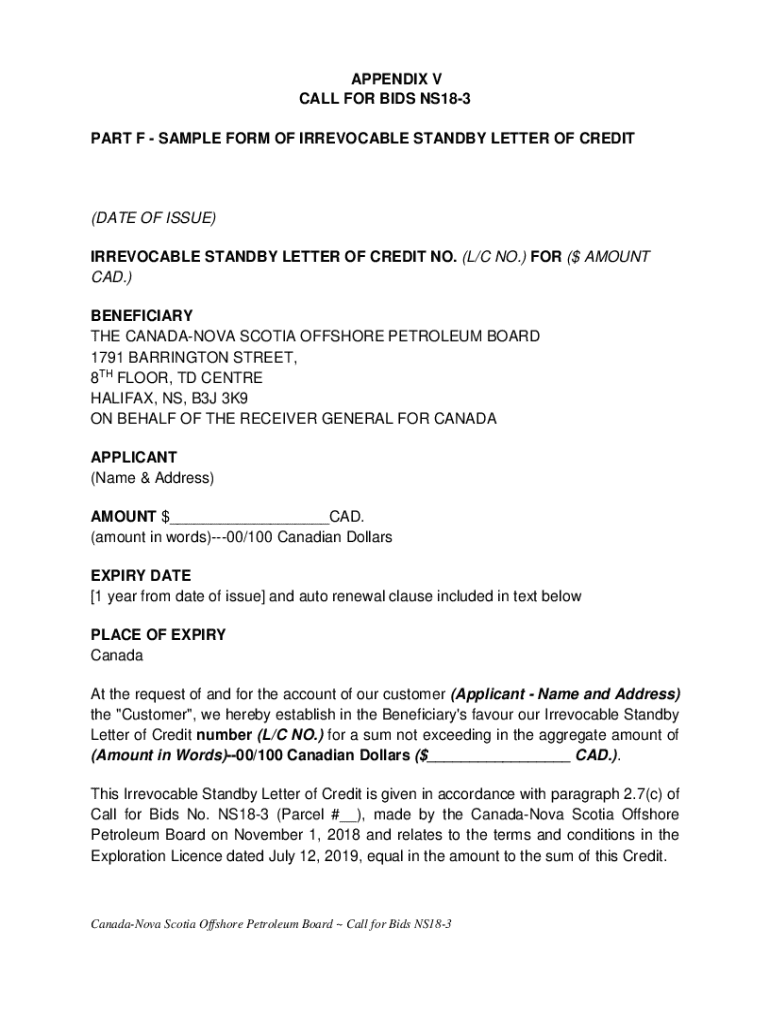

A standby letter of credit (SLOC) is a financial instrument issued by a bank that guarantees payment to a beneficiary if the applicant fails to fulfill a contractual obligation. Unlike traditional letters of credit, which are used in trade transactions, an SLOC serves as a backup payment method. It is often used in various business contexts, including real estate transactions, construction contracts, and service agreements, providing assurance to the party receiving the credit that they will be compensated in case of non-performance.

How to Use a Standby Letter of Credit

To effectively use a standby letter of credit, the applicant must first request the issuance from their bank. This involves providing details about the transaction, including the parties involved and the specific obligations covered. Once issued, the SLOC can be presented to the beneficiary as a guarantee of payment. If the applicant defaults, the beneficiary can draw on the letter by submitting the required documentation to the bank. It is crucial for both parties to understand the terms and conditions outlined in the SLOC to avoid disputes.

Steps to Obtain a Standby Letter of Credit

Obtaining a standby letter of credit involves several steps:

- Identify the need for an SLOC based on the specific transaction or contract.

- Contact a bank to discuss the requirements and process for obtaining an SLOC.

- Provide necessary documentation, including financial statements and details of the transaction.

- Complete any application forms required by the bank.

- Review the terms and conditions of the SLOC before signing.

- Receive the SLOC from the bank and ensure it meets all requirements.

Key Elements of a Standby Letter of Credit

A standby letter of credit typically includes several key elements:

- Applicant: The party requesting the SLOC from the bank.

- Beneficiary: The party that will receive payment if the applicant defaults.

- Amount: The maximum amount that can be drawn under the SLOC.

- Expiration Date: The date until which the SLOC is valid.

- Conditions for Drawing: The specific documentation required for the beneficiary to claim payment.

Legal Use of a Standby Letter of Credit

Standby letters of credit are governed by the Uniform Commercial Code (UCC) in the United States, which provides a legal framework for their use. They are recognized as binding agreements that can be enforced in court. It is important for parties to understand their rights and obligations under the SLOC, as well as any applicable state laws that may influence its enforcement. Proper legal counsel can help ensure compliance and mitigate risks associated with the use of an SLOC.

Examples of Using a Standby Letter of Credit

Standby letters of credit can be used in various scenarios, including:

- Real estate transactions, where a buyer provides an SLOC to assure the seller of payment.

- Construction contracts, where contractors may require an SLOC from subcontractors to guarantee performance.

- Service agreements, where a company may use an SLOC to ensure payment for services rendered.

Create this form in 5 minutes or less

Find and fill out the correct what is a standby letter of credit sloc and how does it

Create this form in 5 minutes!

How to create an eSignature for the what is a standby letter of credit sloc and how does it

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Standby Letter of Credit (SLOC)?

A Standby Letter of Credit (SLOC) is a financial instrument issued by a bank that guarantees payment to a beneficiary if the applicant fails to fulfill contractual obligations. Essentially, it acts as a safety net for transactions, ensuring that the beneficiary receives compensation in case of default. Understanding 'What Is A Standby Letter Of Credit SLOC And How Does It' can help businesses mitigate risks in their dealings.

-

How does a Standby Letter of Credit work?

A Standby Letter of Credit works by providing a guarantee from a bank to pay a specified amount to the beneficiary upon request, provided that the applicant does not meet their obligations. The process typically involves the applicant applying for the SLOC, the bank issuing it, and the beneficiary claiming the funds if necessary. This mechanism is crucial for understanding 'What Is A Standby Letter Of Credit SLOC And How Does It' in practical scenarios.

-

What are the benefits of using a Standby Letter of Credit?

The benefits of using a Standby Letter of Credit include enhanced credibility, improved cash flow management, and reduced risk in transactions. It assures the beneficiary that they will receive payment, which can facilitate smoother business operations. Knowing 'What Is A Standby Letter Of Credit SLOC And How Does It' can help businesses leverage these advantages effectively.

-

What are the costs associated with obtaining a Standby Letter of Credit?

The costs associated with obtaining a Standby Letter of Credit typically include issuance fees, annual fees, and potential transaction fees. These costs can vary based on the bank and the specifics of the agreement. Understanding 'What Is A Standby Letter Of Credit SLOC And How Does It' also involves being aware of these financial implications.

-

How can businesses integrate Standby Letters of Credit into their operations?

Businesses can integrate Standby Letters of Credit into their operations by working closely with their banks to establish terms that align with their contractual obligations. This integration can enhance trust with partners and streamline payment processes. Learning 'What Is A Standby Letter Of Credit SLOC And How Does It' can guide businesses in effectively utilizing this tool.

-

What types of transactions typically use Standby Letters of Credit?

Standby Letters of Credit are commonly used in various transactions, including construction contracts, international trade, and lease agreements. They provide a safety net for both parties involved, ensuring that obligations are met. Understanding 'What Is A Standby Letter Of Credit SLOC And How Does It' can help businesses identify suitable applications for this financial instrument.

-

How long does it take to obtain a Standby Letter of Credit?

The time it takes to obtain a Standby Letter of Credit can vary, but it typically ranges from a few days to a couple of weeks, depending on the bank's processes and the complexity of the application. Businesses should prepare necessary documentation to expedite the process. Knowing 'What Is A Standby Letter Of Credit SLOC And How Does It' can help streamline this timeline.

Get more for What Is A Standby Letter Of Credit SLOC And How Does It

- General form of agreement for sale of business by sole proprietor asset purchase agreement

- Squatters rights 497331188 form

- Contract computer services form

- Affidavit adverse possession form

- Boundary line inspectors form

- Party wall form

- Release waiver liability form

- Affidavit by attorney for defendant in support of motion for reduction of sentence for defendants assistance with another form

Find out other What Is A Standby Letter Of Credit SLOC And How Does It

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast