HOMEOWNERSHIP DIVISIONHousing Education ProgramHou 2016-2026

Understanding the HOMEOWNERSHIP DIVISION Housing Education Program

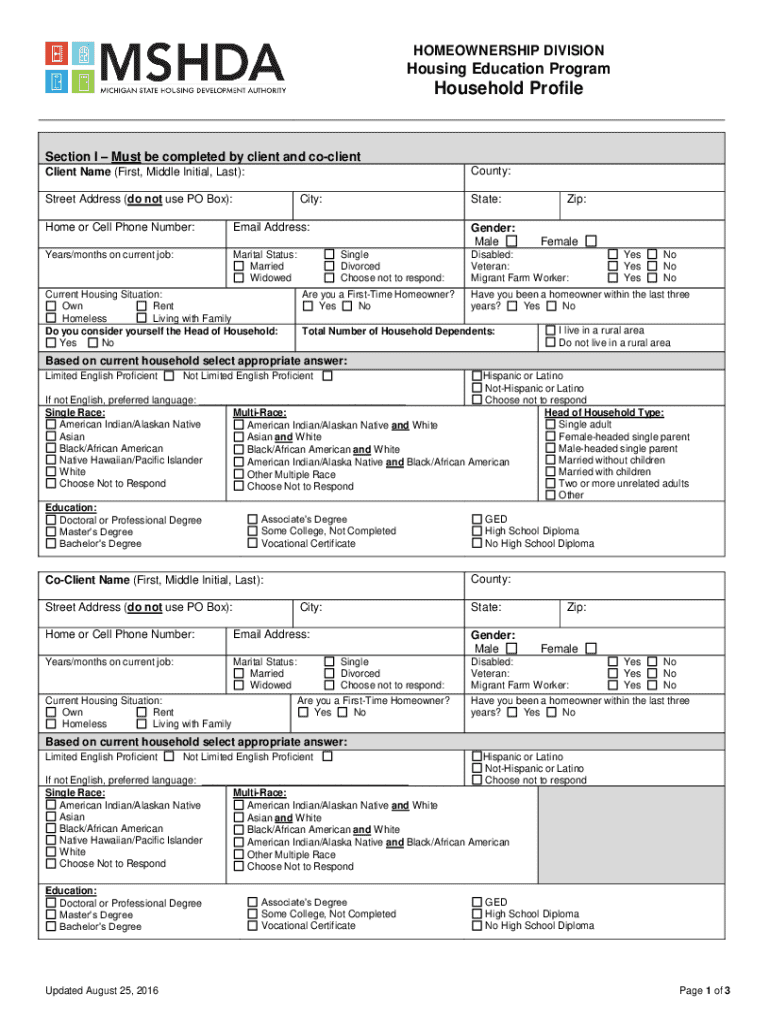

The HOMEOWNERSHIP DIVISION Housing Education Program is designed to provide essential resources and knowledge to prospective homeowners. This program focuses on educating individuals about the home buying process, financial management, and the responsibilities that come with homeownership. Participants gain insights into budgeting, mortgage options, and the importance of credit scores, enabling them to make informed decisions.

Steps to Complete the HOMEOWNERSHIP DIVISION Housing Education Program

Completing the HOMEOWNERSHIP DIVISION Housing Education Program involves several key steps:

- Register for the program through your local housing authority or approved provider.

- Attend all required educational sessions, which may include workshops and online courses.

- Complete any assessments or evaluations that gauge your understanding of the material.

- Obtain a certificate of completion, which may be necessary for certain financial assistance programs.

Eligibility Criteria for the HOMEOWNERSHIP DIVISION Housing Education Program

Eligibility for the HOMEOWNERSHIP DIVISION Housing Education Program typically includes:

- Being a first-time homebuyer or someone looking to enhance their knowledge about homeownership.

- Meeting income requirements set by the program, which may vary by state.

- Willingness to participate in all educational components of the program.

Required Documents for the HOMEOWNERSHIP DIVISION Housing Education Program

To participate in the program, applicants may need to provide certain documents, including:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a driver's license or Social Security card.

- Any previous housing counseling certificates, if applicable.

Legal Use of the HOMEOWNERSHIP DIVISION Housing Education Program

The HOMEOWNERSHIP DIVISION Housing Education Program is recognized by various financial institutions and government agencies. Completion of this program can qualify participants for specific loans and grants, ensuring they meet legal requirements for financial assistance. It is crucial to understand how this program aligns with local housing laws and regulations.

Examples of Using the HOMEOWNERSHIP DIVISION Housing Education Program

Participants in the HOMEOWNERSHIP DIVISION Housing Education Program have successfully utilized their knowledge in various scenarios:

- A first-time homebuyer used insights from the program to negotiate better mortgage terms.

- A family learned effective budgeting strategies, allowing them to save for a down payment.

- An individual improved their credit score by following the program's financial management advice.

Create this form in 5 minutes or less

Find and fill out the correct homeownership divisionhousing education programhou

Create this form in 5 minutes!

How to create an eSignature for the homeownership divisionhousing education programhou

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou?

The HOMEOWNERSHIP DIVISIONHousing Education ProgramHou is designed to provide individuals with the knowledge and resources needed to navigate the home buying process. This program covers essential topics such as budgeting, mortgage options, and the importance of credit scores, ensuring participants are well-prepared for homeownership.

-

How can I enroll in the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou?

Enrolling in the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou is simple. Interested individuals can visit our website to find enrollment options, including online courses and in-person workshops. We encourage prospective homeowners to take this important step towards achieving their homeownership goals.

-

What are the costs associated with the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou?

The HOMEOWNERSHIP DIVISIONHousing Education ProgramHou offers various pricing options to accommodate different budgets. Many programs are available at low or no cost, especially for first-time homebuyers. Check our website for specific pricing details and any available financial assistance.

-

What benefits does the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou provide?

Participants in the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou gain valuable insights into the home buying process, which can lead to better financial decisions. Additionally, completing the program may qualify individuals for down payment assistance and favorable mortgage rates, making homeownership more accessible.

-

Are there any prerequisites for joining the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou?

There are no strict prerequisites for joining the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou. However, a basic understanding of personal finance can be beneficial. We welcome anyone interested in learning about homeownership, regardless of their current financial situation.

-

Can I access the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou online?

Yes, the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou offers online courses that can be accessed from anywhere. This flexibility allows participants to learn at their own pace and convenience, making it easier to fit education into busy schedules.

-

What topics are covered in the HOMEOWNERSHIP DIVISIONHousing Education ProgramHou?

The HOMEOWNERSHIP DIVISIONHousing Education ProgramHou covers a wide range of topics, including budgeting, mortgage types, home inspections, and closing processes. Each module is designed to equip participants with the knowledge they need to make informed decisions throughout their home buying journey.

Get more for HOMEOWNERSHIP DIVISIONHousing Education ProgramHou

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective form

- Massachusetts property form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective form

- Massachusetts dissolution form

- Massachusetts llc 497309837 form

- Living trust for husband and wife with no children massachusetts form

- Massachusetts trust form

Find out other HOMEOWNERSHIP DIVISIONHousing Education ProgramHou

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form