Cp 22 2011-2026

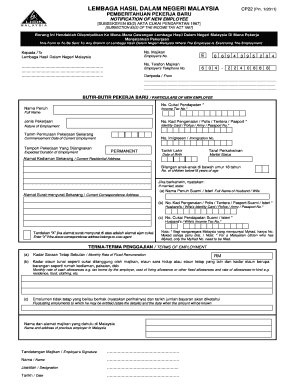

What is the Cp 22?

The Cp 22 is a tax form used by the Internal Revenue Service (IRS) in the United States to notify taxpayers of changes to their tax accounts. This form can be issued for various reasons, including adjustments to tax liabilities or changes in taxpayer status. Understanding the Cp 22 is essential for taxpayers to ensure they are compliant with IRS regulations and to address any discrepancies in their tax records.

Steps to complete the Cp 22

Completing the Cp 22 involves several important steps to ensure accuracy and compliance. First, review the notice carefully to understand the changes being communicated. Next, gather all necessary documentation that supports your position regarding the changes. This may include previous tax returns, payment records, or correspondence with the IRS. Once you have all relevant information, fill out the form accurately, ensuring that all details match your records. Finally, submit the completed form by the specified deadline to avoid any penalties.

Legal use of the Cp 22

The legal use of the Cp 22 hinges on its compliance with IRS guidelines. It serves as an official notification and must be treated as such. Taxpayers should respond to the notice in a timely manner to maintain their legal standing. Failure to address the issues outlined in the Cp 22 could result in further penalties or complications with the IRS. It is crucial to understand that this form is part of the legal framework that governs tax compliance in the United States.

Filing Deadlines / Important Dates

Filing deadlines associated with the Cp 22 are critical for taxpayers to observe. Typically, the IRS will specify a deadline for responding to the notice, which is usually within a certain number of days from the date of issuance. It is important to mark these dates on your calendar and ensure that all necessary actions are taken before the deadline to avoid penalties. Missing these deadlines can lead to additional interest and penalties on any owed amounts.

Required Documents

When responding to a Cp 22 notice, certain documents are often required to support your case. These may include copies of previous tax returns, payment receipts, and any correspondence with the IRS regarding your tax status. It is advisable to keep thorough records and documentation that can substantiate your claims or corrections. Having these documents ready can facilitate a smoother resolution process.

Form Submission Methods (Online / Mail / In-Person)

The Cp 22 can be submitted through various methods, depending on the taxpayer's preference and the nature of the response. Taxpayers may choose to submit the form online through the IRS website, which can expedite processing times. Alternatively, the form can be mailed directly to the address specified in the notice. In some cases, in-person submission at a local IRS office may be appropriate. Each method has its own advantages, so it is important to choose the one that best fits your situation.

Examples of using the Cp 22

Examples of situations where the Cp 22 may be used include cases where a taxpayer has underreported income, resulting in a tax adjustment, or when there are discrepancies in reported deductions. For instance, if a taxpayer receives a notice indicating that their reported income does not match IRS records, they would need to respond using the Cp 22 to clarify the situation. Understanding these examples can help taxpayers navigate their own circumstances more effectively.

Quick guide on how to complete cp 22

Easily Prepare Cp 22 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Cp 22 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Easiest Way to Modify and eSign Cp 22 Effortlessly

- Find Cp 22 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign Cp 22 to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp 22

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cp22a notice?

A cp22a notice is a communication from the IRS informing taxpayers about issues related to their tax returns. It typically addresses discrepancies or additional information required for accurate tax processing. Understanding what is a cp22a notice is essential to resolving any potential tax issues swiftly.

-

How can airSlate SignNow help with handling a cp22a notice?

airSlate SignNow provides a user-friendly platform for electronically signing and managing documents related to tax notices, including a cp22a notice. With features like templates and easy document sharing, you can ensure that you respond to the IRS efficiently. By utilizing airSlate SignNow, you can simplify your compliance process.

-

What features does airSlate SignNow offer for eSigning documents like a cp22a notice?

airSlate SignNow allows for easy eSigning of documents, including important notices such as a cp22a notice. Key features include customizable templates, secure storage, and real-time tracking of document status. These features streamline the signing process and ensure that deadlines are met.

-

Is airSlate SignNow a cost-effective solution for managing a cp22a notice?

Yes, airSlate SignNow offers competitive pricing plans that provide excellent value for businesses needing to manage documents like a cp22a notice. The platform reduces operational costs by minimizing paper usage and streamlining document processes. This financial efficiency helps businesses focus on core activities without worrying about document management overhead.

-

Can I integrate airSlate SignNow with other tools if I receive a cp22a notice?

Absolutely! airSlate SignNow offers integrations with various applications like Google Drive, Dropbox, and more. This means that when you receive a cp22a notice, you can easily import documents from these services for eSigning and management. Integration helps keep your workflow seamless and productive.

-

What benefits does airSlate SignNow provide related to tax documents like a cp22a notice?

Using airSlate SignNow for tax documents such as a cp22a notice offers numerous benefits, including improved efficiency, enhanced security, and faster turnaround times. The platform allows users to gather signatures easily and ensures that documents are securely stored. Its compliance with legal standards also gives users peace of mind when managing sensitive information.

-

How does eSigning a cp22a notice with airSlate SignNow improve my workflow?

ESigning a cp22a notice with airSlate SignNow signNowly speeds up your workflow by reducing the time spent on printing, signing, and scanning documents. With a streamlined digital process, you can efficiently manage multiple tax-related documents. This enhanced efficiency allows for better time management and reduces stress when dealing with tax matters.

Get more for Cp 22

Find out other Cp 22

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word