Gst Clearance Certificate Format

What is the GST clearance certificate format?

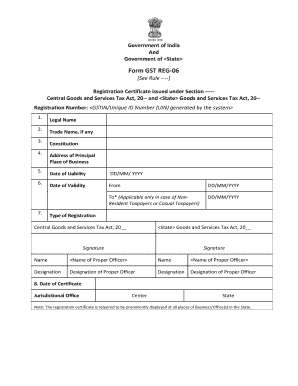

The GST clearance certificate format is a structured document that verifies a taxpayer's compliance with Goods and Services Tax (GST) regulations. This certificate serves as proof that all applicable taxes have been paid, making it essential for businesses to maintain good standing with tax authorities. The format typically includes key information such as the taxpayer's name, GST registration number, details of the tax period, and a declaration of compliance. It is crucial for businesses to understand the specific requirements of this format to ensure it meets legal standards.

How to obtain the GST clearance certificate format

To obtain the GST clearance certificate format, taxpayers can visit the official website of their local tax authority or the GST portal. Most jurisdictions provide downloadable templates or guidelines for completing the certificate. Additionally, businesses may consult with a certified accountant or tax professional to ensure that they are using the correct format and including all necessary information. It is important to verify that the format aligns with state-specific requirements, as these can vary significantly.

Steps to complete the GST clearance certificate format

Completing the GST clearance certificate format involves several key steps:

- Gather necessary information, including your GST registration number and tax payment details.

- Download the appropriate GST clearance certificate template from the official portal.

- Fill in the required fields accurately, ensuring all information is current and correct.

- Review the document for completeness and compliance with legal standards.

- Submit the completed certificate to the relevant tax authority, either online or in person, as specified by local regulations.

Key elements of the GST clearance certificate format

When preparing the GST clearance certificate, several key elements must be included to ensure its validity:

- Taxpayer Information: This includes the name, address, and GST registration number of the taxpayer.

- Tax Period: Clearly indicate the period for which the certificate is being issued.

- Compliance Declaration: A statement confirming that all due taxes have been paid.

- Signature: The certificate must be signed by an authorized representative or the taxpayer.

- Date of Issue: Include the date on which the certificate is issued to maintain accurate records.

Legal use of the GST clearance certificate format

The GST clearance certificate format is legally recognized as proof of compliance with tax obligations. It is often required in various business transactions, such as applying for loans, participating in government tenders, or during audits. To ensure legal validity, it is essential that the certificate is completed accurately and submitted to the appropriate authorities. Failure to provide a valid GST clearance certificate can result in penalties or complications in business operations.

Examples of using the GST clearance certificate format

Businesses may utilize the GST clearance certificate format in several scenarios:

- When bidding for government contracts, where proof of tax compliance is mandatory.

- During financial audits to demonstrate adherence to tax regulations.

- When applying for business loans, as lenders may require evidence of tax compliance.

- For mergers and acquisitions, where a clearance certificate may be necessary to ensure all tax obligations are met.

Quick guide on how to complete gst clearance certificate format

Effortlessly prepare Gst Clearance Certificate Format on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without unnecessary delays. Manage Gst Clearance Certificate Format on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

The simplest way to edit and eSign Gst Clearance Certificate Format with ease

- Obtain Gst Clearance Certificate Format and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Gst Clearance Certificate Format and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst clearance certificate format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GST registration certificate form?

A GST registration certificate form is an essential document that indicates a business is registered under the Goods and Services Tax (GST) system. It's crucial for businesses to have this form to comply with tax laws. The GST registration certificate form validates your legitimacy as a taxpayer and facilitates smooth transactions.

-

How can airSlate SignNow help with the GST registration certificate form?

airSlate SignNow allows you to easily send and eSign the GST registration certificate form, streamlining the process. You can manage document workflows efficiently and ensure that all necessary signatures are collected in a timely manner. This can signNowly reduce delays and enhance compliance.

-

Is there a cost associated with using airSlate SignNow for GST registration certificate form?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. The cost is usually determined by your usage and feature requirements. With affordable options, you can manage GST registration certificate forms without breaking the bank.

-

What features does airSlate SignNow offer for managing GST registration certificate forms?

airSlate SignNow provides features like electronic signatures, document templates, and automated workflows to help with your GST registration certificate form. These tools enhance efficiency and allow for secure document management. You can track the status of your forms in real time, ensuring no steps are missed.

-

Can I integrate airSlate SignNow with other applications for handling GST registration certificate form?

Absolutely! airSlate SignNow offers seamless integrations with various business applications. This means you can easily connect to CRM systems, cloud storage platforms, and more, facilitating a comprehensive approach to managing your GST registration certificate form. Integration helps in streamlining operations and enhancing productivity.

-

What are the benefits of using airSlate SignNow for GST registration certificate forms?

Using airSlate SignNow for your GST registration certificate forms offers numerous benefits, such as increased speed in processing documents and improved compliance through easy eSigning. Additionally, the solution’s user-friendly interface ensures that even non-technical users can navigate it effectively. You also benefit from enhanced security and tracking of all document transactions.

-

Is airSlate SignNow secure for handling important documents like GST registration certificate forms?

Yes, airSlate SignNow is designed with security as a top priority, employing state-of-the-art encryption and compliance with legal regulations. This ensures that your GST registration certificate form and any sensitive information remain protected. You can confidently manage your documents knowing they are secured against unauthorized access.

Get more for Gst Clearance Certificate Format

- Wisconsin forwardhealth form f 11096a

- Employee fun fact sheet form

- Llc membership interest bbill of saleb form

- Key club service verification form

- Adult adoption how to adopt an adult in california forms and instructions to adopt an adult in california courts

- Uk property use the sa105 supplementary pages when filing a tax return for the year ended 5 april if you are an individual or a form

- Raleys cake order form

- Us chamber of commerce 50 state review of job creation form

Find out other Gst Clearance Certificate Format

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors