UK Property Use the SA105 Supplementary Pages When Filing a Tax Return for the Year Ended 5 April If You Are an Individual or a 2023

Understanding the SA105 Supplementary Pages

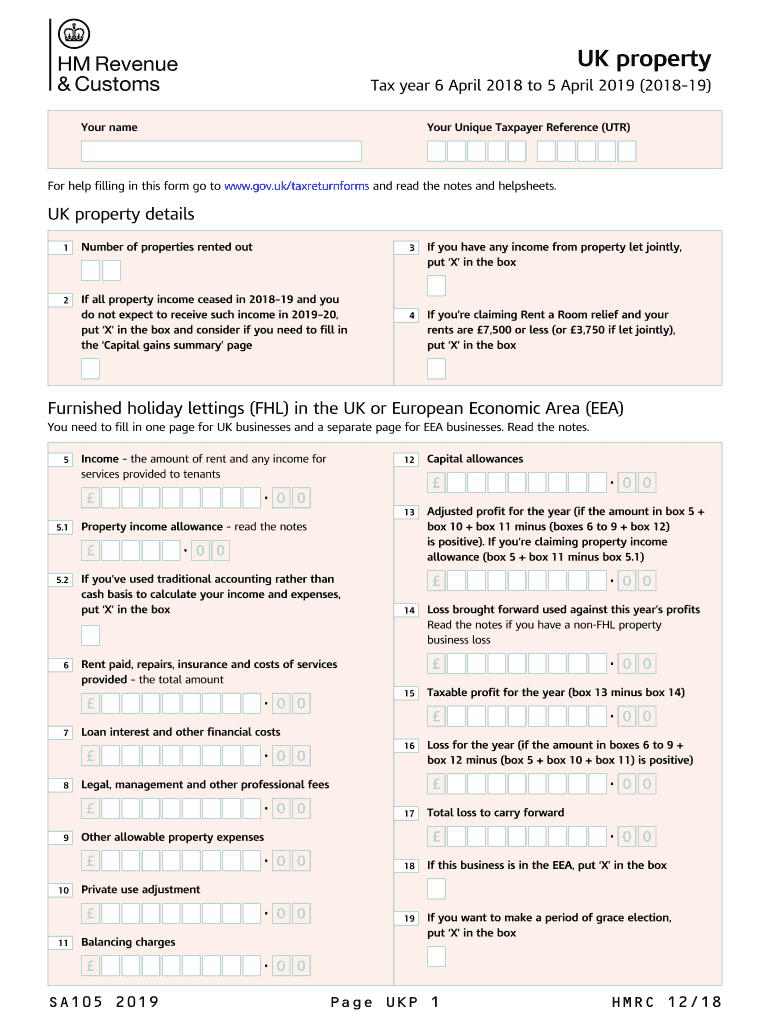

The SA105 Supplementary Pages are essential for individuals or rental businesses in the UK who need to declare income from land and property, including furnished holiday lettings. These pages are part of the Self Assessment tax return process and allow taxpayers to report their rental income, allowable expenses, and any other relevant information. Properly completing the SA105 is crucial for ensuring compliance with UK tax laws and accurately reporting income.

How to Complete the SA105 Supplementary Pages

Completing the SA105 involves several key steps. Taxpayers should begin by gathering all necessary documentation, including rental income records and expense receipts. The form requires detailed information about the property or properties being rented out, including the total income received and any allowable expenses incurred during the tax year. It is important to ensure that all figures are accurate to avoid potential penalties.

Key Elements of the SA105 Supplementary Pages

The SA105 includes several important sections that must be filled out. These sections cover:

- Property details, including address and type of property.

- Total rental income received during the tax year.

- Allowable expenses, such as repairs, maintenance, and management fees.

- Any capital gains or losses if the property was sold during the tax year.

Each section must be completed accurately to ensure compliance with HM Revenue and Customs (HMRC) regulations.

Filing Deadlines for the SA105

It is important to be aware of the filing deadlines associated with the SA105. Typically, the deadline for submitting the Self Assessment tax return, including the SA105, is January 31 following the end of the tax year on April 5. Late submissions may result in penalties, so it is advisable to file as early as possible to avoid complications.

Required Documents for the SA105

To complete the SA105, taxpayers should have the following documents ready:

- Records of rental income received, such as bank statements or invoices.

- Receipts for allowable expenses related to the property.

- Any previous tax returns or correspondence from HMRC.

- Details of any property sales if applicable.

Having these documents organized will facilitate a smoother filing process.

Penalties for Non-Compliance with the SA105

Failing to accurately complete and submit the SA105 can lead to significant penalties. HMRC may impose fines for late submissions, inaccuracies, or failure to declare income. It is crucial for individuals and rental businesses to ensure that all information is reported correctly and on time to avoid these penalties.

Quick guide on how to complete uk property use the sa105 supplementary pages when filing a tax return for the year ended 5 april if you are an individual or a

Complete UK Property Use The SA105 Supplementary Pages When Filing A Tax Return For The Year Ended 5 April If You Are An Individual Or A seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage UK Property Use The SA105 Supplementary Pages When Filing A Tax Return For The Year Ended 5 April If You Are An Individual Or A on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign UK Property Use The SA105 Supplementary Pages When Filing A Tax Return For The Year Ended 5 April If You Are An Individual Or A effortlessly

- Locate UK Property Use The SA105 Supplementary Pages When Filing A Tax Return For The Year Ended 5 April If You Are An Individual Or A and click Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or sharing a link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign UK Property Use The SA105 Supplementary Pages When Filing A Tax Return For The Year Ended 5 April If You Are An Individual Or A while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uk property use the sa105 supplementary pages when filing a tax return for the year ended 5 april if you are an individual or a

Create this form in 5 minutes!

How to create an eSignature for the uk property use the sa105 supplementary pages when filing a tax return for the year ended 5 april if you are an individual or a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA105 Supplementary Pages and why is it important for UK property owners?

The SA105 Supplementary Pages are essential for individuals or rental businesses declaring income from land and property or furnished holiday lettings in the UK. They provide a structured format to report your rental income and expenses accurately. Using the SA105 ensures compliance with HMRC regulations when filing your tax return for the year ended 5 April.

-

How can airSlate SignNow assist with filing the SA105 Supplementary Pages?

airSlate SignNow simplifies the process of preparing and submitting the SA105 Supplementary Pages by allowing you to eSign and send documents securely. Our platform ensures that all necessary forms are completed accurately and efficiently. This helps you stay organized and compliant when declaring income from UK property.

-

What features does airSlate SignNow offer for managing property-related documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage. These tools streamline the management of property-related documents, making it easier to prepare your SA105 Supplementary Pages. This efficiency is crucial for individuals and rental businesses declaring income from land and property in the UK.

-

Is airSlate SignNow cost-effective for small rental businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small rental businesses. Our pricing plans cater to various needs, ensuring that you can access essential features without overspending. This affordability is particularly beneficial for those filing the SA105 Supplementary Pages for the year ended 5 April.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage finances related to UK property. This integration allows for easy transfer of data, which is vital when preparing your SA105 Supplementary Pages and ensuring accurate reporting of rental income.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents offers numerous benefits, including enhanced security, convenience, and speed. You can sign your SA105 Supplementary Pages from anywhere, reducing the time spent on paperwork. This efficiency is especially important for individuals and rental businesses declaring income from land and property in the UK.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. This ensures that your sensitive information, including your SA105 Supplementary Pages, is protected against unauthorized access. Trusting airSlate SignNow means you can focus on your rental business without worrying about document security.

Get more for UK Property Use The SA105 Supplementary Pages When Filing A Tax Return For The Year Ended 5 April If You Are An Individual Or A

- 600s corporation tax return georgia department of revenue form

- Corporation tax return form

- Form it 257 claim of right credit tax year 2021

- Form ct 636 alcoholic beverage production credit tax year

- Partners instructions for form it 204 ip taxnygov

- Form ct 3 general business corporation franchise tax

- Tax year end and fiscal period canadaca form

- Form it 201 att other tax credits and taxes taxnygov

Find out other UK Property Use The SA105 Supplementary Pages When Filing A Tax Return For The Year Ended 5 April If You Are An Individual Or A

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed