Propertytaxrebate Form

What is the Propertytaxrebate Form

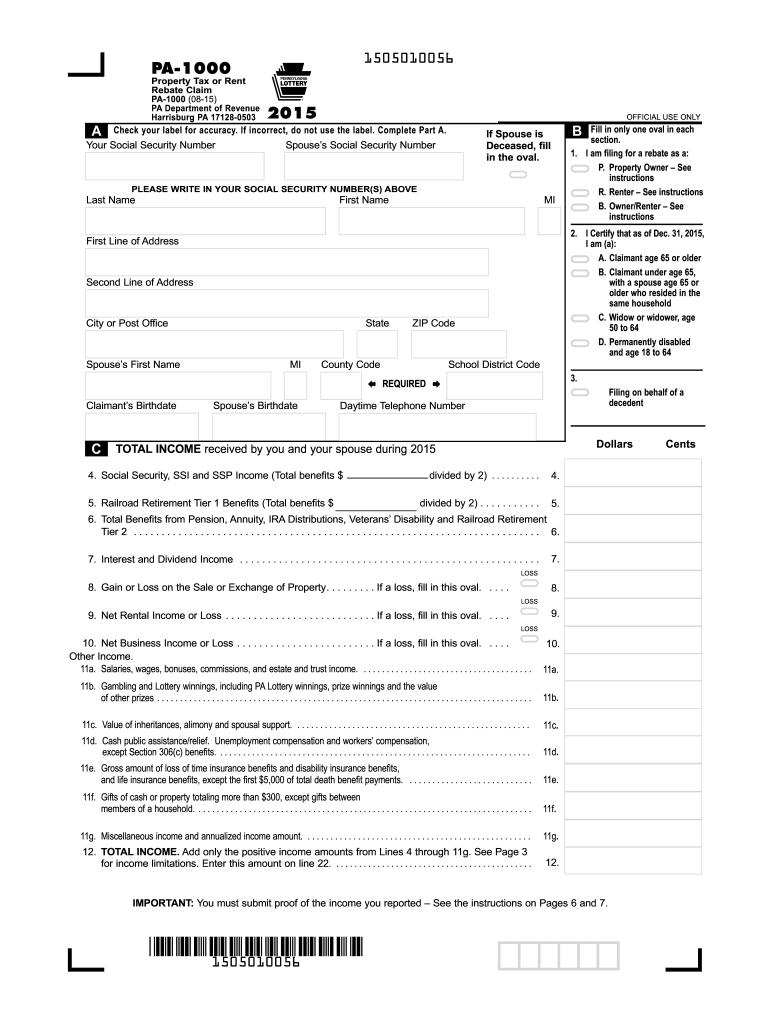

The Propertytaxrebate form is a specific document used by property owners in the United States to apply for tax rebates or reductions on their property taxes. This form is essential for individuals seeking financial relief based on certain eligibility criteria, such as income levels or age. The completion and submission of this form can lead to significant savings, making it a valuable tool for homeowners.

How to use the Propertytaxrebate Form

Using the Propertytaxrebate form involves several straightforward steps. First, ensure that you meet the eligibility criteria set by your state. Next, obtain the form from your local tax authority or download it from their website. Fill out the form accurately, providing all required information, including your property details and personal identification. Finally, submit the completed form according to your local guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Propertytaxrebate Form

Completing the Propertytaxrebate form requires attention to detail. Here are the steps to follow:

- Gather necessary documents, such as proof of income, property deed, and identification.

- Download or request the Propertytaxrebate form from your local tax office.

- Carefully read the instructions provided with the form.

- Fill in your personal information, including your name, address, and property details.

- Provide any additional information required, such as income verification.

- Review the completed form for accuracy before submission.

- Submit the form according to the specified method.

Eligibility Criteria

Eligibility for the Propertytaxrebate form varies by state but typically includes factors such as age, income level, and property ownership status. Many states require applicants to be homeowners and may have specific income thresholds that determine eligibility for rebates. It is important to check your state's guidelines to ensure that you meet all necessary criteria before applying.

Form Submission Methods

The Propertytaxrebate form can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many states allow electronic filing through their tax authority's website.

- Mail: You can print the completed form and send it via postal service to the designated tax office.

- In-Person: Some jurisdictions permit applicants to submit the form directly at local tax offices.

Key elements of the Propertytaxrebate Form

The Propertytaxrebate form includes several key elements that must be completed accurately. These typically consist of:

- Personal Information: Name, address, and contact details of the applicant.

- Property Information: Details about the property for which the rebate is being requested.

- Income Information: Documentation or statements that verify the applicant's income.

- Signature: A declaration that the information provided is true and accurate, often requiring a signature or electronic signature.

Quick guide on how to complete propertytaxrebate form

Effortlessly Prepare Propertytaxrebate Form on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Propertytaxrebate Form on any device using the airSlate SignNow apps available for Android or iOS and simplify your document-related tasks today.

The Easiest Way to Modify and Electronically Sign Propertytaxrebate Form with Ease

- Locate Propertytaxrebate Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Propertytaxrebate Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the propertytaxrebate form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Propertytaxrebate Form?

A Propertytaxrebate Form is a document used by property owners to claim tax rebates on their properties. This form streamlines the process of documenting and submitting your tax rebate requests, helping you save money on property taxes. Using airSlate SignNow, you can easily complete and sign your Propertytaxrebate Form online.

-

How does airSlate SignNow simplify the Propertytaxrebate Form process?

airSlate SignNow simplifies the Propertytaxrebate Form process by providing an intuitive platform for filling out, signing, and sending documents electronically. You can track the status of your Propertytaxrebate Form in real-time, ensuring a smooth and hassle-free experience. Our solution also reduces paper use and enhances security with encrypted communications.

-

Is there a cost associated with using airSlate SignNow for the Propertytaxrebate Form?

Yes, there is a subscription cost for using airSlate SignNow, but we offer various pricing plans to suit different needs. The investment provides you with a cost-effective way to manage your Propertytaxrebate Form and other documents. Additionally, the time and money saved from efficient document management outweigh the subscription costs.

-

Can I integrate airSlate SignNow with other applications for managing the Propertytaxrebate Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, making it easy to manage your Propertytaxrebate Form alongside other business tools. This connectivity enhances your workflow and ensures that all relevant data is organized and accessible in one place. Our extensive API integrations can be customized to fit your business needs.

-

What are the benefits of using airSlate SignNow for my Propertytaxrebate Form?

One major benefit of using airSlate SignNow for your Propertytaxrebate Form is the efficiency it brings to document handling. You can reduce turnaround times signNowly by eliminating the need for printing and mailing physical forms. Furthermore, the platform ensures that your Propertytaxrebate Form is securely stored and easily retrievable whenever needed.

-

Is it safe to sign a Propertytaxrebate Form through airSlate SignNow?

Yes, signing your Propertytaxrebate Form through airSlate SignNow is safe. We prioritize your security with industry-standard encryption and comply with regulations to protect your data. With our audit trails, you can verify all actions taken on your Propertytaxrebate Form, ensuring complete transparency.

-

How do I get started with airSlate SignNow for my Propertytaxrebate Form?

Getting started with airSlate SignNow for your Propertytaxrebate Form is quick and easy. Simply create an account on our website, select a pricing plan, and you can immediately begin creating and signing your Propertytaxrebate Form. Our user-friendly interface and robust support resources will guide you through every step.

Get more for Propertytaxrebate Form

Find out other Propertytaxrebate Form

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form