New Mexico Counter Offer Form 5102

What is the New Mexico Counter Offer Form 5102

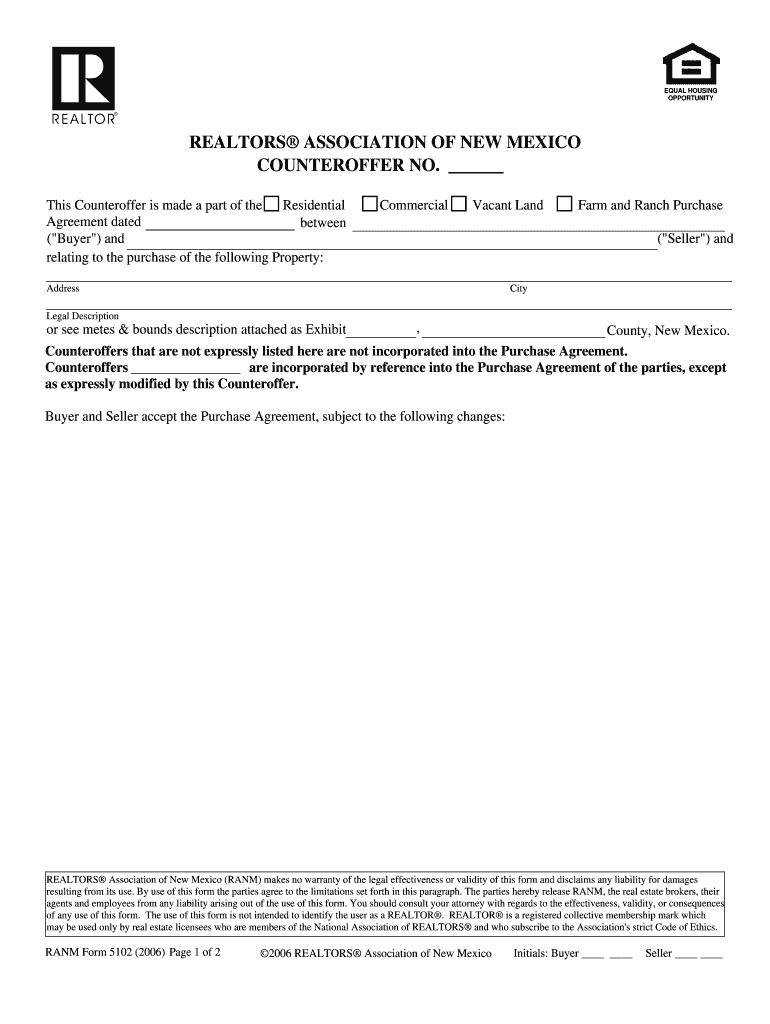

The New Mexico Counter Offer Form 5102 is a legal document used in real estate transactions. It allows a buyer or seller to respond to an initial offer with a modified proposal. This form is essential in negotiations, as it outlines the terms that differ from the original offer, including price adjustments, contingencies, and other conditions. Understanding this form is crucial for anyone involved in real estate dealings in New Mexico, as it helps facilitate clear communication between parties.

How to use the New Mexico Counter Offer Form 5102

Using the New Mexico Counter Offer Form 5102 involves several steps. First, ensure you have the original offer document available for reference. Fill out the form by clearly stating the changes you wish to propose. Be specific about the terms you are altering, such as the sale price or closing date. Once completed, present the counter offer to the other party. They can accept, reject, or make another counter offer. This process continues until both parties reach an agreement or decide to terminate negotiations.

Steps to complete the New Mexico Counter Offer Form 5102

Completing the New Mexico Counter Offer Form 5102 requires careful attention to detail. Follow these steps:

- Review the original offer to understand its terms.

- Clearly state your name and the other party's name at the top of the form.

- Indicate the changes you wish to propose, ensuring clarity and specificity.

- Include any necessary contingencies or conditions that apply to your counter offer.

- Sign and date the form to validate your proposal.

Once completed, deliver the form to the other party promptly to keep negotiations moving forward.

Key elements of the New Mexico Counter Offer Form 5102

The New Mexico Counter Offer Form 5102 contains several key elements that are crucial for its validity and effectiveness. These include:

- Identification of Parties: Names and contact information of both the buyer and seller.

- Original Offer Reference: A clear reference to the initial offer being countered.

- Proposed Changes: Detailed descriptions of the terms being modified.

- Contingencies: Any conditions that must be met for the counter offer to be accepted.

- Signatures: Signatures of both parties to confirm agreement to the proposed terms.

Legal use of the New Mexico Counter Offer Form 5102

The legal use of the New Mexico Counter Offer Form 5102 is essential for ensuring that negotiations are documented and enforceable. This form serves as a written record of the proposed changes to the original offer, which can be critical in case of disputes. It is important to ensure that all terms are clearly stated and agreed upon by both parties. Legal validity is maintained when the form is properly filled out, signed, and delivered in a timely manner.

Filing Deadlines / Important Dates

While the New Mexico Counter Offer Form 5102 does not have specific filing deadlines, it is important to act promptly in negotiations. Delays can lead to missed opportunities or changes in market conditions. Therefore, once the counter offer is prepared, it should be presented to the other party as soon as possible to facilitate a timely response. Keeping track of important dates related to the overall transaction, such as closing dates and inspection periods, is also crucial.

Quick guide on how to complete new mexico counter offer form 5102

Prepare New Mexico Counter Offer Form 5102 effortlessly on any device

Managing documents online has gained signNow traction among organizations and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage New Mexico Counter Offer Form 5102 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign New Mexico Counter Offer Form 5102 with ease

- Locate New Mexico Counter Offer Form 5102 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal authority as a traditional wet ink signature.

- Review all your details and press the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign New Mexico Counter Offer Form 5102 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new mexico counter offer form 5102

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to IRS Form 5102 instructions?

airSlate SignNow offers a user-friendly platform that simplifies executing IRS Form 5102 instructions. With features like customizable templates, automatic reminders, and secure eSigning, users can efficiently manage their documentation process without hassle.

-

How can airSlate SignNow help streamline the completion of IRS Form 5102?

By utilizing airSlate SignNow, users can easily access IRS Form 5102 instructions directly within the platform. This ensures that you have all the necessary guidance to complete the form accurately, reducing the risk of errors and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5102 instructions?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs. Each plan offers unique features that can help you effectively manage IRS Form 5102 instructions while staying within your budget.

-

Does airSlate SignNow offer integrations with other software for IRS Form 5102 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow. Whether you use CRM systems, document management tools, or cloud storage, you can incorporate IRS Form 5102 instructions into your existing processes.

-

What benefits does airSlate SignNow provide for managing IRS Form 5102 instructions?

AirSlate SignNow offers signNow benefits, including increased efficiency and reduced turnaround times. By automating the signing process for IRS Form 5102 instructions, users can focus on their core business activities while ensuring the documentation is handled promptly.

-

Can I customize IRS Form 5102 instructions within airSlate SignNow?

Yes, airSlate SignNow allows for customization, enabling you to modify IRS Form 5102 instructions to fit your specific needs. You can add logos, adjust text fields, and tailor the document to ensure it meets your requirements seamlessly.

-

What support does airSlate SignNow offer for users handling IRS Form 5102 instructions?

airSlate SignNow provides extensive customer support, including tutorials, guides, and direct assistance for users navigating IRS Form 5102 instructions. Our team is dedicated to ensuring you have the resources you need to succeed.

Get more for New Mexico Counter Offer Form 5102

- Declaration of interest statement example 41087211 form

- Disability application form

- Example of filled psc form

- Xxn abbreviation list form

- School physical form 13360716

- Online clinical competency checklist mls 1123 principles of hematology and hemostasis student wildcat id course instructor form

- Sap appeal form

- Intercompany transfer agreement template form

Find out other New Mexico Counter Offer Form 5102

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors