Dept of Revenue Ct Form 115a

What is the Dept Of Revenue Ct Form 115a

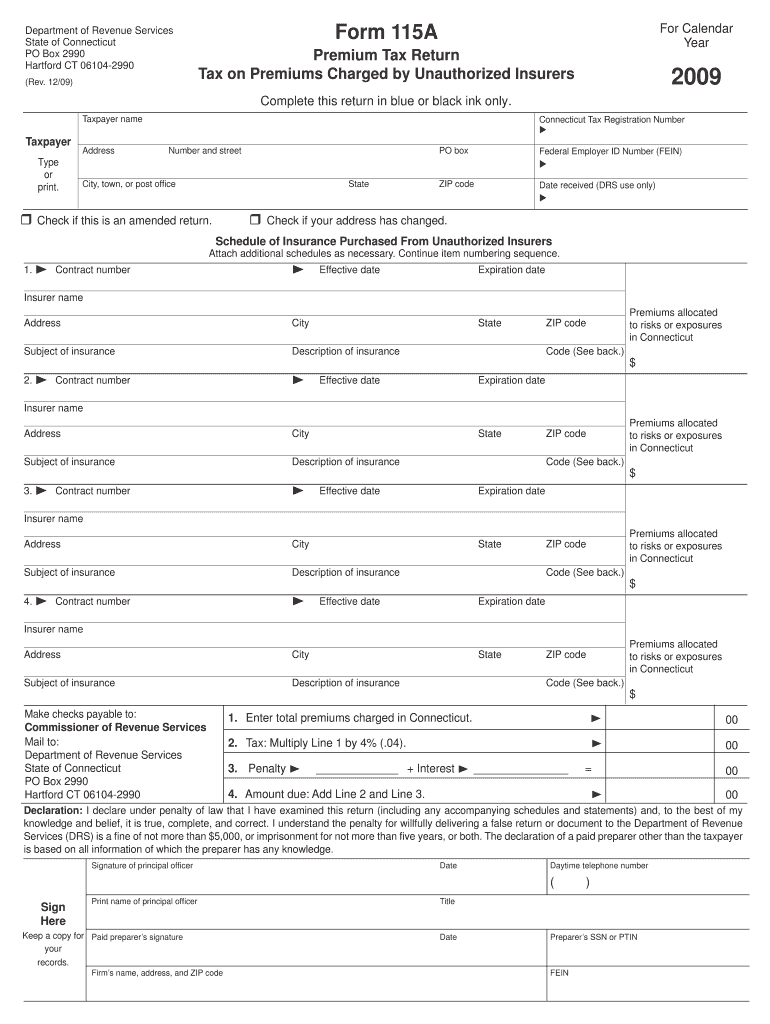

The Dept of Revenue CT Form 115a is a critical document used in Connecticut for various tax-related purposes. It serves as a declaration for business entities to report their income and expenses accurately. This form is essential for ensuring compliance with state tax regulations and helps the Department of Revenue collect necessary data for tax assessments and audits. Understanding the purpose of Form 115a is vital for any business operating in Connecticut.

Steps to complete the Dept Of Revenue Ct Form 115a

Completing the Dept of Revenue CT Form 115a requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and expense receipts.

- Fill out the identification section with your business name, address, and tax identification number.

- Report your total income for the year, ensuring accuracy to avoid discrepancies.

- List all deductible expenses, providing detailed descriptions and amounts.

- Calculate your taxable income by subtracting total expenses from total income.

- Review the form for completeness and accuracy before submission.

How to obtain the Dept Of Revenue Ct Form 115a

The Dept of Revenue CT Form 115a can be obtained through several methods. The most convenient way is to visit the official website of the Connecticut Department of Revenue Services. Here, you can download the form directly in PDF format. Alternatively, you may request a physical copy by contacting the department via phone or visiting their office in person. Ensuring you have the correct version of the form is crucial for compliance.

Legal use of the Dept Of Revenue Ct Form 115a

The legal use of the Dept of Revenue CT Form 115a hinges on its proper completion and submission. This form must be filled out truthfully and accurately, as any false information can lead to penalties or legal repercussions. It is essential to maintain records of the submitted form and any supporting documents for future reference or audits. Compliance with state laws regarding tax reporting is mandatory for all business entities.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Dept of Revenue CT Form 115a can be done through various methods to accommodate different preferences. Businesses have the option to file the form online via the Connecticut Department of Revenue Services website, which is often the fastest method. Alternatively, the form can be mailed to the designated address provided on the form instructions. For those who prefer a more personal approach, in-person submission at a local Department of Revenue office is also available. Each method has its own processing times and requirements.

Key elements of the Dept Of Revenue Ct Form 115a

Understanding the key elements of the Dept of Revenue CT Form 115a is essential for accurate completion. The form typically includes sections for business identification, income reporting, expense deductions, and tax calculations. Each section must be filled out with precise figures and relevant details to ensure compliance with state tax laws. Additionally, the form may require signatures from authorized representatives to validate the information provided.

Quick guide on how to complete 2010 dept of revenue ct form 115a

Complete Dept Of Revenue Ct Form 115a effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Handle Dept Of Revenue Ct Form 115a on any device using airSlate SignNow's Android or iOS applications and simplify any document-based workflow today.

How to edit and eSign Dept Of Revenue Ct Form 115a with ease

- Find Dept Of Revenue Ct Form 115a and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Dept Of Revenue Ct Form 115a and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

Create this form in 5 minutes!

How to create an eSignature for the 2010 dept of revenue ct form 115a

How to make an eSignature for the 2010 Dept Of Revenue Ct Form 115a online

How to create an electronic signature for the 2010 Dept Of Revenue Ct Form 115a in Google Chrome

How to generate an electronic signature for signing the 2010 Dept Of Revenue Ct Form 115a in Gmail

How to create an electronic signature for the 2010 Dept Of Revenue Ct Form 115a right from your mobile device

How to generate an eSignature for the 2010 Dept Of Revenue Ct Form 115a on iOS

How to make an eSignature for the 2010 Dept Of Revenue Ct Form 115a on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to the CT Dept of Revenue?

airSlate SignNow is a digital signature and document management platform that simplifies the process of eSigning documents. For businesses interacting with the CT Dept of Revenue, using airSlate SignNow can enhance efficiency by streamlining document workflows and ensuring compliance with state regulations.

-

How does airSlate SignNow ensure compliance with CT Dept of Revenue regulations?

airSlate SignNow adheres to industry standards and legal requirements, making it an ideal choice for businesses working with the CT Dept of Revenue. The platform provides features such as secure storage, audit trails, and robust encryption, which help maintain compliance and protect sensitive information.

-

What are the pricing plans for airSlate SignNow for businesses dealing with the CT Dept of Revenue?

airSlate SignNow offers several pricing plans tailored to fit different business needs, including those interacting with the CT Dept of Revenue. These plans are designed to be cost-effective, allowing businesses to select a package that provides the features they need without excess costs.

-

What features does airSlate SignNow offer that are beneficial for handling documents for the CT Dept of Revenue?

Key features of airSlate SignNow that benefit users working with the CT Dept of Revenue include bulk sending, document templates, and seamless eSignature integration. These functionalities enable quick and efficient document processing, vital for timely communication with the department.

-

Can airSlate SignNow integrate with other software used for CT Dept of Revenue interactions?

Yes, airSlate SignNow can integrate with a variety of software solutions that businesses may already be using for interactions with the CT Dept of Revenue. This includes popular CRM and productivity tools, ensuring a smooth and connected workflow.

-

How secure is airSlate SignNow when submitting documents to the CT Dept of Revenue?

Security is a top priority for airSlate SignNow, especially when dealing with documents submitted to the CT Dept of Revenue. The platform employs advanced security measures, including encryption and secure access controls, to safeguard all sensitive data.

-

Can I use airSlate SignNow for tax-related documents for the CT Dept of Revenue?

Absolutely! airSlate SignNow is a reliable solution for managing tax-related documents intended for the CT Dept of Revenue. Its user-friendly interface makes it easy to prepare, send, and obtain signatures on essential tax forms.

Get more for Dept Of Revenue Ct Form 115a

- Lincoln vulcv lincoln financial group form

- Chicago title north carolina form

- Litter application form american dog breeders association

- Excavator training ppt form

- Oshacampuscom form

- Objection huron county probate and juvenile court form

- Aflac cancellation notice m0784 form

- Amway new joining application form

Find out other Dept Of Revenue Ct Form 115a

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation