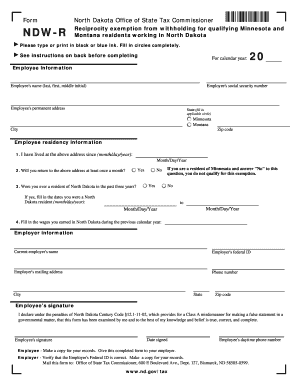

Ndw R Form

What is the Ndw R?

The Ndw R, also known as the North Dakota reciprocity form, is a crucial document for individuals seeking to establish residency and claim benefits in North Dakota. This form is particularly relevant for those who have moved from another state and wish to ensure that their previous residency is acknowledged for tax purposes. It simplifies the process of recognizing out-of-state credentials and facilitates smoother transitions for new residents.

How to use the Ndw R

Using the Ndw R involves a straightforward process that requires the completion of specific sections relevant to your residency status. Individuals must provide accurate personal information, including their previous state of residency and the duration of their stay in North Dakota. Once filled out, the form should be submitted to the appropriate state authority to ensure compliance with local regulations.

Steps to complete the Ndw R

Completing the Ndw R involves several key steps:

- Gather necessary personal information, including identification and residency details.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the designated state agency, either online or by mail.

Legal use of the Ndw R

The legal use of the Ndw R is governed by state regulations that outline its validity in establishing residency. The form must be filled out correctly and submitted to the appropriate authorities to be considered legally binding. Compliance with these regulations is essential to ensure that the residency claims are recognized by the state.

Eligibility Criteria

To be eligible to use the Ndw R, individuals must meet specific criteria, including:

- Proof of residency in North Dakota.

- Demonstration of prior residency in another state.

- Compliance with state tax regulations.

Required Documents

When completing the Ndw R, applicants must provide several supporting documents to verify their residency status. These may include:

- Identification documents, such as a driver's license or state ID.

- Proof of previous residency, such as utility bills or lease agreements.

- Any additional documentation requested by the state agency.

Quick guide on how to complete ndw r 130771

Effortlessly Prepare Ndw R on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Ndw R on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Ndw R with Ease

- Obtain Ndw R and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form: by email, SMS, or invite link, or download it to your computer.

Forget about missing or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ndw R and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ndw r 130771

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow's ndw r services?

The pricing for airSlate SignNow's ndw r services is competitive and varies based on the plan chosen. We offer a free trial to help you explore our features. Our plans are designed to cater to businesses of all sizes, ensuring that you find an option that fits your budget.

-

What features does airSlate SignNow offer with its ndw r solution?

airSlate SignNow provides a comprehensive suite of features for ndw r, including customized templates, unlimited document sending, and real-time collaboration. Our platform also supports advanced signing options and robust security measures. This ensures that your documents are both effective and secure.

-

How does airSlate SignNow improve the eSigning process for ndw r?

With airSlate SignNow, the eSigning process for ndw r is streamlined and user-friendly. Our platform allows you to send documents for signature instantly and track their status in real-time. This simplifies workflows and signNowly reduces the time spent on document management.

-

Can I integrate airSlate SignNow with other software for ndw r?

Yes, airSlate SignNow offers robust integration capabilities for ndw r, allowing you to connect with various third-party applications. Our solution easily integrates with tools like Google Drive, Salesforce, and many others. This enhances your document workflow and ensures compatibility with your existing systems.

-

What benefits does airSlate SignNow provide for businesses using ndw r?

Businesses using airSlate SignNow for ndw r enjoy improved efficiency and reduced operational costs. Our platform allows for faster document turnaround and minimizes paper usage, benefiting both your team and the environment. Additionally, our advanced analytics help track document performance.

-

Is there customer support available for users of airSlate SignNow's ndw r?

Absolutely! airSlate SignNow offers dedicated customer support for users of our ndw r services. Whether you have questions about setup or need assistance with features, our support team is available via chat, email, and phone to provide prompt assistance.

-

What security measures are in place for airSlate SignNow's ndw r service?

Security is a top priority for airSlate SignNow's ndw r service. We implement industry-standard encryption protocols to protect your documents and user data. Additionally, we comply with various regulations such as GDPR and HIPAA to ensure your information remains secure.

Get more for Ndw R

- Waiver and release upon final payment georgia form

- Vfs oman form

- A day in the navy navyleague councils support form

- U s dod form dod af af 4321 download u s dod form dod af af 4321

- Hernando county boat ramp pass 625719250 form

- Tc 20mc utah tax return for misc corporations form

- Ri 1040nr schedule ii form

- Line producer agreement template form

Find out other Ndw R

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online