Indiana W4 Printable Form

What is the Indiana W4 Printable

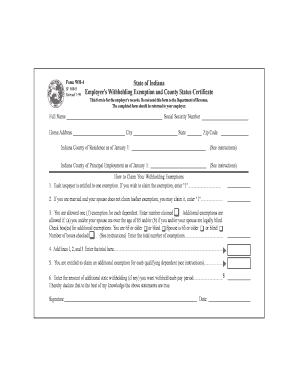

The Indiana W4 form, also known as the Indiana state withholding form, is a crucial document for employees in Indiana. This form allows individuals to specify the amount of state income tax to be withheld from their paychecks. The Indiana W4 form is essential for ensuring that the correct amount of taxes is deducted, helping to avoid underpayment or overpayment of state taxes throughout the year. Completing this form accurately is vital for both employees and employers to maintain compliance with state tax regulations.

How to obtain the Indiana W4 Printable

Obtaining the Indiana W4 form is straightforward. Individuals can download the Indiana W4 PDF directly from the Indiana Department of Revenue's official website. Additionally, many employers provide the form to new employees during the onboarding process. It is important to ensure that you are using the correct version of the form for the applicable tax year, as forms can change from year to year.

Steps to complete the Indiana W4 Printable

Completing the Indiana W4 form involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Provide the number of allowances you are claiming. This number affects the amount of state tax withheld from your paycheck.

- If applicable, you can also specify additional withholding amounts.

- Finally, sign and date the form to validate it.

Legal use of the Indiana W4 Printable

The Indiana W4 form is legally binding when filled out correctly and submitted to your employer. It is important to ensure that the information provided is accurate and reflects your current tax situation. Misrepresentation or failure to submit the form can lead to penalties, including under-withholding of taxes, which may result in a tax bill at the end of the year. Employers are required to keep the form on file for their records and to ensure compliance with state tax laws.

Key elements of the Indiana W4 Printable

Several key elements are essential to the Indiana W4 form, including:

- Personal Information: Your name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects withholding amounts.

- Additional Withholding: An option for those who wish to have extra tax withheld.

- Signature: A signature is required to validate the form.

Form Submission Methods

Once the Indiana W4 form is completed, it must be submitted to your employer. This can typically be done in several ways:

- In-Person: Handing the completed form directly to your employer's HR or payroll department.

- By Mail: Sending the form through postal service if your employer allows for mailed submissions.

- Electronically: Some employers may accept electronic submissions via email or through an employee portal.

Quick guide on how to complete indiana w4 printable

Complete Indiana W4 Printable effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, modify, and eSign your documents quickly without any delays. Manage Indiana W4 Printable on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Indiana W4 Printable without any hassle

- Locate Indiana W4 Printable and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you'd like to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Alter and eSign Indiana W4 Printable and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana w4 printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana W4 form 2019?

The Indiana W4 form 2019 is a state tax withholding form used by employers to determine the amount of state income tax to withhold from an employee's paycheck. It is essential for proper tax compliance in Indiana and ensures that employees have the correct amount withheld based on their personal situation. If you're an employee or employer in Indiana, understanding this form is critical for accurate tax reporting.

-

How can airSlate SignNow help with the Indiana W4 form 2019?

With airSlate SignNow, you can easily create, sign, and manage your Indiana W4 form 2019 and other important documents digitally. Our platform streamlines the process, allowing for quick fill-outs and electronic signatures, which saves time and enhances accuracy. Plus, you can securely share the completed forms with your HR department.

-

Is there a cost associated with using airSlate SignNow for the Indiana W4 form 2019?

airSlate SignNow offers a cost-effective solution for managing the Indiana W4 form 2019. Pricing may vary based on the subscription plan you choose, but we provide options that cater to both individuals and businesses. Our plans are designed to offer great value for the range of features we provide.

-

Can I integrate airSlate SignNow with other apps for handling the Indiana W4 form 2019?

Yes, airSlate SignNow integrates seamlessly with various applications and software, making it easier to manage the Indiana W4 form 2019 alongside your other business tools. This integration capability enhances workflow efficiency and ensures that all your documents are in sync across platforms. Check out our integrations to see which tools might benefit your processes.

-

What are the benefits of using airSlate SignNow for the Indiana W4 form 2019?

Using airSlate SignNow for the Indiana W4 form 2019 provides numerous benefits, including faster turnaround times for document signing and easier tracking of submission statuses. The platform ensures compliance with state regulations while providing a user-friendly interface that requires no technical expertise. You'll appreciate the convenience and security we offer for document handling.

-

Can I save my completed Indiana W4 form 2019 with airSlate SignNow?

Absolutely! airSlate SignNow allows you to save your completed Indiana W4 form 2019 and access it anytime, anywhere. All your signed documents are securely stored in the cloud, giving you peace of mind that you can retrieve them whenever necessary. This feature is particularly helpful for record-keeping and tax filing purposes.

-

Is it easy to fill out the Indiana W4 form 2019 using airSlate SignNow?

Yes, filling out the Indiana W4 form 2019 using airSlate SignNow is a straightforward process. Our intuitive interface guides you through each step, ensuring that you can complete the form quickly and accurately. With features like pre-filled information and easy navigation, you'll find it efficient to handle your tax withholding details.

Get more for Indiana W4 Printable

- Dodea gpc 8052 form

- Figna id card form

- T5018 fillable form

- Tax computation format malaysia

- Ccg 0106 6 25 09 d r a f t pmd uscourtforms

- Ptn psychology teacher network american psychological association apa form

- Eintragungen mglichkeit im einvernehmen mit der dienstgeberseite eine form

- Monthly payment plan agreement template form

Find out other Indiana W4 Printable

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement