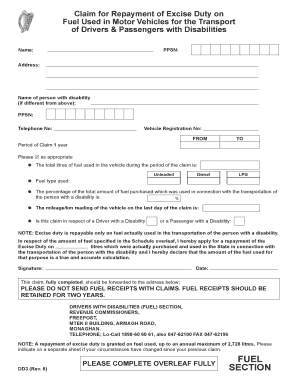

Form Dd3

What is the Form DD3?

The DD3 form from the IRS is a specific document used primarily for tax purposes. It serves as a declaration of certain tax-related information, which may include income details, deductions, and credits. This form is essential for taxpayers to accurately report their financial situation to the IRS and ensure compliance with federal tax laws. Understanding its purpose is crucial for anyone looking to navigate the complexities of tax filing.

How to Use the Form DD3

Using the DD3 form involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow IRS guidelines closely to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted electronically or by mail, depending on your preference and the specific requirements set by the IRS.

Steps to Complete the Form DD3

Completing the DD3 form requires a systematic approach:

- Gather all relevant financial documents.

- Carefully read the instructions provided with the form.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, dividends, and other sources.

- List any deductions or credits you are eligible for.

- Review the completed form for accuracy.

- Submit the form by the designated deadline.

Legal Use of the Form DD3

The DD3 form is legally binding when filled out correctly and submitted in accordance with IRS regulations. It is essential that all information provided is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. By using a reliable platform for electronic signatures, taxpayers can ensure that their submissions are secure and compliant with eSignature laws, enhancing the form's legal validity.

IRS Guidelines

The IRS provides specific guidelines for the use of the DD3 form. These guidelines include instructions on how to fill out the form, deadlines for submission, and the types of information required. Familiarizing yourself with these guidelines is crucial for ensuring that your tax filing is accurate and timely. The IRS website offers comprehensive resources to assist taxpayers in understanding their obligations and the proper use of the form.

Form Submission Methods

The DD3 form can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Electronic submission through IRS-approved e-filing systems.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Each method has its own set of guidelines and deadlines, so it is important to choose the one that best fits your needs.

Quick guide on how to complete form dd3

Effortlessly prepare Form Dd3 on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form Dd3 across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign Form Dd3 with ease

- Obtain Form Dd3 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form Dd3 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form dd3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dd3 form from the IRS?

The dd3 form from the IRS is a document used for reporting various tax-related information. It is essential for businesses to ensure compliance with tax regulations. Understanding the dd3 form from the IRS helps streamline financial processes and maintain accurate records.

-

How can airSlate SignNow help me with the dd3 form from the IRS?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the dd3 form from the IRS. Our solution ensures secure and compliant handling of sensitive information. With customizable templates and workflows, managing your dd3 form from the IRS becomes a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the dd3 form from the IRS?

Yes, airSlate SignNow offers various pricing plans based on your business needs. Each plan includes features that facilitate the eSigning and management of documents, including the dd3 form from the IRS. You can choose a plan that suits your budget while getting the best value for your eSigning needs.

-

Can I integrate airSlate SignNow with other software for the dd3 form from the IRS?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, making it easier to manage the dd3 form from the IRS alongside your other workflows. Popular integrations include Google Drive, Salesforce, and many more, ensuring that your documents are always within signNow.

-

What are the benefits of using airSlate SignNow for the dd3 form from the IRS?

Using airSlate SignNow for the dd3 form from the IRS offers several benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform allows for quick turnaround times on document signing, ensuring you meet your deadlines without hassle. Plus, digital records simplify audit processes and compliance adherence.

-

Is it safe to use airSlate SignNow for handling the dd3 form from the IRS?

Yes, airSlate SignNow employs industry-standard encryption and security measures to protect your data, including the dd3 form from the IRS. With our stringent compliance with data protection regulations, you can confidently manage your sensitive documents without fear of bsignNowes. Security is our top priority.

-

How quickly can I complete the dd3 form from the IRS using airSlate SignNow?

The time to complete the dd3 form from the IRS using airSlate SignNow can be signNowly reduced compared to traditional methods. Our platform allows for instant eSigning and quick access to completed forms. This rapid processing can help keep your financial tasks on track and within deadlines.

Get more for Form Dd3

Find out other Form Dd3

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free