Form ST 120 1711,Contractor Exempt Purchase CertificateST1201

What is the Form ST 120 1?

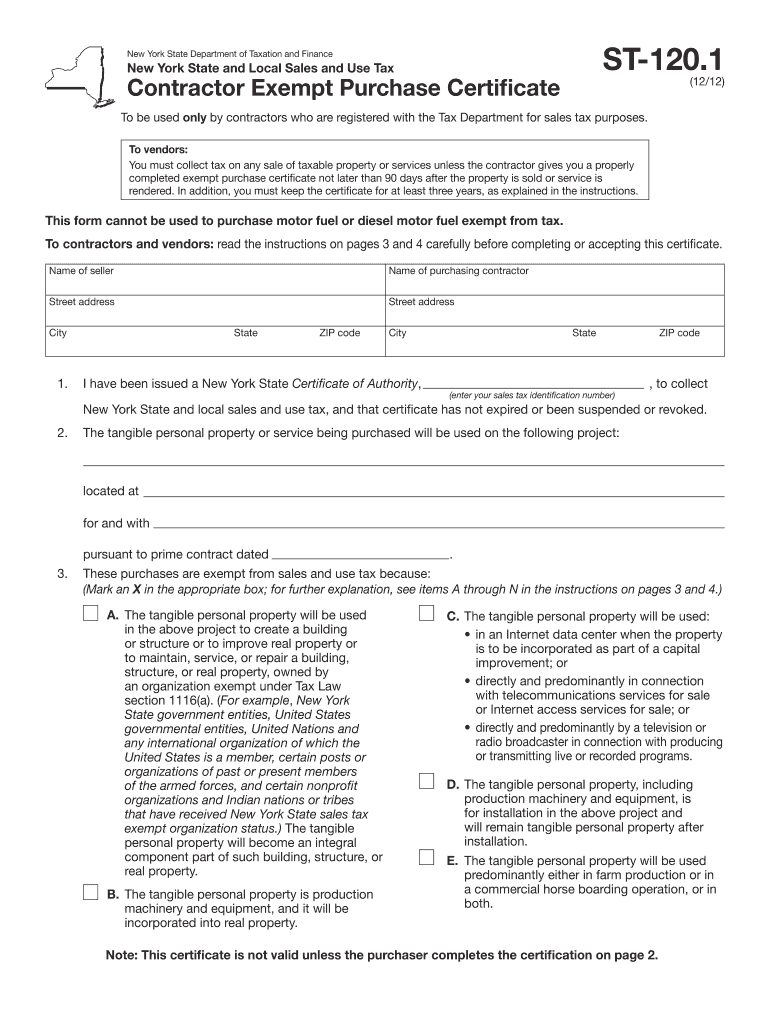

The Form ST 120 1 is a tax exempt form used in New York State, formally known as the Contractor Exempt Purchase Certificate. This document allows eligible contractors to make tax-exempt purchases of materials and supplies that will be incorporated into real property. By using this form, businesses can avoid paying sales tax on items that are essential for their operations, provided they meet the necessary criteria established by the state.

Steps to Complete the Form ST 120 1

Completing the Form ST 120 1 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the contractor's name, address, and tax identification number. Next, clearly indicate the purpose of the purchase and the specific materials being acquired. It is crucial to provide the seller's information as well. After filling out the form, both the buyer and seller should sign it to validate the transaction. Retain a copy for your records, as this may be required for future reference or audits.

Legal Use of the Form ST 120 1

The legal use of the Form ST 120 1 is governed by New York State tax laws. To be valid, the form must be completed accurately and used for qualifying purchases. Misuse of the form, such as using it for personal items or non-qualifying goods, can lead to penalties. It is essential for contractors to understand the legal implications of using this tax-exempt certificate and to ensure that all purchases comply with state regulations.

State-Specific Rules for the Form ST 120 1

New York State has specific rules regarding the use of the Form ST 120 1. Contractors must be registered with the state and possess a valid tax identification number to utilize this form. Additionally, the items purchased must be directly related to the contractor's work and intended for incorporation into real property. Familiarity with these rules is vital to avoid potential legal issues and ensure that tax exemptions are applied correctly.

Examples of Using the Form ST 120 1

There are various scenarios in which the Form ST 120 1 can be utilized effectively. For instance, a construction company may use this form to purchase lumber, concrete, or roofing materials without incurring sales tax. Similarly, an electrical contractor might use it for wiring and fixtures that will be installed in a new building. Each example highlights the importance of the form in facilitating cost savings for contractors engaged in projects that require significant material investments.

Eligibility Criteria for the Form ST 120 1

To be eligible to use the Form ST 120 1, contractors must meet specific criteria set forth by New York State. They must be registered as a business entity and possess a valid tax identification number. Furthermore, the purchases made using this form must be for items that will be incorporated into real property as part of a construction project. Understanding these eligibility requirements is essential to ensure compliance and avoid any issues during audits.

Quick guide on how to complete form st 1201711contractor exempt purchase certificatest1201

Effortlessly prepare Form ST 120 1711,Contractor Exempt Purchase CertificateST1201 on any device

Managing documents online has become increasingly popular with both businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents since you can easily locate the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form ST 120 1711,Contractor Exempt Purchase CertificateST1201 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Steps to modify and eSign Form ST 120 1711,Contractor Exempt Purchase CertificateST1201 with ease

- Locate Form ST 120 1711,Contractor Exempt Purchase CertificateST1201 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Form ST 120 1711,Contractor Exempt Purchase CertificateST1201 and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 1201711contractor exempt purchase certificatest1201

How to create an eSignature for the Form St 1201711contractor Exempt Purchase Certificatest1201 online

How to create an electronic signature for your Form St 1201711contractor Exempt Purchase Certificatest1201 in Google Chrome

How to make an electronic signature for signing the Form St 1201711contractor Exempt Purchase Certificatest1201 in Gmail

How to create an electronic signature for the Form St 1201711contractor Exempt Purchase Certificatest1201 right from your smart phone

How to generate an eSignature for the Form St 1201711contractor Exempt Purchase Certificatest1201 on iOS

How to generate an electronic signature for the Form St 1201711contractor Exempt Purchase Certificatest1201 on Android OS

People also ask

-

What is the st120 1 and how does it work?

The st120 1 is a powerful eSignature solution offered by airSlate SignNow that allows businesses to send and sign documents electronically. With this user-friendly tool, you can streamline your document workflows and ensure secure signing, making it easier for teams to collaborate and finalize agreements.

-

What features are included with the st120 1 plan?

The st120 1 plan includes essential features such as customizable templates, multi-party signing, and real-time tracking of document status. Additionally, users can benefit from advanced security measures to ensure that sensitive information is protected throughout the signing process.

-

How much does the st120 1 plan cost?

The pricing for the st120 1 plan is competitive and designed to fit various business needs. Customers can choose from different subscription tiers that provide flexibility depending on the volume of documents and the number of users, ensuring they only pay for what they need.

-

Can I integrate the st120 1 with other applications?

Yes, the st120 1 seamlessly integrates with popular applications such as Google Drive, Dropbox, and CRM systems like Salesforce. These integrations enhance productivity by allowing users to manage documents more efficiently without disrupting their existing workflows.

-

What are the benefits of using st120 1 for my business?

Using st120 1 can signNowly improve your business's efficiency by reducing the turnaround time for document approvals. The solution enables quick access to signed documents, minimizes paper use, and enhances compliance with digital signature laws, giving your business a modern edge.

-

Is the st120 1 solution secure and compliant?

Absolutely! The st120 1 solution is built with robust security features, including encryption and secure authentication processes. It also complies with international eSignature laws, ensuring that your documents are legally binding and safe from tampering.

-

How can my team benefit from using st120 1?

Your team can benefit from the st120 1 by simplifying the signing process, which allows for faster decision-making and improved collaboration. With its easy-to-navigate interface, users can manage and route documents efficiently, leading to enhanced productivity across the board.

Get more for Form ST 120 1711,Contractor Exempt Purchase CertificateST1201

Find out other Form ST 120 1711,Contractor Exempt Purchase CertificateST1201

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF