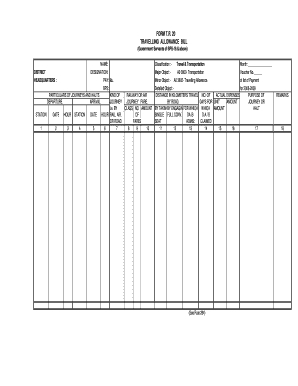

Tr 20 Form

What is the TR-20 Form

The TR-20 form is a crucial document used in specific tax-related contexts within the United States. It serves as a declaration of certain financial details, often required by state tax authorities. Understanding the purpose of the TR-20 form is essential for accurate tax reporting and compliance. This form typically gathers information about income, deductions, and other financial data necessary for tax calculations.

How to Use the TR-20 Form

Using the TR-20 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form carefully, making sure to provide accurate figures and complete all sections. Once completed, review the form for any errors before submitting it to the appropriate tax authority. Depending on your situation, you may need to attach additional documentation to support your claims.

Steps to Complete the TR-20 Form

Completing the TR-20 form requires attention to detail. Follow these steps for a smooth process:

- Gather required documents, including W-2s, 1099s, and receipts.

- Begin filling out the form by entering your personal information, such as name and address.

- Input your income details, ensuring accuracy in figures.

- List any deductions you are eligible for, providing necessary documentation.

- Review the entire form for completeness and accuracy.

- Submit the form electronically or via mail, following the specific guidelines provided by the tax authority.

Legal Use of the TR-20 Form

The TR-20 form is legally binding when filled out correctly and submitted to the relevant tax authority. It must comply with federal and state regulations regarding tax reporting. Ensuring that all information is accurate and complete will help avoid any legal issues or penalties associated with incorrect filings. It is advisable to keep copies of the submitted form and any supporting documents for your records.

Filing Deadlines / Important Dates

Filing deadlines for the TR-20 form can vary based on individual circumstances and state regulations. Generally, it is important to submit the form by the tax deadline to avoid penalties. Taxpayers should be aware of any specific dates that apply to their situation, such as extensions or special circumstances that may affect their filing timeline. Keeping a calendar of important tax dates can help ensure timely submissions.

Form Submission Methods

The TR-20 form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a physical copy of the form to the appropriate address.

- In-person submission at designated tax offices or locations.

Choosing the right submission method can streamline the filing process and ensure that the form is received in a timely manner.

Quick guide on how to complete tr 20 form

Easily Prepare Tr 20 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can access the right form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tr 20 Form on any platform with the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to Modify and Electronically Sign Tr 20 Form Effortlessly

- Find Tr 20 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form—by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and electronically sign Tr 20 Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tr 20 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form t r 20 and how is it used?

The form t r 20 is a specific document used for various filing purposes, often required in specific business transactions. It helps ensure compliance and proper documentation, streamlining the process for both businesses and clients. Using airSlate SignNow to eSign the form t r 20 makes it easier and faster to complete essential paperwork without delays.

-

How can airSlate SignNow assist with completing the form t r 20?

airSlate SignNow offers a user-friendly platform to fill out and electronically sign your form t r 20. Our intuitive features allow you to save time and reduce errors by easily adding signatures, dates, and other required information. This ensures that your documents are processed swiftly and efficiently.

-

What are the pricing options for using airSlate SignNow for the form t r 20?

airSlate SignNow provides flexible pricing options tailored to meet various business needs. Our plans start competitively, ensuring businesses can afford to eSign documents like the form t r 20 without breaking the bank. Additionally, we offer a free trial for users to evaluate the platform's capabilities before committing.

-

Are there any integrations available for the form t r 20 on airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with numerous applications to enhance your workflow while handling the form t r 20. These integrations help streamline processes by connecting with tools you already use, making it easier to manage documents, whether in CRM systems or project management platforms.

-

What are the key benefits of using airSlate SignNow for my form t r 20 filings?

Using airSlate SignNow for your form t r 20 offers signNow benefits like increased efficiency and reduced processing time. Our platform not only simplifies the signing process but also enhances security and compliance through encrypted signatures and document tracking. This ensures your important filings are timely and secure.

-

Is it secure to eSign the form t r 20 using airSlate SignNow?

Absolutely! airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect your form t r 20 and other sensitive documents. We prioritize user privacy and compliance with industry standards, ensuring your information remains confidential and secure throughout the signing process.

-

Can I use airSlate SignNow for other forms aside from the form t r 20?

Yes, airSlate SignNow can be utilized for a wide range of documents beyond just the form t r 20. Our versatile platform is designed to handle various business forms, contracts, and agreements, catering to diverse industries and needs. This makes it a comprehensive solution for all your eSignature requirements.

Get more for Tr 20 Form

- Subp 020 editable and saveable california judicial council forms

- 1120s s corporation tax return checklist mini form

- And regulatory services form

- Unreasonable to live at home form

- Client history questionnaire dermatologyallergy university of uwveterinarycare wisc form

- 90 day chronological bible reading plan form

- Tff application santa barbara form

- Enterprise software license agreement template form

Find out other Tr 20 Form

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word