1120S, S Corporation Tax Return Checklist, Mini Form

What is the 1120S, S Corporation Tax Return Checklist, Mini Form

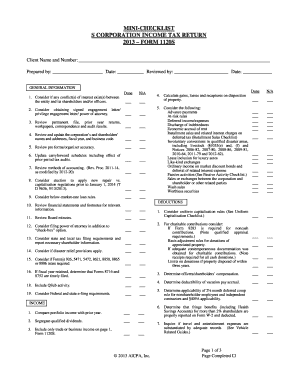

The 1120S, S Corporation Tax Return Checklist, Mini Form is a crucial document for S corporations in the United States. It serves as a guide to ensure that all necessary information and documentation are gathered before filing the tax return. This form helps streamline the process, making it easier for businesses to comply with IRS regulations. It includes essential items such as income details, deductions, and credits that must be reported accurately to avoid penalties.

Key elements of the 1120S, S Corporation Tax Return Checklist, Mini Form

Understanding the key elements of the 1120S, S Corporation Tax Return Checklist, Mini Form is vital for accurate filing. The form typically includes:

- Business Information: Name, address, and Employer Identification Number (EIN) of the corporation.

- Income Information: Total income, including gross receipts and other income sources.

- Deductions: A comprehensive list of allowable deductions, such as salaries, rent, and utilities.

- Shareholder Information: Details regarding shareholders and their respective shares of income and deductions.

- Tax Credits: Any applicable tax credits that the corporation may claim.

Steps to complete the 1120S, S Corporation Tax Return Checklist, Mini Form

Completing the 1120S, S Corporation Tax Return Checklist, Mini Form involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the business information section accurately, ensuring the EIN and address are correct.

- Report total income from all sources, ensuring no income is omitted.

- List all deductible expenses, verifying that each expense is allowable under IRS guidelines.

- Provide information about shareholders, including their names and shares of income.

- Review the form for completeness and accuracy before submission.

Legal use of the 1120S, S Corporation Tax Return Checklist, Mini Form

The legal use of the 1120S, S Corporation Tax Return Checklist, Mini Form is governed by IRS regulations. This form must be filled out accurately to ensure compliance with federal tax laws. An improperly completed form can lead to penalties or audits. It is essential to retain copies of the completed checklist and any supporting documents for record-keeping purposes, as these may be required in case of an IRS inquiry.

Filing Deadlines / Important Dates

Awareness of filing deadlines is essential for S corporations to avoid penalties. The due date for filing the 1120S form is typically the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If additional time is needed, an extension can be requested, but it is important to file the extension form on time to avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 1120S, S Corporation Tax Return Checklist, Mini Form can be done through various methods. Corporations may choose to file electronically, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location. In-person submissions are generally not available for tax forms, so electronic or mail methods are recommended for compliance and tracking purposes.

Quick guide on how to complete 1120s s corporation tax return checklist mini form

Complete 1120S, S Corporation Tax Return Checklist, Mini Form effortlessly on any device

The management of digital documents has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the suitable form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage 1120S, S Corporation Tax Return Checklist, Mini Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to alter and eSign 1120S, S Corporation Tax Return Checklist, Mini Form easily

- Find 1120S, S Corporation Tax Return Checklist, Mini Form and click Get Form to initiate.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign 1120S, S Corporation Tax Return Checklist, Mini Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1120s s corporation tax return checklist mini form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1120S, S Corporation Tax Return Checklist, Mini Form?

The 1120S, S Corporation Tax Return Checklist, Mini Form is a comprehensive tool designed to help S Corporations streamline their tax return process. This checklist ensures that all necessary documents and information are gathered and prepared for filing, making tax season easier and more efficient for business owners.

-

How do I access the 1120S, S Corporation Tax Return Checklist, Mini Form?

You can easily access the 1120S, S Corporation Tax Return Checklist, Mini Form through the airSlate SignNow platform. Simply sign up for an account, and you will have immediate access to this checklist, along with other essential tools for managing your documents and eSignatures.

-

What features are included with the 1120S, S Corporation Tax Return Checklist, Mini Form?

The 1120S, S Corporation Tax Return Checklist, Mini Form includes organized steps for document preparation, reminders for due dates, and the ability to collect digital signatures. These features help ensure that your S Corporation tax return is completed accurately and on time, reducing the risk of errors.

-

Is the 1120S, S Corporation Tax Return Checklist, Mini Form easy to use?

Yes, the 1120S, S Corporation Tax Return Checklist, Mini Form is designed with user-friendliness in mind. Its intuitive layout allows users of all levels, whether beginners or experienced professionals, to navigate and complete the checklist effortlessly.

-

Can the 1120S, S Corporation Tax Return Checklist, Mini Form be integrated with other software?

Absolutely! The 1120S, S Corporation Tax Return Checklist, Mini Form is designed to seamlessly integrate with various accounting and tax preparation software. This integration enhances efficiency by allowing users to sync data and documents directly, saving time during the filing process.

-

What are the pricing options for using the 1120S, S Corporation Tax Return Checklist, Mini Form?

airSlate SignNow offers competitive pricing options for the 1120S, S Corporation Tax Return Checklist, Mini Form. Pricing may vary based on the features selected and the number of users, but it remains cost-effective, ensuring that businesses of all sizes can manage their tax filings without breaking the bank.

-

What are the benefits of using the 1120S, S Corporation Tax Return Checklist, Mini Form?

Using the 1120S, S Corporation Tax Return Checklist, Mini Form provides numerous benefits including improved organization of tax documents, reduced stress during tax season, and a higher likelihood of accurate filings. This checklist assists businesses in maintaining compliance while optimizing their tax preparation process.

Get more for 1120S, S Corporation Tax Return Checklist, Mini Form

Find out other 1120S, S Corporation Tax Return Checklist, Mini Form

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document