Ca 540 Form

What is the CA 540 Form

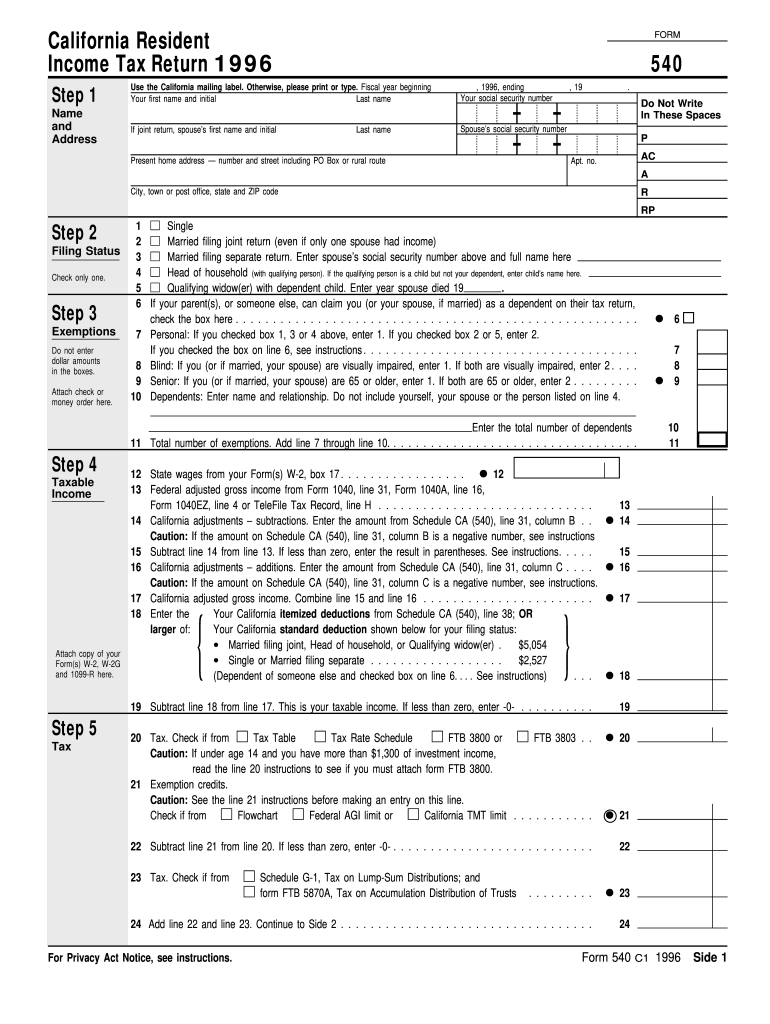

The CA 540 form, officially known as the California Resident Income Tax Return, is a crucial document for individuals who reside in California and need to report their income to the state. This form is used to calculate the amount of state tax owed or the refund due based on the taxpayer's income, deductions, and credits. It is essential for ensuring compliance with California tax laws and for accurately assessing one's financial obligations to the state.

Steps to Complete the CA 540 Form

Completing the CA 540 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, fill out personal information, including your name, address, and Social Security number. After that, report your total income and any adjustments. Calculate your taxable income by applying standard or itemized deductions. Finally, determine your tax liability, apply any credits, and sign the form. Review the completed form for errors before submission.

Legal Use of the CA 540 Form

The CA 540 form is legally binding when filled out and submitted correctly. It must adhere to the regulations set forth by the California Franchise Tax Board. Electronic submission of the form is accepted, provided that it complies with the eSignature laws, ensuring that the document is legally valid. Using a secure platform for electronic filing can enhance the legitimacy of the submission, as it often includes features like an audit trail and encryption.

Form Submission Methods

The CA 540 form can be submitted through various methods, catering to different preferences. Taxpayers can file electronically, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the appropriate address provided by the California Franchise Tax Board. In-person submissions are also possible at designated tax offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the CA 540 form are crucial to avoid penalties and interest. Generally, the deadline for submission is April 15 of the following year after the tax year ends. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure that all required forms and payments are submitted on time to maintain compliance.

Required Documents

To accurately complete the CA 540 form, several documents are required. These include income statements such as W-2 forms from employers, 1099 forms for freelance or contract work, and any documentation related to deductions, such as mortgage interest statements or medical expenses. Having these documents organized and readily available can streamline the filing process and help ensure that all income and deductions are accurately reported.

Quick guide on how to complete ca 540 form

Manage Ca 540 Form effortlessly on any device

Digital document handling has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to locate the right document and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Ca 540 Form on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Ca 540 Form with ease

- Locate Ca 540 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ca 540 Form and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca 540 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to tax california 1996?

airSlate SignNow is an electronic signature solution designed to streamline document workflows, including those related to tax california 1996. It allows businesses to easily send, sign, and store important tax documents securely and efficiently.

-

How can airSlate SignNow help me with my tax california 1996 filings?

Using airSlate SignNow, you can manage your tax california 1996 filings by electronically signing and sending required documentation. This ensures that your filings are completed accurately and on time, reducing the risk of penalties or issues with the California Franchise Tax Board.

-

Is there a free trial available for airSlate SignNow for tax california 1996 purposes?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for managing tax california 1996 documents. This trial provides insight into how the platform can simplify your eSignature needs without any upfront commitment.

-

What features does airSlate SignNow offer for managing tax california 1996 documents?

airSlate SignNow includes features such as customizable templates, secure document storage, and audit trails, which are crucial for handling tax california 1996 documents. These features enhance your ability to maintain compliance and ensure a smooth workflow.

-

How does airSlate SignNow ensure the security of my tax california 1996 documents?

airSlate SignNow implements encryption and compliance with industry standards to protect your tax california 1996 documents. This level of security helps safeguard sensitive information throughout the signing process.

-

Can I integrate airSlate SignNow with other tools I use for tax california 1996?

Absolutely! airSlate SignNow integrates with various software platforms to enhance your efficiency in handling tax california 1996 documents. This includes integrations with popular accounting and business management tools to streamline your workflow.

-

What are the pricing plans for airSlate SignNow suitable for tax california 1996 users?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses handling tax california 1996 documents. Whether you are a small business or a large enterprise, there is a cost-effective option to fit your requirements.

Get more for Ca 540 Form

- Flat sharing agreement form

- Application for schengen visa form number 119031 migrationsverket

- Myfloridalicense com dbpr hr form

- Pembroke pines building department form

- Fl005 208844628 form

- Wrl tplic 163196 form

- Family medical leave flma application columbia county form

- Job hazard analysis checklist fill online printable form

Find out other Ca 540 Form

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy