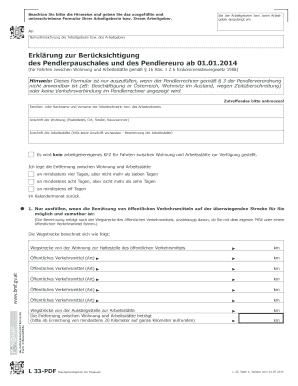

L33 Formular 2014

What is the L33 Formular

The L33 Formular is a specific document used primarily for tax purposes in the United States. It is designed to assist individuals in reporting certain financial details to the Internal Revenue Service (IRS). The form typically includes sections for income reporting, deductions, and credits, making it essential for accurate tax filing. Understanding its components is crucial for compliance and to ensure that all necessary information is provided to avoid penalties.

How to use the L33 Formular

Using the L33 Formular involves several steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary financial documents, including W-2s, 1099s, and any receipts for deductible expenses. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions before submission. Finally, choose a submission method that suits your needs, whether online or by mail.

Steps to complete the L33 Formular

Completing the L33 Formular requires a systematic approach. Begin by downloading the form from a reliable source or accessing it through tax preparation software. Follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income in the designated sections, ensuring to include all sources of income.

- List any deductions or credits you are eligible for, providing necessary documentation as required.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the L33 Formular

The L33 Formular must be used in accordance with IRS regulations to be considered legally binding. This means that all information provided must be truthful and complete. Failure to comply with these legal standards can result in penalties, including fines or audits. It is advisable to keep a copy of the completed form and any supporting documents for your records, as they may be required for future reference or in case of an audit.

Required Documents

To successfully complete the L33 Formular, certain documents are required. These typically include:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable donations.

- Any other relevant financial statements that support the information reported on the form.

Form Submission Methods

The L33 Formular can be submitted through various methods, allowing for flexibility based on individual preferences. Common submission methods include:

- Online submission via IRS-approved e-filing systems, which may offer faster processing times.

- Mailing a paper copy of the completed form to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete l33 formular

Complete L33 Formular effortlessly on any device

Digital document handling has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage L33 Formular on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign L33 Formular seamlessly

- Find L33 Formular and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to submit your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign L33 Formular and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct l33 formular

Create this form in 5 minutes!

How to create an eSignature for the l33 formular

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the l33 formular, and how does it work?

The l33 formular is an advanced digital document solution designed to simplify the process of eSigning and managing forms. It enables users to create, send, and sign documents securely within a user-friendly interface, speeding up workflows signNowly. With airSlate SignNow, businesses can integrate the l33 formular into their operations to enhance productivity.

-

How much does airSlate SignNow's l33 formular cost?

Pricing for the l33 formular through airSlate SignNow varies based on the plan you choose. Competitive pricing options are available, making it accessible for businesses of all sizes. You can explore our pricing tiers online to find the best fit for your needs without compromising on essential features.

-

What are the key features of the l33 formular?

The l33 formular comes with features such as template creation, automated workflows, and real-time tracking of document status. Additionally, it supports various file formats, ensuring versatility in document management. These features collectively streamline the eSignature process, enhancing efficiency for users.

-

What benefits does the l33 formular offer for businesses?

By using the l33 formular, businesses can save time and reduce costs associated with traditional paperwork processes. This digital solution enables faster approvals and improves collaboration among teams. Moreover, it boosts security and compliance, ensuring that sensitive information is well-protected.

-

Can the l33 formular be integrated with other software?

Yes, the l33 formular seamlessly integrates with various third-party applications, enhancing its functionality. Popular integrations include CRM systems, cloud storage services, and project management tools. This flexibility allows businesses to customize their document workflows, improving overall efficiency.

-

Is the l33 formular user-friendly for those unfamiliar with digital solutions?

Absolutely! The l33 formular is designed with a user-friendly interface that requires minimal training. Users can easily navigate the platform, making it accessible even for those who are not tech-savvy. Support resources and tutorials are also available to assist new users.

-

How can I start using the l33 formular today?

To start using the l33 formular, visit our website and sign up for a free trial. This allows you to explore all the features of airSlate SignNow without any commitment. Once you're satisfied, you can choose a plan that best fits your business requirements and get started right away.

Get more for L33 Formular

- Fall river public schools cori form

- 30 day notice to change the terms of your rental agreement to residents and all others in possession of apt located at street form

- Ahba entry form american herding breed association

- Application for tenancy tryourrentals com form

- Shamrock foundation cats form

- Janata personal accident proposal form

- Bus pass application form for people aged 60 or over

- If you require this form in large print please contact

Find out other L33 Formular

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast