Form P524 Tax for Examiner

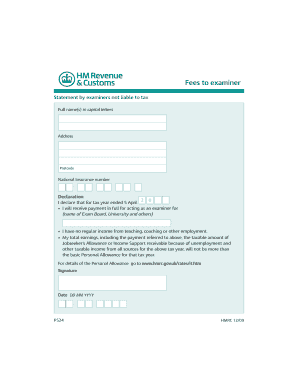

What is the Form P524 Tax For Examiner

The Form P524 Tax for Examiner is a document used primarily by tax examiners to assess and review tax-related information. This form is essential for ensuring compliance with tax regulations and facilitates the examination process. It serves as a standardized method for tax examiners to collect necessary data from taxpayers, ensuring that all relevant information is available for accurate assessments.

How to use the Form P524 Tax For Examiner

Using the Form P524 Tax for Examiner involves several steps to ensure that all required information is accurately provided. Taxpayers should first review the form to understand the specific data needed. It is advisable to gather all relevant financial documents before starting the completion process. Once the form is filled out, it should be reviewed for accuracy before submission to the appropriate tax authority.

Steps to complete the Form P524 Tax For Examiner

Completing the Form P524 Tax for Examiner involves the following steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the designated tax authority by the specified deadline.

Legal use of the Form P524 Tax For Examiner

The legal use of the Form P524 Tax for Examiner is governed by various tax laws and regulations. It is crucial for taxpayers to ensure that the information provided is accurate and complete, as any discrepancies can lead to penalties or further scrutiny. The form must be submitted in compliance with the deadlines set by the Internal Revenue Service (IRS) or state tax authorities to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form P524 Tax for Examiner can vary based on the specific tax year and the taxpayer's circumstances. It is essential to be aware of these deadlines to ensure timely submission. Typically, forms are due on the same dates as other tax filings, often falling on April 15 for individual taxpayers. However, extensions may be available under certain conditions, so checking the latest IRS guidelines is advisable.

Required Documents

When completing the Form P524 Tax for Examiner, several documents may be required to substantiate the information provided. Commonly needed documents include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return

- Any relevant financial statements

Form Submission Methods (Online / Mail / In-Person)

The Form P524 Tax for Examiner can typically be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online submission via the tax authority's electronic filing system

- Mailing a physical copy of the form to the designated address

- In-person submission at local tax offices, if applicable

Quick guide on how to complete form p524 tax for examiner

Effortlessly Prepare Form P524 Tax For Examiner on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents efficiently without delays. Manage Form P524 Tax For Examiner on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

The Easiest Way to Modify and eSign Form P524 Tax For Examiner Effortlessly

- Locate Form P524 Tax For Examiner and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive data using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes just moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign Form P524 Tax For Examiner and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form p524 tax for examiner

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form p524 tax for examiner?

The form p524 tax for examiner is a specific tax document utilized for compliance and examination purposes. It serves as a standard form that helps businesses and tax professionals prepare and submit necessary financial information to applicable tax authorities. Understanding this form is crucial for ensuring accurate tax reporting.

-

How can airSlate SignNow help with the form p524 tax for examiner?

AirSlate SignNow streamlines the process of completing and eSigning the form p524 tax for examiner. Our platform allows users to create, send, and securely sign this tax document quickly and efficiently, reducing the time and hassle associated with traditional paper methods. This can greatly enhance workflow for accountants and businesses dealing with tax compliance.

-

Is there a cost associated with using airSlate SignNow for the form p524 tax for examiner?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs for managing documents, including the form p524 tax for examiner. We provide various subscription options with a clear outline of features, allowing users to select a plan that fits their budget and requirements. Cost-effective and transparent, our pricing is designed with small to large businesses in mind.

-

What features does airSlate SignNow offer for managing the form p524 tax for examiner?

AirSlate SignNow provides features such as customizable templates for the form p524 tax for examiner, automated workflows, and real-time document tracking. These tools enhance efficiency and ensure that all necessary parties can access and sign the document smoothly. Additionally, our cloud storage capabilities offer easy retrieval and management of tax documents anytime.

-

Can airSlate SignNow integrate with other applications for the form p524 tax for examiner?

Yes, airSlate SignNow offers seamless integrations with popular applications and services, simplifying the management of the form p524 tax for examiner. Whether you're using CRM software, accounting systems, or cloud storage solutions, our platform ensures that your workflow is optimized and interconnected across various tools. This integration capability enhances overall productivity.

-

What are the benefits of using airSlate SignNow for the form p524 tax for examiner?

Using airSlate SignNow for the form p524 tax for examiner provides numerous benefits, such as reducing paperwork, speeding up the signing process, and improving document security. Our electronic signing solution also minimizes errors and ensures that all necessary fields are completed accurately. This leads to increased efficiency and compliance with regulatory requirements.

-

Is airSlate SignNow secure for handling the form p524 tax for examiner?

Absolutely, airSlate SignNow prioritizes security, especially for sensitive documents like the form p524 tax for examiner. Our platform employs advanced encryption and secure access protocols to protect your data. Users can confidently manage and sign their tax documents, knowing that their information is safeguarded against unauthorized access.

Get more for Form P524 Tax For Examiner

- Cute baby calf multiplication puzzle math coloring puzzle form

- Metacognitive reading log 65328182 form

- Toronto on m5v 3ji form

- Corporate resolution form ohio

- Childrens hospital los angeles online referral form

- 5000 role model student application form

- Dmap 3302 form

- And return for update purposes only form

Find out other Form P524 Tax For Examiner

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure