Refund of Class 2 Nic Form

What is the Refund Of Class 2 Nic Form

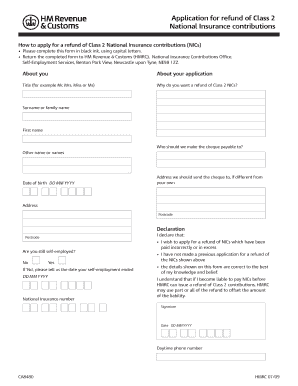

The Refund Of Class 2 Nic Form is a specific document used in the United States for claiming refunds on Class 2 National Insurance contributions. This form is essential for individuals who have overpaid their contributions or are eligible for refunds due to changes in their employment status or income levels. Understanding the purpose of this form is crucial for ensuring compliance with tax regulations and maximizing potential refunds.

How to use the Refund Of Class 2 Nic Form

Using the Refund Of Class 2 Nic Form involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be downloaded from official government websites. Next, fill out the required fields accurately, providing personal information such as your name, address, and National Insurance number. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Steps to complete the Refund Of Class 2 Nic Form

Completing the Refund Of Class 2 Nic Form requires attention to detail. Here are the steps to follow:

- Download the form from an official source.

- Fill in your personal details, including your National Insurance number.

- Indicate the reason for your refund claim.

- Attach any required supporting documents that validate your claim.

- Review the completed form for accuracy.

- Submit the form via the designated method, either online, by mail, or in person.

Key elements of the Refund Of Class 2 Nic Form

The Refund Of Class 2 Nic Form includes several key elements that are crucial for its validity. These elements typically consist of:

- Personal Information: Name, address, and National Insurance number.

- Reason for Refund: Clear explanation of why the refund is being requested.

- Supporting Documentation: Any necessary documents that support your claim.

- Signature: A signature is often required to validate the form.

Legal use of the Refund Of Class 2 Nic Form

The legal use of the Refund Of Class 2 Nic Form is governed by specific tax laws and regulations. It is important to ensure that the form is filled out correctly and submitted within the stipulated deadlines to avoid penalties. The form serves as a formal request for a refund and must comply with the legal requirements set forth by the Internal Revenue Service (IRS) and other relevant tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Refund Of Class 2 Nic Form can vary based on individual circumstances and tax regulations. Typically, it is advisable to submit the form as soon as you determine that you are eligible for a refund. Keeping track of important dates, such as the end of the tax year or specific deadlines set by the IRS, can help ensure that your claim is processed in a timely manner.

Quick guide on how to complete refund of class 2 nic form

Complete Refund Of Class 2 Nic Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Refund Of Class 2 Nic Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to adjust and electronically sign Refund Of Class 2 Nic Form with ease

- Locate Refund Of Class 2 Nic Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Refund Of Class 2 Nic Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the refund of class 2 nic form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining a Refund Of Class 2 Nic Form?

To obtain a Refund Of Class 2 Nic Form, you'll need to complete the necessary application and submit it along with any required documentation. airSlate SignNow simplifies this process by allowing you to eSign your forms quickly and securely. This ensures that your refund request is processed efficiently without any delays.

-

How much does it cost to utilize the Refund Of Class 2 Nic Form service?

The pricing for using the Refund Of Class 2 Nic Form service via airSlate SignNow is competitive and designed to cater to businesses of all sizes. By offering various plans, we ensure that you have access to a cost-effective solution without compromising on features. Choose a plan that best fits your needs and start managing your refunds seamlessly.

-

What features can I expect when using airSlate SignNow for a Refund Of Class 2 Nic Form?

When using airSlate SignNow for a Refund Of Class 2 Nic Form, you can expect robust features like easy document upload, customizable templates, and real-time tracking of your signing process. Additional tools for collaboration and storage further enhance your experience. These features empower you to handle your refund forms efficiently.

-

Is airSlate SignNow safe for submitting the Refund Of Class 2 Nic Form?

Absolutely! airSlate SignNow prioritizes your data security with advanced encryption protocols. When you submit a Refund Of Class 2 Nic Form, you can be assured that your information is protected from unauthorized access. We are committed to maintaining the highest levels of security in handling sensitive documents.

-

Can I integrate airSlate SignNow with other software for the Refund Of Class 2 Nic Form?

Yes, airSlate SignNow offers integrations with a variety of software applications to enhance your workflow. This includes popular CRM systems, cloud storage services, and productivity tools. Integrating our platform can streamline the process for handling your Refund Of Class 2 Nic Form, saving you time and increasing efficiency.

-

What are the benefits of using airSlate SignNow for a Refund Of Class 2 Nic Form?

Using airSlate SignNow for a Refund Of Class 2 Nic Form provides numerous benefits, including streamlined document handling, faster turnaround times, and cost savings associated with paperless processes. You'll also experience enhanced collaboration with team members and clients through our user-friendly interface. All these factors contribute to a more efficient refund management system.

-

How can airSlate SignNow help me track the status of my Refund Of Class 2 Nic Form?

With airSlate SignNow, tracking the status of your Refund Of Class 2 Nic Form is straightforward. Our platform provides real-time notifications and status updates, allowing you to see when your form has been viewed, signed, and completed. This transparency greatly enhances your ability to manage your refund requests effectively.

Get more for Refund Of Class 2 Nic Form

- Jockeys management agreement racing queensland form

- Transfer request clovis municipal school district form

- Family financial statement form

- Blank health questionnaire form

- Collection documents form

- Gilberts elementary virtual backpack july 27 202 form

- Bowmanville community organization membership form join the bcochicago

- Simply complete the form below and return it with a 40 check to wspn p wspn wildapricot

Find out other Refund Of Class 2 Nic Form

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free